Articles of Interest

Issues to Consider When Investing in Chinese Equity

If two words describe Canadian CIOs’ actions – or lack thereof – regarding investing in China today, it’s fence sitting. In fact, very few pension funds currently have a standalone Chinese equity allocation. As the Pension Investment Association of Canada’s 2021 Defined Benefit Asset Mix Report shows, Chinese equity is buried in the median allocation to “Emerging Markets (EM)” equity (4.9%) or in “Global All Cap (22.4%), Global Large Cap (19.4%) and/or “Global Small Cap” (5.1%) equity, and this likely didn’t change in 2022. So why and how should CIOs think about allocating to Chinese equity today?

Why Chinese Equity as a Standalone Allocation?

Today, Chinese equity is significantly under-represented in global equity portfolios across institutional investors. Separating Chinese equity as a standalone allocation can provide investors with a more efficient global equity portfolio as:

- China is Second Largest Economy with Solid Growth Prospects: Today, China’s GDP is larger than that of India, Russia, Africa and Latin America combined[1], and while China’s GDP slowed to 3% in 2022 (vs. 8.4% in 2021), China’s GDP growth is forecast at 4.6% in 2023 and 4.1% in 2024.[2] In contrast, recession concerns abound for 2023-24 across Developed Markets. Moreover, China’s economy should continue to grow over the next 10+ years, when China is expected to eclipse the U.S. as the world’s largest economy[3];

- China’s Robust and Growing Equity Market: China’s equity market is currently the second largest globally and is larger than Japan’s market, which is often treated as a standalone allocation;

- China Dominates MSCI Emerging Markets Index (EM Index) with Room to Grow: Most CIOs still think of China as part of EM. China’s weight in the EM Index grew from ~7% in 2000 to ~14% in 2008 to ~32% in 2022, and should increase with the China A Shares inclusion (currently 20%). At 100% China A Shares inclusion, China could be 45% of the EM Index;[4]

- China’s Low Allocation in MSCI ACWI Index (ACWI Index): Most investors use the ACWI Index as their equity benchmark, yet China represented <4% of the ACWI Index in December 2022. Also, the ACWI Index currently overweights offshore mega-/large-cap Chinese companies (i.e., H Shares and U.S. ADRs), at the expense of faster-growing Chinese companies (i.e., generally China A Shares). Hence, CIOs should invest either in an All China equity portfolio across H Shares, U.S. ADRs, and China A Shares (i.e., a diversified portfolio) or focus solely on China A Shares (ideally with a local manager), to capitalize on higher potential returns;

- China A Shares Additive in Global Equity Portfolio: China A Shares provide global equity investors with diversification, significant alpha opportunity and higher potential returns. The long-term investment case to overweight China A Shares is as follows:

