Articles of Interest

What you Need to Know about the Recent Real Return Bond Announcement

Key takeaways

- The Federal Government has ceased issuing RRBs effective immediately

- Don’t expect other domestic issuers to fill the gap left by the Federal Government

- Tactical investors in RRBs will likely exit the asset class due to even less liquidity

- Strategic investors (pension plans, insurance companies) will likely hold onto the bonds they already own

- Investors will still be able to hedge inflation, but will likely have to accept more basis risk

On Thursday, November 3, 2022, the Ministry of Finance (MoF) announced they were ceasing the issuance of Real Return Bonds (RRBs) in Canada. The Federal Government had been issuing RRBs regularly since 1991 and has been the largest source of inflation-protected securities for the last 30 years.

The implication for Canadian investors varies significantly depending on the nature of the particular investment they hold. Investors without inflation-linked liabilities will see liquidity dry up even further and they will likely look to the U.S. market to hedge or exit the asset class. For those with inflation-linked liabilities (pension plans and insurance companies etc.) the implications are different because they are more willing to buy-and-hold any available RRBs until maturity, and are typically less concerned with the future ability to sell. Either way, adding to inflation-protection investment programs will require looking at alternative investment strategies.

The key questions we are hearing:

- What were the Ministry of Finances’ key drivers behind the decision?

- What has been the reaction of the RRB market?

- Is the RRB market broken?

- Can Treasury Inflation-Protected Securities be used to hedge against inflation?

What were the Ministry of Finance's key drivers behind the decision?

The MoF cites low demand for the product and we expect this will lead to further reduction in availability as liquidity continues to dry up.

The MoF’s full report can be found here where the announcement is discussed briefly on page 69. Some additional insights are in the Fall Debt Management Strategy Consultations where they note weak demand for RRBs and that Canadian investors are using Treasury Inflation-Protected Securities (TIPS) as well as infrastructure investments to hedge inflation in their portfolios.

The decision seems to be especially odd given increased concerns investors have around hedging against inflation compared to recent years when inflation was contained. We don’t think there was any lack of demand for these bonds. As of now, we can only speculate on what drove the decision to cease issuing RRBs, but there are a few interesting data points worth discussing.

Demand and liquidity in the bond market

To the best of our knowledge, there was not a consultative period amongst institutional investors and plan sponsors prior to the announcement. Given the impact this decision would have on the market, it could have been that the Government didn’t want to cause panic with rumors about the end of the RRB program. One reason cited for the decision was the lack of liquidity in the RRB market which deters investors. Liquidity is the ability to transact the amount you want at a fair bid/ask spread. RRBs were by no means liquid, but that was a result of the lack of supply relative to the demand.

Retail investors, strategic investors and institutional investors without liabilities tied to the Consumer Price Index (CPI) would have previously avoided RRBs due to a lack of liquidity. For this segment, the news was not significant, but it reduces liquidity and makes this an even less viable asset class. However, the larger buyers of these securities are pension plan and insurance companies with CPI risks embedded in their liabilities. These investors are not looking for liquidity as a means to sell, but to buy more. They are more likely to buy and hold these securities until maturity.

When you ask investors, lack of demand is hard to believe. From Dec. 1989 – Dec. 2020, CPI has grown at a rate of 2% per year with very little deviation. Now that we’ve experienced an inflation event, there is more reason to believe this is a risk worth hedging and investment committees are asking about this.

While illiquidity has been a concern in this market, it was not broken for the buy-and-hold investors looking to hedge against inflation risk. The resolution would have been more issuance, not less.

