Articles of Interest

The Future of ESG

Plans under 1 billion AUM: how can they optimize investment outcomes and ESG?

Institutions have adapted their portfolios considerably over the last few decades. The classic 60% equity / 40% fixed income pension model originated in the 1980s, when interest rates were much higher. Since then, interest rates compressed dramatically, changing the paradigm. Demands evolved, and with it, the asset management industry expanded its capabilities, broadening into new asset classes.

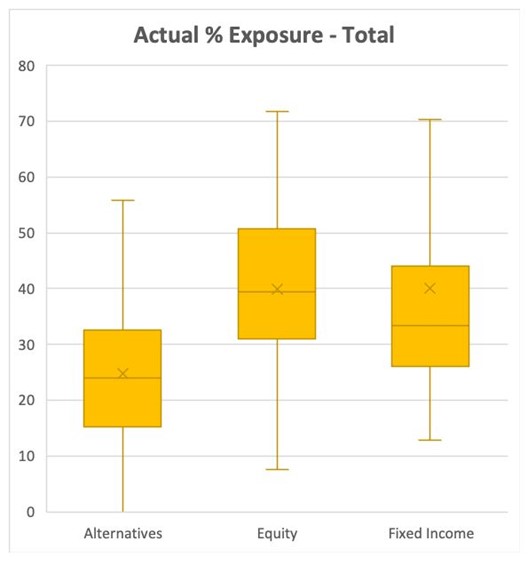

As the graphic below demonstrates, asset mixes have drifted away dramatically from the staid 60/40 classic model established nearly 40 years ago:

Source: Pension Investment Association of Canada 2021 Asset Mix Report, https://piacweb.org/site/publications/asset-mix-report

The PIAC figures represent assets reported from all Canadian defined benefit pension plans and covers $2.786 trillion.

Alternative assets now feature prominently in institutional portfolios, covering Real Assets like Infrastructure and Real Estate and extending to Private Debt and Private Equity placements. The average pension asset mix has changed substantially, but access to some asset classes varies widely, dependent on plan size, internal resources, and governance models.

Furthermore, Responsible Investing (RI)/Environmental, Social and Governance (ESG) has emerged as a prominent focus for institutional investors. The subject is immensely complex, demanding extensive resources to evaluate different approaches. Such complexity may pull stakeholders in different directions. Policy decisions can be arduous, and executing the policy even more so.

Additionally, there is greater understanding of what drives Alpha in returns. Numerous academic studies have highlighted that Factors drive Alpha, not fundamental stock picking, as was believed for decades. Factors, like Active mandates, may be cyclical, but they are consistent, rules-based methodologies to align exposures with plan objectives.

Smaller plans may gaze at large or mega-sized plans and aspire to diversify their portfolios to achieve the same risk management and performance metrics, but their options may be limited. There is a huge disconnect between what large and mega-sized plans can execute and the options available to small and medium investors. The larger plans have more in-house capabilities and can operate as direct or co-investors, performing their own due diligence on an asset, deploying their capital once they are satisfied their due diligence has identified a suitable exposure. They can exert control.

In contrast, smaller plans cannot exert control; their flexibility is limited. They gain access through Pools, accepting manager risk, an idiosyncratic data set and face higher costs with potential liquidity limitations.

How can this disparity be addressed? Is there a way for smaller plans to emulate the intentions larger plans express in their asset mixes?

Exchange Traded Funds are remarkable market access tools. Trading fluidly on exchanges, they are easily implemented in portfolios large and small. The ETF was initially envisaged as an institutional tool to facilitate quick, broad index exposure, and the ability to express an investment thesis quickly and effectively.

Many institutional investors use Exchange Traded funds for tactical allocations or to bridge exposures when switching managers, but they should also be considered as core exposures to achieve long-term strategic objectives.

In today’s ETF world, smaller plans can avail themselves of a vast array of well conceived exposures across asset classes, ranging from segmented fixed income to Factors and to RI/ESG screened mandates. The playing field can be leveled.

