Articles of Interest

Spread Too Thin: Positioning In Credit Markets

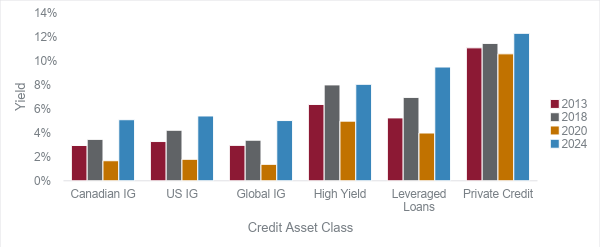

After decades of low interest rates investors are warming to the income to be found again in fixed income investing. All-in yield levels are the highest in over ten years, and the current opportunity to capture these yields looks especially attractive compared to the ultra-low rates of 2020.

Headline Yields on All Credit Asset Classes Are at Highs

Source: Bloomberg, Cliffwater LLC. February 16, 2024

But investors need to pay attention to the drivers of all-in yields. With any credit instrument, the yield is comprised of two elements:

- Base rate – the “risk-free” interest rate from which a credit instrument is priced. This is a matching term government bond for fixed-term debt like investment grade and high yield. This is usually a market rate like SOFR (Secured Overnight Financing Rate) or CDOR (Canadian Dollar Offered Rate) for floating rate credit instruments.

- Credit spread – this is the additional yield you earn above the base rate, which represents compensation for the credit risk the investor is taking.

With these elements in mind, we are cautious about using the all-in yield as the signal that credit is the most attractive place to be in the fixed-income universe. The rise in base rates has been the main driver of the attractive yield levels we now see in markets, hiding the relatively tight valuations in credit spreads.

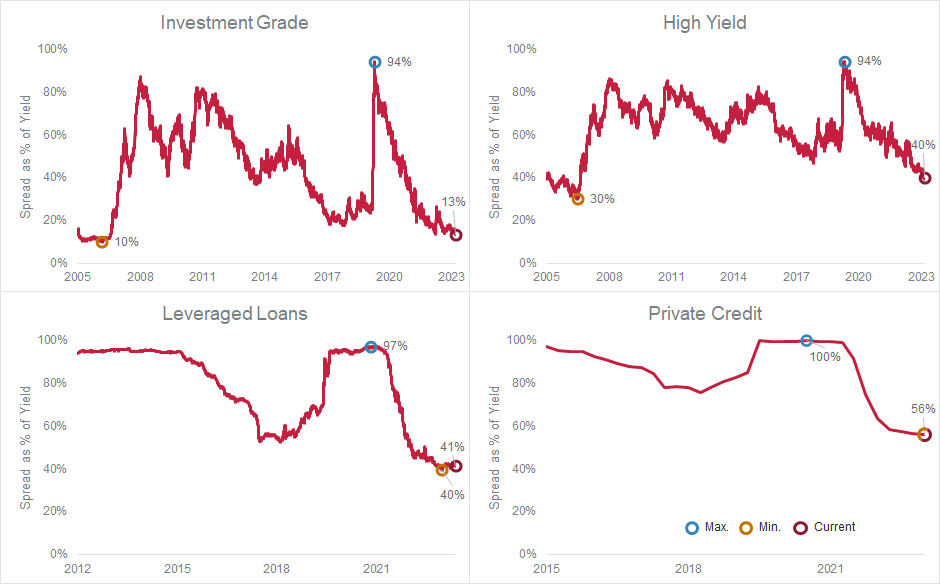

Consider looking at credit spread as a percentage of the all-in yield. Across almost all credit asset classes, the spread currently contributes at or near the lowest percentage of yield over the last decade.

Credit Spread as a Percentage of All-In Yield

Source: Bloomberg, Cliffwater LLC. February 14, 2024

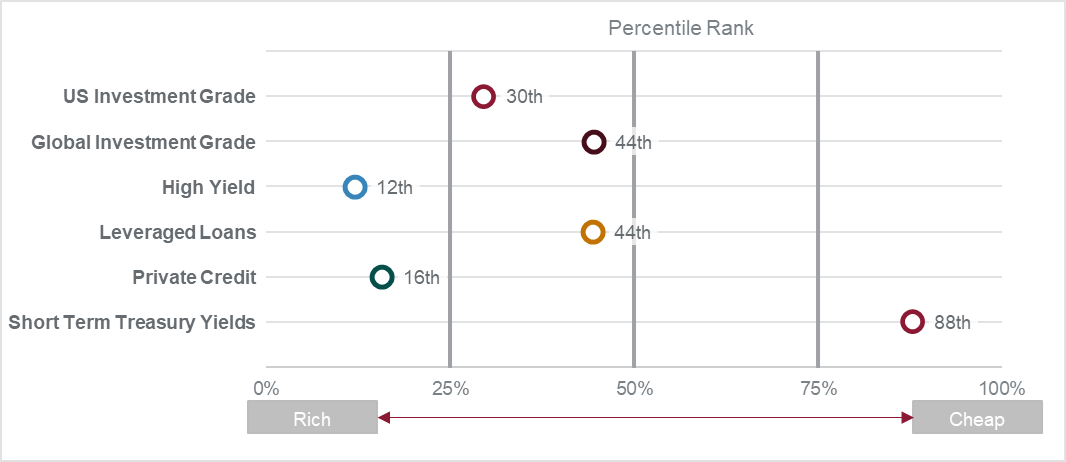

From a valuation basis, markets are not pricing in as much credit risk as in past periods, and this means that the price of credit risk is relatively expensive despite the eye-grabbing yields we see across the asset class. If we compare current spread levels to historical, all major credit asset classes trade tighter than long-run averages. The only component trading near longer-run highs is interest rates, at the 88th percentile.