The costs of inflation-protected bonds

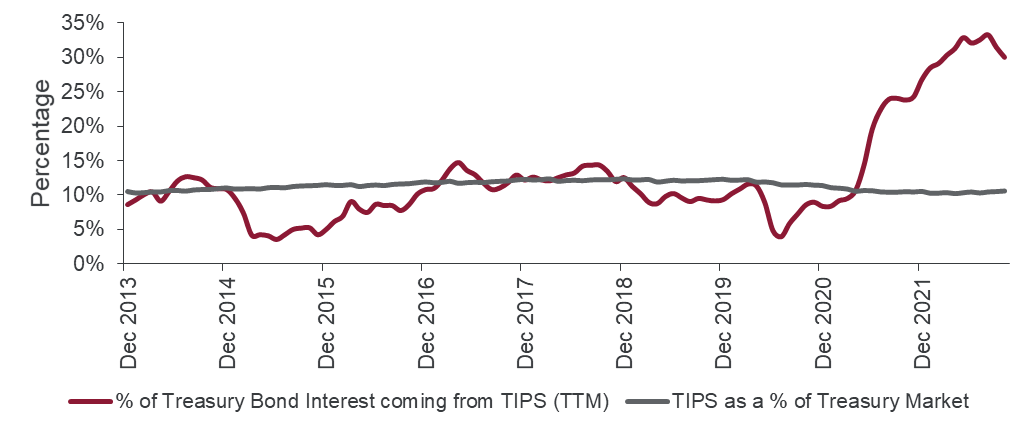

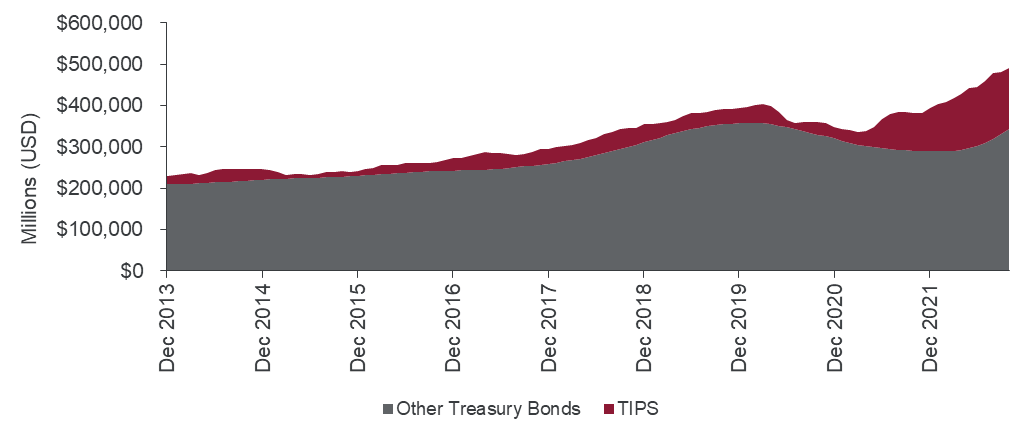

The U.S. market offers some evidence about why issuers are not excited about putting more inflation-linked securities into the market. The U.S. equivalent of RRBs, TIPS, make up only 10% of the U.S. Treasury market, yet with higher inflation, will account for roughly 1/3 of the overall interest expense on all treasury bonds.

As inflation has started to decline, we expect inflation-protected securities to account for a smaller portion of interest expenses. This raises a good question—is this announcement a sign that the MoF is worried that inflation-and therefore interest expenses-will remain elevated?

Even if this were the case, we don’t think any government agency has a good enough crystal ball that tells them what inflation will do in the future. However, the protection that RRB and TIPS investors received came from somewhere. It might not come as a surprise that if a particular type of security is more expensive to issue, we would not see as many of them issued in the future.

What has been the reaction of the RRB market?

The announcement doesn’t mean existing RRBs are going to stop doing what they are supposed to do. However, RRBs will be even harder to come by as investors who need to hedge against inflation will stash them away. After the announcement, investors scooped up whatever bonds they could in fear they’d be harder to come by.

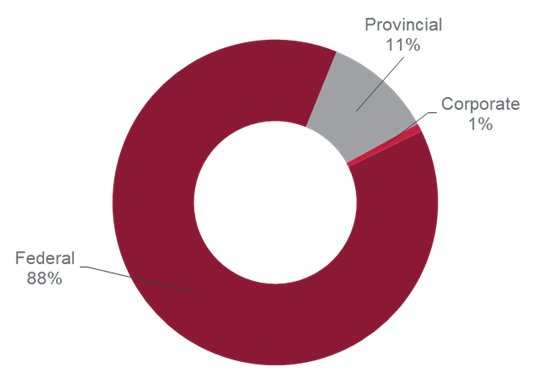

The only regular issuer in the Canadian inflation-linked bond market has been the Federal Government, so it's had a major impact on market participants.

