Articles of Interest

Positioning Your Stock Portfolio: Passive or Active Management?

Manager underperformance has cast doubt on the value of active management in a market increasingly dominated by a few large U.S. tech companies. Although the volatility seen in early 2025 may have benefited some active strategies, the long-term question remains: what is the best approach for stock market exposure - passive or active management? We’ll answer this question by analyzing the historical performance of managers and benchmark indexes.

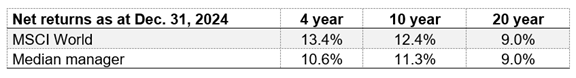

Over the past decade, market returns have exceeded the historical average, enabling many investors to improve their financial health. However, median manager performance, after management fees, has been below the benchmark.

Despite the market volatility since the start of 2025, active managers continue to underperform.

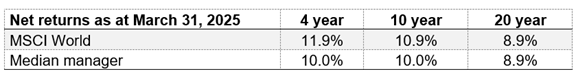

Since the 2008 financial crisis, the proportion of global equity strategies generating added value has been declining. Since 2020, the median manager has no longer added value, regardless of management approach.

Analysis of Current Market Performance and Risks

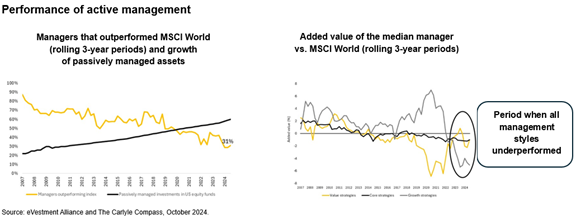

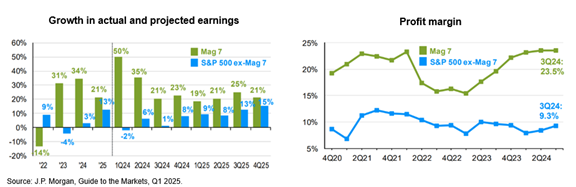

In recent years, performance has been attributable to a limited number of stocks. The number of stocks outperforming the S&P 500 is below the historical average, limiting opportunities to stand out through stock selection. The “Magnificent Seven” stocks1, which represent 24% of the MSCI World Index and 33% of the S&P 500, have contributed over 50% of the S&P 500’s return and 33% of the MSCI World’s return since 2021.

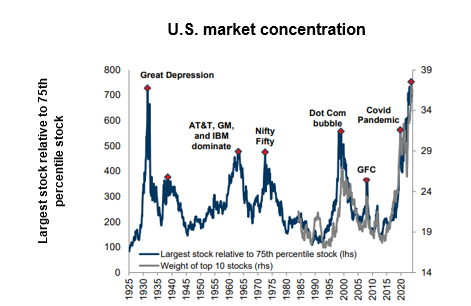

Few managers have allocated more than 30% of their portfolio to these seven stocks, which would represent a high concentration in a single sector. For example, a portfolio with no Nvidia shares in 2024 would have resulted in a shortfall of around 3% relative to the global market. Market concentration and returns have reached an unprecedented level. The top 10 stocks in the S&P 500 account for nearly 40% of the index—the highest concentration since 1925.

Historically, the level of index concentration has been cyclical. As a result, it is expected to decline over the next few years, which seems to have been the case since the beginning of 2025. If it continues to do so, this tentative return to stock and sector diversification could benefit active management. In fact, following a decline in concentration, over 75% of active managers outperformed the market, as observed in the 1970s and after the tech bubble burst in the early 2000s.2

Is the Past Representative?

Despite the heightened risk associated with global indexes due to their heavy weighting in a few stocks, there are two notable differences compared to other periods of high concentration:

1. The largest companies in terms of market capitalization also generate the highest earnings growth and profit margins. The future performance of these stocks will have a significant influence on index returns. Currently, the risk seems more closely related to expectations for earnings growth than to the usual risk linked to the financial quality of these companies.

2. The strong growth in passively managed assets benefits the largest companies and puts pressure on active managers. This tendency has also been strengthened by the rise of exchange-traded funds and online savings platforms.

Which Approach Should You Select for Your Stock Market Portfolio?

The structural trend in favour of index funds could accentuate the level of concentration and continue to create a market that is hard for active managers to beat. The solution to this is rigorous risk management and alignment with each investor’s specific investment objectives.

In addition to choosing between passive or active management, you also need to consider whether your portfolio structure is aligned with your long-term investment objectives. Furthermore, some managers now make it possible to calibrate risk and exposure to certain factors, thereby delivering desired characteristics that may differ from those obtained through simple market exposure. Here are a few questions to guide you:

- What is the objective of your stock market exposure in terms of your overall assets?

- What is your risk tolerance (is it a priority to protect capital and limit losses during downturns or prolonged periods of lower-than-expected returns)?

- Are you willing to accept market beta performance and focus on other categories with a higher probability of generating alpha?

- Are sustainable investing criteria important to you?

Your responses should guide your investment strategy. With the market volatility in 2025, it remains essential to meticulously plan and progressively implement your strategy, despite the slight decrease in performance gaps observed between passive and active management.

Our Investment Consulting team can help you build a portfolio that aligns with your objectives.

1 The “Magnificent Seven”: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla.

2 Wellington Management: An index isn’t a fiduciary — and six other concerns about the push for passive.

Alexandre Bernard, M. Sc., CFA, Partner, Investment consulting, Normandin Beaudry

An economist by training, Alexandre has more than 15 years of experience in the area of finance and asset management. He is also the head of the private equity research team.

Alexandre’s curious mind and passion for investment mean he is always on top of current events. He is also responsible for developing Normandin Beaudry’s database of investment managers. Alexandre puts his strong analytical skills and portfolio-building expertise to use in supporting institutional and private clients representing several billion dollars in assets.

Raphaël Gariépy, M. Sc., CFA, Principal, Investment consulting, Normandin Beaudry

Raphaël serves as the head of the public equities research team since 2017. He oversees the Normandin Beaudry's investment beliefs regarding equity portfolios and also the process of selecting equity managers for clients. He is also a member of the sustainable investing research team.

Raphaël has more than 10 years of experience in asset management, as well as a bachelor’s in actuarial sciences combined with a master’s in finance. This multitalented consultant is also an excellent communicator who knows how to explain things so they’re easy to understand. He relies on the innovative expertise he’s gained to serve a wide range of clients (wealthy families, public and private sectors, pension plans and religious communities) with assets worth anything from several million to several billion dollars.