Relative Value in Credit Asset Classes vs. Rates

Source: Bloomberg, Cliffwater LLC. February 15, 2024

How CIBC Asset Management is Positioning Credit Exposure

This is not to say that we think investors should avoid credit and buy interest rate risk. By recognizing the primary driver of all-in yield levels and the relative “richness” of credit spreads, we believe investors should consider the modes they and their managers are positioning within credit asset classes. In our view, the dominance of base rates over spread as the driver of value dictates a cautious stance in credit mandates. In our strategies this view is expressed in three ways:

- Higher allocation to non-credit such as cash-equivalents, government bonds, etc., to be used as liquid capital for future periods when spreads are more attractive

- Low portfolio sensitivity to changes in credit spreads (not interest rates), as measured by “credit duration”. Our low credit duration means any moves wider in spreads will have less impact on returns versus a higher credit duration.

- Lower exposure to non-investment grade and floating rate credit such as high yield, leveraged loans, and private credit given tighter spreads and risk of falling base rates eroding income production.

Given the backdrop of high base rates and tighter spreads, we believe this positioning is ideal. We maintain a low-risk posture, which should help protect capital if spreads move wider, and we do so without undermining all-in yield in our portfolios, given the majority of yield to be captured is coming from the non-credit component of fixed-income markets. This positioning also gives strategies “dry powder” that can be tactically deployed into credit asset classes as spreads widen and offer more attractive entry points.

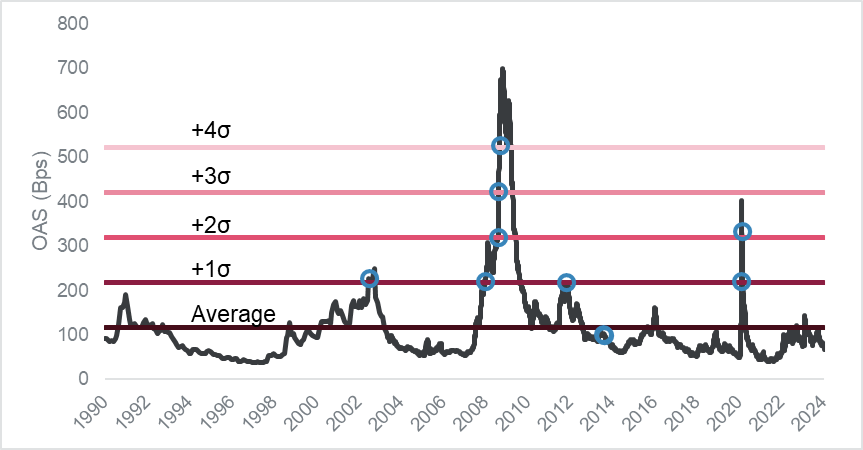

Generally speaking, credit spreads are mean reverting, and times of ultra-wide spreads are often the best time to rotate “dry powder” back into credit exposure. Timing the wides in spreads is near impossible, but the nature of spread movements can guide increasing/decreasing allocation. For example, if investors used standard deviations of spreads above average as a trigger to allocate to investment grade bonds, their annualized five-year return, on average, would have been 8% following each allocation versus 4.4% on a five year rolling basis in all periods.

Using Mean Reversion in Spreads to Trigger Increased Allocations

Source: Bloomberg, Cliffwater LLC. February 16, 2024

While seeing yield back in the fixed-income market is a welcome trend, we caution investors to contemplate what drives these attractive all-in yields and, given those drivers, the best way to allocate in credit. Is increasing base rates the trigger to increase credit spread exposure, or are future bouts of spread widening a better entry point? And in the world of multiple credit asset classes, what is the best format to express a view?

Given our current view, we believe fixed income allocations should be conservatively positioned, getting “paid to wait” for future periods where credit risk should look more attractive, and spreads are not stretched too thin.

Disclaimer

The views expressed in this document are the views of CIBC Asset Management Inc. and are subject to change at any time. CIBC Asset Management Inc. does not undertake any obligation or responsibility to update such opinions. This document is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this document should consult with their advisor. All opinions and estimates expressed in this document are as of the date of publication unless otherwise indicated, and are subject to change. CIBC Asset Management and the CIBC logo are trademarks of Canadian Imperial Bank of Commerce (CIBC), used under license. The material and/or its contents may not be reproduced without the express written consent of CIBC Asset Management Inc.

Certain information that we have provided to you may constitute “forward-looking” statements. These statements involve known and unknown risks, uncertainties and other factors that may cause the actual results or achievements to be materially different than the results, performance or achievements expressed or implied in the forward-looking statements.

Bloomberg®” is a service mark of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by CIBC Asset Management Inc.. Bloomberg is not affiliated with CIBC Asset Management Inc., and Bloomberg does not approve, endorse, review, or recommend any CIBC Asset Management Inc. products.

Aaron Young, CFA, Vice President, Global Fixed Income, CIBC Asset Management

A member of CIBC Asset Management's Fixed Income team, Aaron is responsible for the expert design and management of solutions for fixed income investors.

He has been in the investment industry for 13 years. Prior to rejoining CIBC in 2023, Aaron was a Portfolio Manager at RPIA on the portfolio management and research team. He began his career at CIBC Asset Management in 2010 in institutional client servicing, and as an Associate Client Portfolio Manager with the Fixed Income team.

Aaron has published numerous research papers on fixed income, credit, and ESG investing, and has been a featured speaker at many Canadian and global investment forums.

He holds a Bachelor of Arts degree from the University of Toronto. Aaron is also a CFA charterholder and a member of the CFA Society of Toronto.