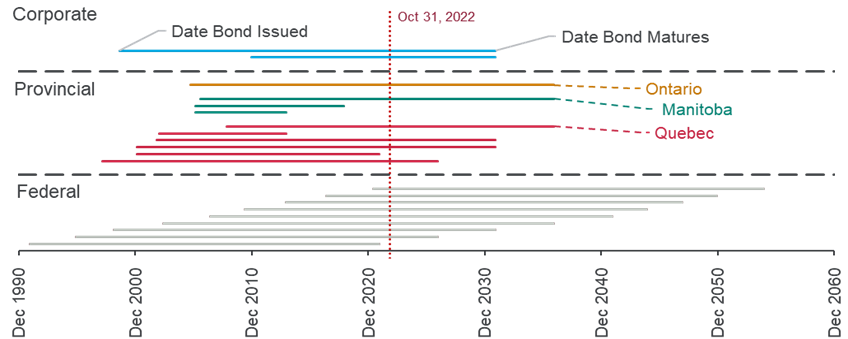

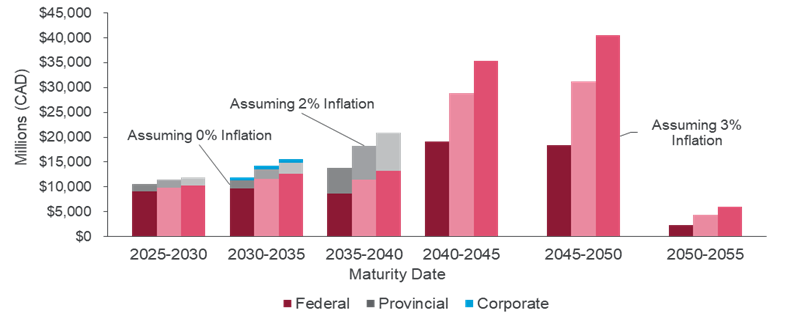

There hasn’t been a new provincial RRB issue since November 2008 and the corporate inflation-linked bond market is essentially a small handful of private placements. There have been municipal and corporate bonds where coupons are linked to CPI, but not the principal.

As investors take every chance they get to buy outstanding RRBs, we’re expecting to see a premium on them. This could lead some investors to consider selling their bonds when prices are elevated and use alternative measures to hedge against inflation. The next date on the calendar for RRB investors is the coupon payment on December 1, 2022. Normally, the Bank of Canada (BoC) would issue additional bonds at the same time, so investors could reinvest the cash, but this year it doesn’t look like that is going to happen.

Is the RRB market broken?

It is probably too early to tell if the RRB market is broken. The stability (or lack of) will likely depend if there are enough buyers in the future for an asset class that may no longer exist. Given the increase in perceived inflation risk and the market size of indexed pension and insurance liabilities, we feel there will likely be demand for RRBs if you need to sell while these roll off over the next 30 years.

Right now, it only appears the RRB market is broken if you're trying to buy more bonds given the surge in demand. We haven’t seen evidence of people trying to sell large blocks of RRBs yet, so we can only speculate that pension plan and insurance companies who have inflation-linked liabilities would be more than happy to acquire them before someone else does.

However, the news is still fresh and it's hard to know what the dealers will be able to provide years down the road. This is important for investors of all sizes who may need to rebalance. If there is no market for these bonds, investors could face a similar situation to the one in the U.K. that forced sellers into an illiquid market and drove yields up in a short time period. Levered RRB strategies should be updating their stress tests to account for further lack of liquidity.

Nearly half of the federal bonds don’t mature until at least 2040, so they'll still be around for a long time.

Can TIPS be used to hedge against inflation?

Treasury Inflation-Protected Securities are the U.S. equivalent of RRBs. Although they provide protection against inflation in another country— they generally perform similar to Canadian RRBs.

The biggest benefit of using TIPS is the market is much larger than the RRB market ($1.8T USD vs $68B CAD). The market in the U.S. also has greater liquidity, so investors can expect to implement inflation-linked programs easier and quicker. This is why most strategic and active investors use TIPS as opposed to RRBs.