Factors

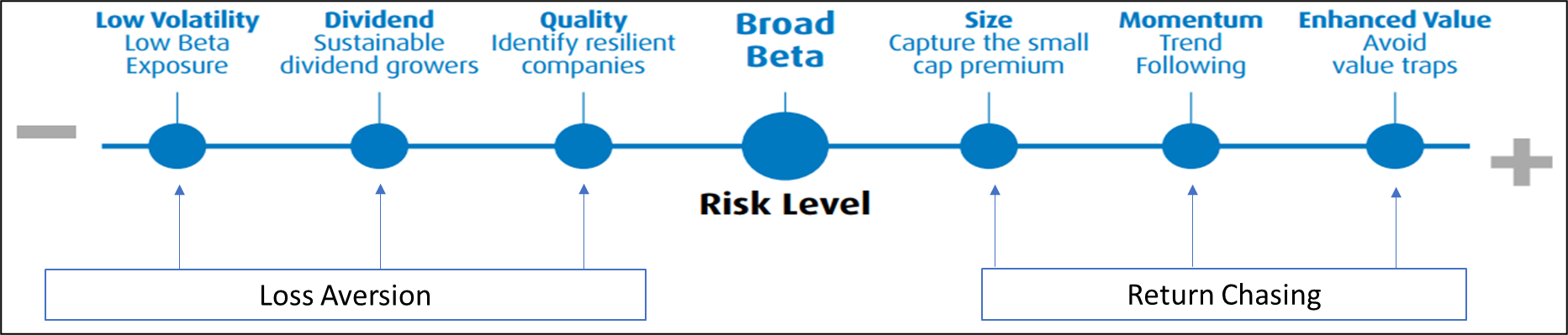

Factors have emerged as robust portfolio building blocks, displaying consistent attributes for pension pans to model to their distinct objectives. As the graphic below displays, some Factors can be integrated to reduce risk or to accent it.

Source: BMO Exchange Traded Funds/MSCI, March 2023

Quite often, factors are confused with styles, but they are far more defined. Style, be it growth, Value or Growth-at-a-Reasonable Price, will identify an attribute, but the benchmark index will usually be market capitalization weighted.

Factors, in contrast, are weighted according to the Factor matrix, breaking from the market capitalization mold.

Many pension plans have an expressed preference for active management, but many of the elements they seek in active mandates can be found in Factors:

- High conviction portfolio;

- Concentrated portfolio;

- Tracking error to the broad benchmark, indicating high active share;

- The potential to capture alpha.

Active managers may outperform when their style, capitalization or sector preferences are in the ascendency, but they revert to the mean when as the economic cycle evolves.

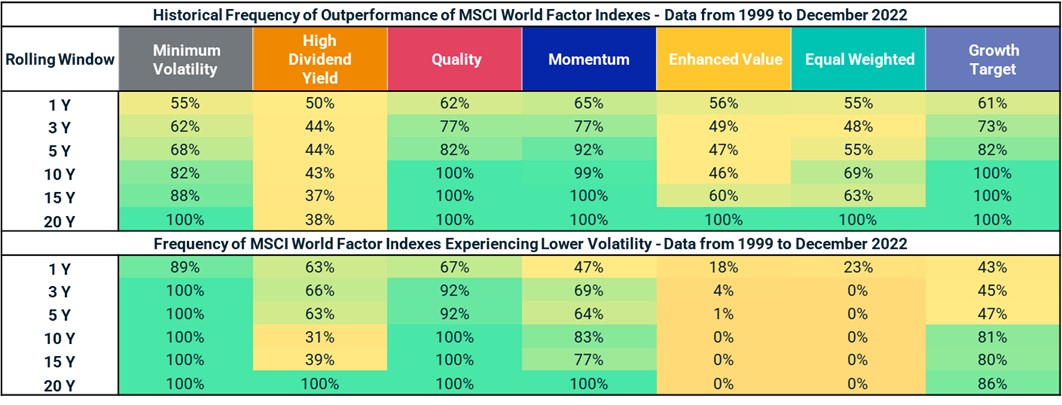

Factors have displayed an enduring value over long-term periods, aligning with pension plan objectives to implement assets which correspond to their long-term liabilities:

Longer time horizons 🠮 higher historical occurrence of outperformance, with diversification benefits becoming apparent over longer investment periods

Alternative Investments

The alternative asset category may provide diversification benefits to pension plans, but access is limited and fraught with obstacles. Though evergreen funds have emerged, alternative asset management costs remain expensive. Moreover, idiosyncratic data sets make it difficult to model exposure to a pension plan’s Asset Liability model, and liquidity and capacity constraints lead to placement delays, all of which make it difficult to maintain model allocations.