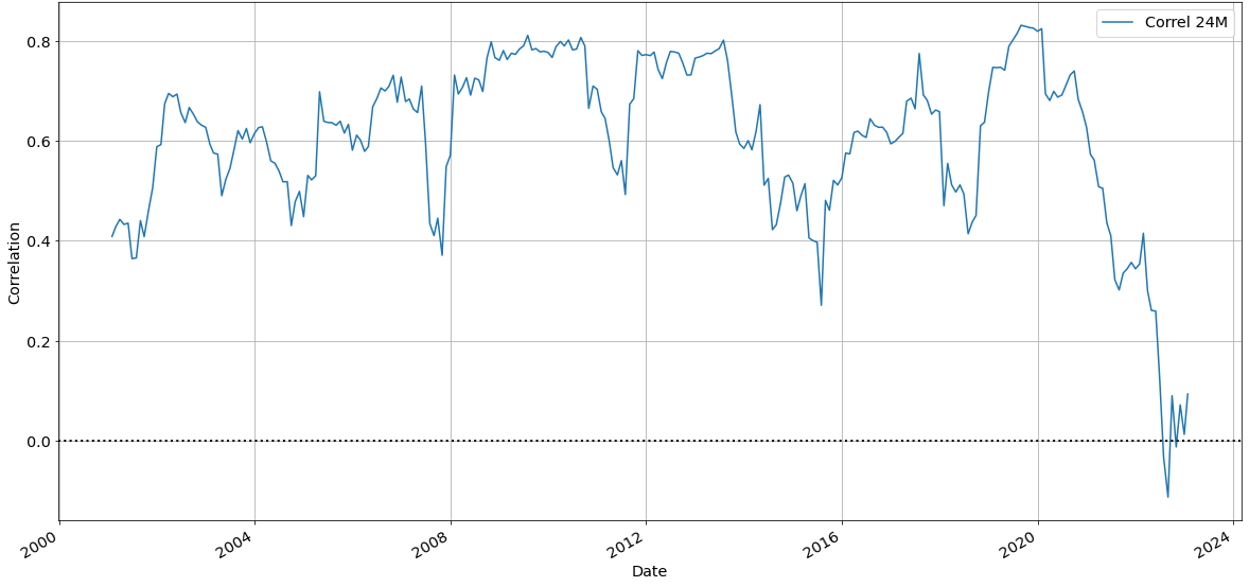

- Diversification Benefits: The China A Shares market includes all of the sectors and companies in China’s dynamic economy and it has a relatively low correlation to other global equity markets (see Figure 1).

- Significant Alpha Opportunity: While the China A Shares market is becoming more institutional, retail investors still represent 65+% of daily turnover.[5] Hence, active managers can capitalize on the China A Shares’ market inefficiencies to deliver significant alpha. In fact, for the 3, 5, 7 and 10 years to December 2020, the median manager in Mercer’s China A Shares universe significantly outperformed the MSCI China A Onshore Index.[6] Indeed, China A Shares’ alpha opportunity should persist for at least the next decade.

- China’s Economy Strong, Vibrant and Growing: Given the stage and priorities of China’s economy over the next decade, investors can capitalize on China’s unique growth opportunities. Today, China dominates the manufacturing of electronics, machinery, devices and appliances. However, Chinese companies in the sweet spot of their innovation cycle (i.e., mid-cycle growth stage) can accelerate momentum to replace imports, commercialize next-generation technologies, meet upgraded domestic consumption needs and digitize the economy; and

- China A Shares Under-Represented in Global Equity Portfolios: Today the most attractive investment opportunities in China A Shares are under-represented in standard benchmarks[7]; As noted, China was <4% of the ACWI Index in December 2022, while the 10 largest companies (all U.S.) represented ~14% of the ACWI Index[8].

Figure 1: Chinese Equity Has Relatively Low Correlation to Global Equity (Jan 2003-Dec 2022)

Chart shows rolling 24-month return correlation between MSCI China and MSCI World (in local currency)

Sources: Data from Datastream, Wellington Management

How to Invest in Chinese Equity?

In addition to allocating to EMs as part of the total global equity portfolio (the Equity Portfolio), CIOs can consider three options[9]:

- Option 1 – Strategic Overweight to Chinese Equity (10-20% of Equity Portfolio): CIOs can capitalize on the portfolio efficiency benefits of China exposure by allocating at least 10% of the Equity Portfolio to China A Shares. Over the next decade, assuming the outlook for China remains positive, this allocation can slowly increase, perhaps to 20% of the ACWI Index;

- Option 2 – Limited Overweight to Chinese Equity (5-10% of Equity Portfolio): CIOs can still gain some portfolio efficiency benefits of China exposure by allocating 5-10% of the Equity Portfolio to China A Shares; or

- Option 3 – Index Allocation to Chinese Equity (<5% of Equity Portfolio): At a minimum, CIOs can allocate the current index weight of <5% of the ACWI Index to Chinese equity.