For investors looking at this space for the first time, it is important to remember that you need to hedge both the currency risk and the underlying interest rate risk. Despite inflation being nearly 7.2% in the U.S., nominal bonds in Canada have outperformed U.S. TIPS because the increase in real rates has been so much higher in the U.S.

This means a stand-alone program needs to have the ability to hedge foreign exchange and interest rate risks which add additional requirements compared to a Canadian RRB program.

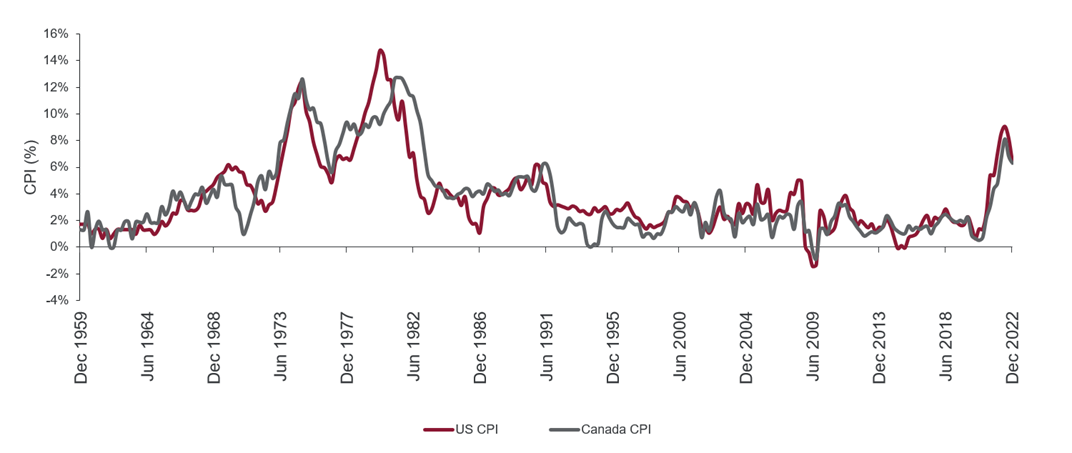

U.S. CPI vs Canadian CPI

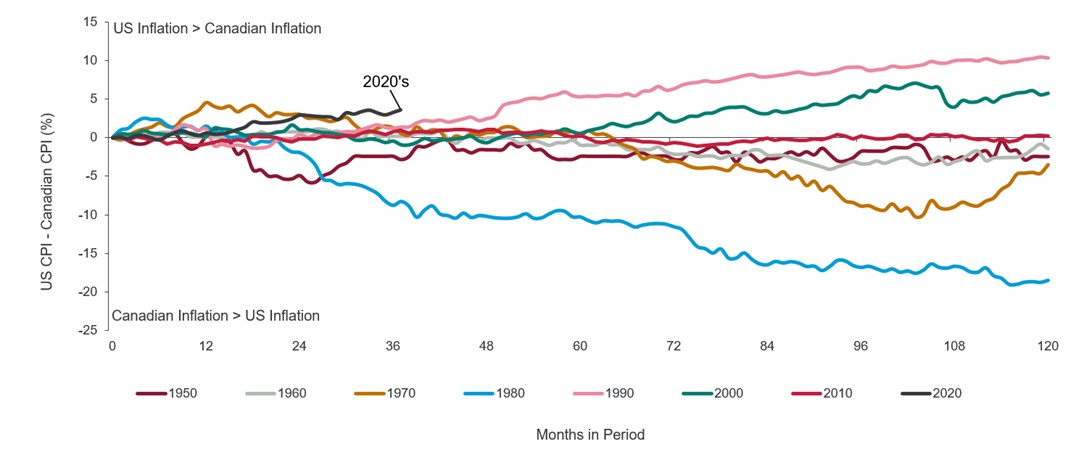

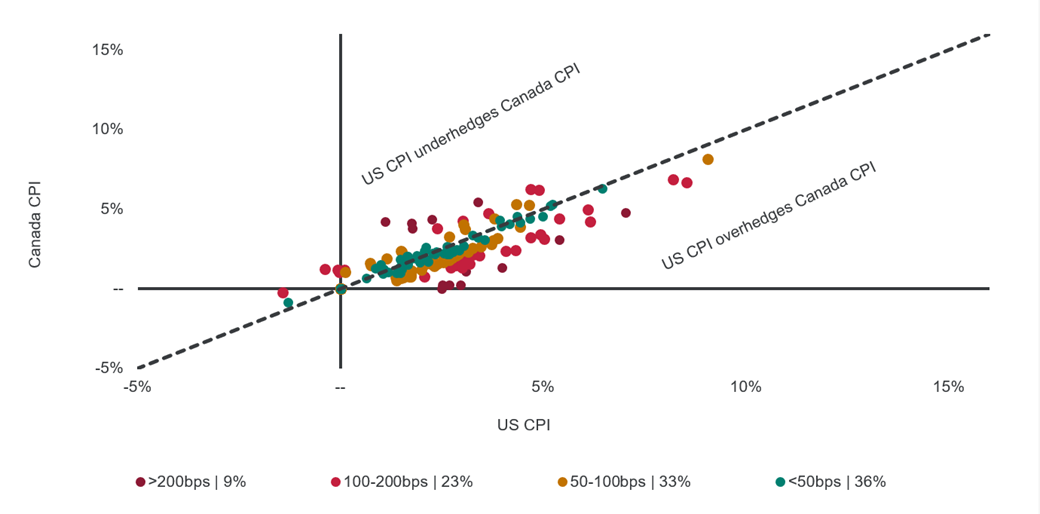

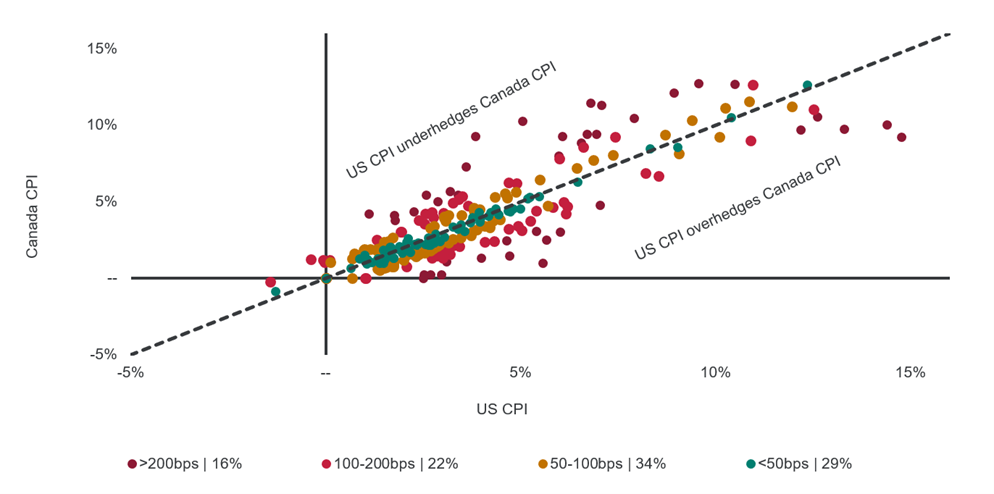

Since 1989 U.S. CPI has run 0.5% p.a. higher than Canadian CPI. The last few decades would have seen this strategy provide additional inflation protection over time. However, past inflation is not indicative of future returns. If investors want to take away one thing from this observation, it's that inflation can persist at different levels across countries over long periods of time.

Inflation protection is most important during periods of high inflation. Unfortunately, we don’t have many precedents to learn from. The only other inflationary period since WWII was in the 1970s and it isn’t a good comparison because the world was a much different place. The way central banks reacted to rising inflation was very different.