ETFs can be used to gain access to listed assets in global Infrastructure, Global Agriculture, Real Estate and Commodities or Gold. In some instances, listed exposure may be highly correlated to unlisted assets, but without the aforementioned obstacles.

Some pension plans want to implement a multi-asset credit strategy, using private debt, mortgages, and other non-traditional exposures to diversify. Some ETFs can provide very similar risk & return metrics to such non-traditional exposures, but offer market depth and liquidity which improve access and increase flexibility.

For small to midsized investors, an ETF may be competitively priced compared to pools, but its index may also provide a longer and consistent data set to model to risk and return, relative to the challenges which may arise when assessing non-traditional assets available in pools.

There is no doubt that there are advantages to traditional Alternative exposures in Pools. There may be an illiquidity premium, which may boost returns. The assets do not mark-to-market, and smoothed reporting provides plans with some stability in their decision making.

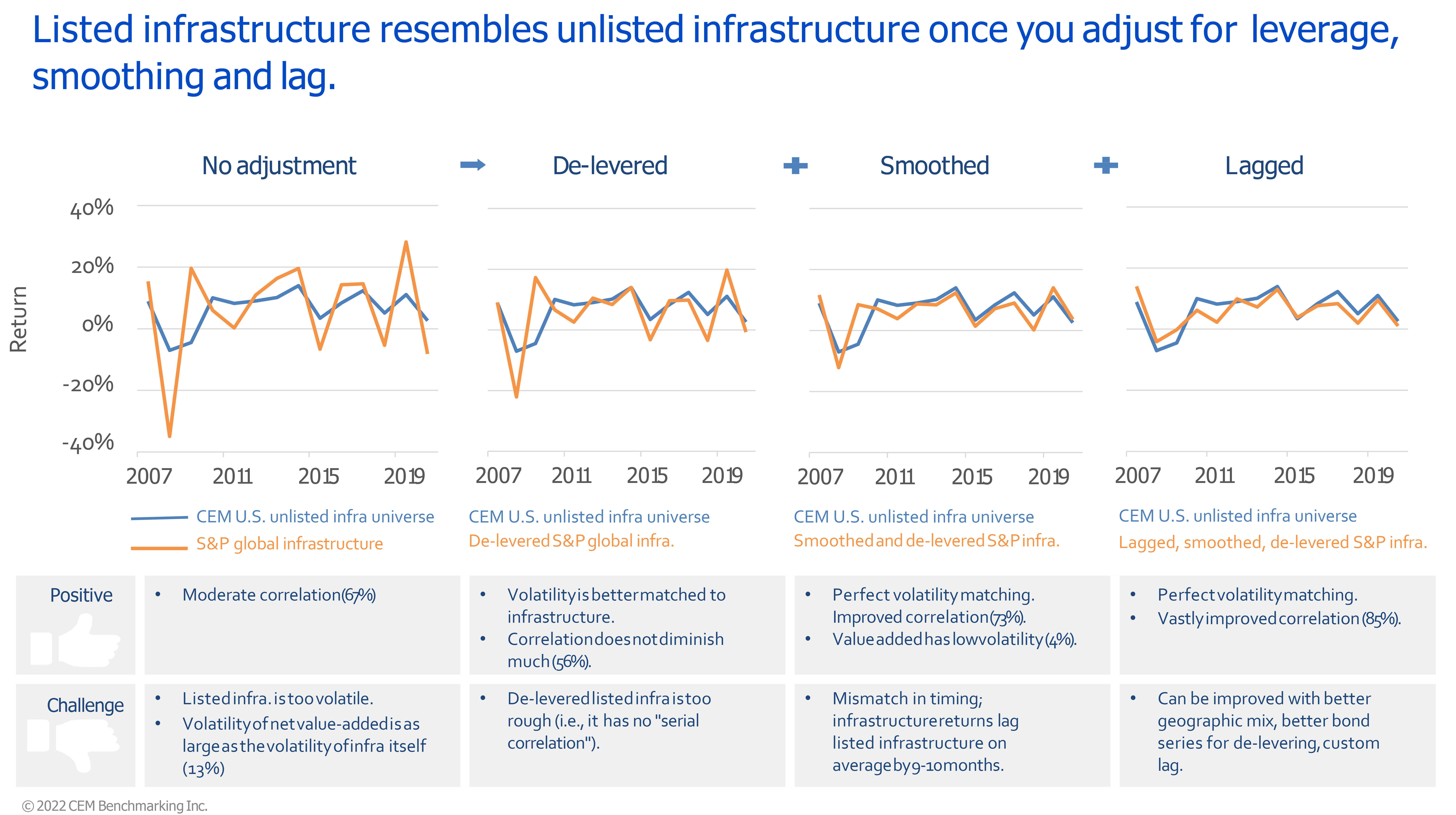

Although assets that do not mark-to-market appear to be more stable, economic events certainly affect their true value. Listed assets in Infrastructure and Real Estate ETFs may appear to be more volatile in the short-term but, over a longer period, some studies have shown their performance is highly correlated to their unlisted counterparts.

RI/ESG

The responsible investment and ESG realm poses a real challenge for smaller pension plans. They have the same fiduciary obligations as plans many times their size, but with a fraction of the time and resources to devote to an exacting and potentially divisive topic.

Many plans delegate responsibilities in the RI/ESG area to their external managers, depending on them to have integrated RI/ESG into their securities screening methodologies. The inherent flaw with delegating to external managers is that each manager will have different definitions or interpretations, resulting in an inconsistent policy being applied across regions and across asset classes.

Implementing an index RI/ESG ETF, using a transparent and consistent rules-based methodology, will provide seamless exposure throughout a portfolio. In addition, because the index tables a set of explicit rules and exclusions, the methodology can be a foundation to build consensus among stakeholders.