To date, Canadian CIOs have generally defaulted to Option 3. “We leave any decision on China to our global equity or EM managers” is a common CIO refrain. However, as consultants reaffirm, rising U.S.-China tensions and de-globalisation are the wrong reasons to avoid investing in China. As Mercer notes, not allocating (or limiting an allocation) to China “would only provide limited protection across a broad spectrum of “worst-case” scenarios while foregoing potential portfolio efficiency benefits across numerous benign scenarios.”[10]

CIOs who seek to capitalize on China’s long-term growth can invest with best-in-class local China managers who:

- Understand Culture and Political Landscape: Local managers speak the language, understand Chinese culture and politics better than foreigners, and can assess pertinent political and economic issues. For example, some local managers pivoted away from large internet companies and educational technology platforms long before the Government “cracked down” on them in 2021;

- Have Practical Knowledge of Economy and Extensive Corporate Network: Local managers can validate economic facts on-the-ground in China due to their extended local networks, and they can do the onsite leg-work to conduct proper due diligence on local companies and their management teams, as well as on a company’s customers, suppliers, etc.;

- Capitalize on Market Inefficiencies and Find Growing Companies: Local managers can capitalize on inefficiencies in the China A Shares market and deliver significant alpha. Also, these managers focus on critical sectors in China’s economy where Government programs provide strong tailwinds, and their local networks help uncover fast-growing companies; and

- Educate and Engage Corporate Management on Value of ESG: Some local managers have embraced global ESG best practices and are members of PRI and/or of other ESG-related alliances.[11] These managers educate and engage Chinese CEOs on ESG, and continue to make progress on ESG issues.

Conclusion

Consultants and asset managers make the case that China should be a core allocation in investors’ Equity Portfolios, to enhance diversification and increase alpha. China is well positioned in 2023 for a strong economic and equity market rebound, given its dynamic corporate sector, maturing capital markets, and the growth of consumer spending. Beijing continues to invest heavily in new infrastructure technology, including artificial intelligence, 5G, cyber-security and semi-conductors. China’s economy is advancing to upstream “next-gen tech,” and many innovative Chinese companies are replacing western imports, commercializing new technologies, meeting upgraded domestic needs and digitizing the economy. If CIOs seek to capitalize on these growth opportunities over the next decade, they should invest in both offshore and onshore Chinese equity, with China A Shares offering the best risk-return and alpha opportunity.

[3] Global Economics Paper The Path to 2075 — Slower Global Growth, But Convergence Remains Intact (goldmansachs.com)

[4] MSCI Emerging Markets Index (Dec 2022) and China: Time to Fly Solo? (gsam.com); For A Shares inclusion, see China A Shares: What Have We Learned? - MSCI

[5] https://www.caixinglobal.com/2022-06-24/retail-investors-share-of-chinese-stock-markets-falls-below-70-101903331.html

[6] Mercer’s paper on Positioning your portfolio for the future of emerging markets: The case for a dedicated China allocation (May 2021), Page 11, Figure 10.

[7] Mercer’s paper on The Case for China Revisited – Public Equities (Sep 2022), Page 8. Executive Summary

[8] Source: MSCI, as at end Dec 2022, based on stock weights in MSCI AC World Index.

[9] Mercer’s paper on The Case for China Revisited – Public Equities (Sep 2022), Aon’s paper on An Emerging Equity Opportunity: China A-Shares (Mar 2020), WTW’s paper on The merits of a stand alone equity allocation to China (Nov 2020) and WTW’s paper on Allocation to China in a new world order (Nov 2020).

[10] Mercer’s paper on The case for China revisited - Public equities (Summary) (Sep 2022), Page 2.

[11] International Capital Markets Association and China Central Depository & Clearing Co., Ltd. paper in Jan 2023 on ESG Practices in China

Regis Dale, Senior Advisor, Bin Yuan Capital, and Bernice Miedzinski, President, StarBridge Capital

Regis Dale is a Senior Advisor to Bin Yuan Capital and he has worked for two decades in Chinese equity markets.

Bernice Miedzinski is President of StarBridge Capital and represents Bin Yuan Capital in Canada.