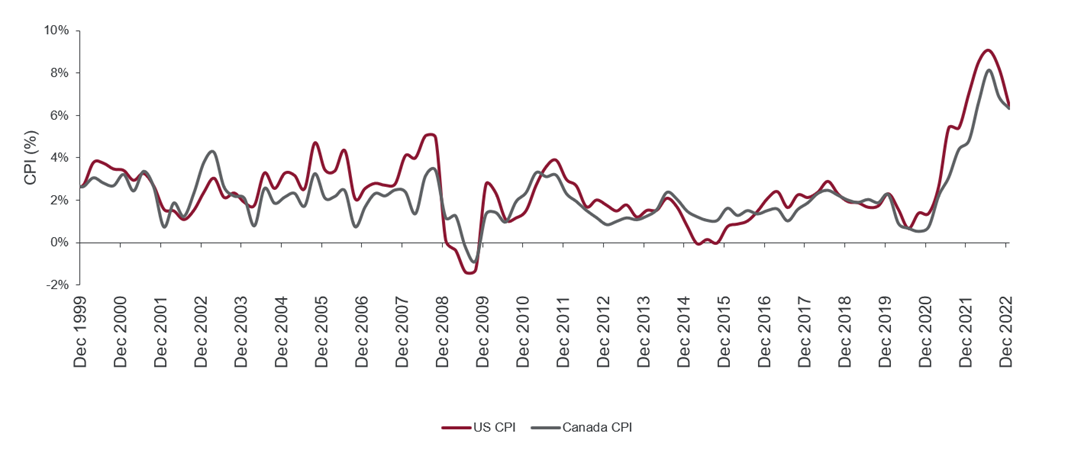

One thing that’s still the same is Canada and the U.S. could still see their inflation numbers diverge. The 2010s were a unique time where inflation between the two countries rarely deviated from each other. However, in the first 36 months of the 2020s, we’ve seen U.S. CPI outperform Canadian CPI by nearly 5%. This could cause some investors to suffer from recent bias.

TIPS do provide protection against Canadian index-linked liabilities. Although the relationship is not perfect, it has held up remarkably well despite the recent spike in inflation.

How much noise is acceptable? About one-third of the time annual inflation has been within 50 basis points (bps) of each other. One-third of the time it has been within 50-100 bps and the other third it has been greater than 100 bps. Weighed against the benefits of increased liquidity this may be a basis risk that many deem acceptable.

Conclusion

The timing of this announcement from the MoF is not ideal because hedging inflation is becoming more important for investors. It’s especially important for investors with inflation-linked liabilities, yet the most direct tool has just been removed from investor toolkits. Pension plan and insurance companies that have liability exposure to CPI and have the ability to hold RRBs until maturity should still look to RRBs as they provide the cleanest and simplest offset to inflation exposure.

These securities are going to be harder to come by in the future. Even investors who currently hold RRBs should explore alternative inflation protection strategies such as TIPS, inflation swaps, infrastructure and real estate investments.

The past 30 years may be remembered by bond historians (if that’s a thing) as the "Liquid RRB Era."

Michael Cook CFA, Vice-President and LDI Client Portfolio Manager, Institutional Client Relations

Michael Cook is a member of CIBC Asset Management’s (CAM) Institutional team. Mr. Cook is responsible for day-to-day client servicing with a focus on Liability Driven Investment (LDI) solutions. He also works on developing investment solutions with asset liability management objectives for current and prospective clients.

Prior to joining CAM in 2020, Mr. Cook was a Director in the Defined Benefit Solutions group at Sun Life Financial where he led LDI business development and the client servicing team. Prior to that, he was a Vice President at East Coast Fund Management Inc. where his responsibilities included credit research and supporting clients with educational and marketing material.

Mr. Cook holds an MBA from the University of British Columbia and a BComm degree from the University of Alberta. He is also a CFA charterholder and a member of the CFA Society of Toronto.

NOTICE

For more information, please contact your CIBC Asset Management representative.

All information in this document is as at 02/23/2023, unless otherwise indicated, and is subject to change.

The views expressed in this document are the views of CIBC Asset Management Inc. and are subject to change at any time. CIBC Asset Management Inc. does not undertake any obligation or responsibility to update such opinions. This document is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this document should consult with his or her advisor. All opinions and estimates expressed in this document are as of the date of publication unless otherwise indicated, and are subject to change.

Certain information that we have provided to you may constitute “forward-looking” statements. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual results or achievements to be materially different than the results, performance or achievements expressed or implied in the forward-looking statements.

“Bloomberg®” is a service mark of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by CIBC Asset Management Inc. Bloomberg is not affiliated with CIBC Asset Management Inc., and Bloomberg does not approve, endorse, review, or recommend any CIBC Asset Management Inc. products.

CIBC Asset Management and the CIBC logo are trademarks of Canadian Imperial Bank of Commerce (CIBC), used under license.

The material and/or its contents may not be reproduced without the express written consent of CIBC Asset Management Inc.