Some RI/ESG ETFs are constructed to track the risk and return metrics of broad benchmark indices, but select only the top rated companies to realize their stated objective. For plans looking to combine Active and Index exposures in a portfolio, some of these RI/ESG index ETFs may be used as core benchmark exposures, mimicking the broad Beta while aligning with the thematic RI/ESG overlay.

Conclusion

The pension world covers an enormous range; what some can accomplish, others cannot. Smaller plans wishing to emulate strategies larger plans have implemented can do so through Exchange Traded Funds. Access, cost and execution advantages make ETFs excellent tools for all investors, regardless of size, yet they are particularly valuable to small and medium sized plans.

It may be necessary to review plan documents to determine if Exchange Traded Funds are permitted investments, but there are several key advantages to integrating ETFs as a suitable vehicle to alleviate some concerns:

- Investment Management Agreements are not required, therefore reducing implementation costs;

- Fees are competitive for smaller plans that lack pricing power;

- Access to strategies or asset classes which may not be available through Pools;

- Broad and deep data set to model risk and return to a plan’s Asset Liability requirements;

- Simplified due diligence can reduce governance costs.

Fortunately, the expanding Canadian ETF industry provides extensive choice.

Disclosure:

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

Mark Webster, Director ETFs, BMO

Mark is the BMO ETF team's representative for Western Canada. With over 30 years of experience in the financial services industry, Mark has covered many diverse forms of financial risk. He began his career as a professional indemnity broker, becoming a vice president at Minet International Professional Indemnity Ltd. (now part of AON), conducting risk analysis for the Big 8 global accounting firms, as well as some of the top U.S. law firms. He is responsible for overseeing the proliferation of ETFs throughout Canada's vast western region and providing support to portfolio managers from the Pacific (Duncan B.C.), to the Lakehead (Thunder Bay, Ontario). He has worked as a retail investment advisor with RBC DS; in the mutual fund industry with First Trust Portfolios; and has held several other positions in the pension industry. He brings with him a Master's degree in Russian History from McGill University and several CSI accreditations.