Articles of Interest

Inflation waits: The long-term impacts on plan sponsors and members

The Canadian economy has recovered faster from the impacts of the COVID-19 pandemic than initially expected. The recent upturn in inflation, and the higher rates Bank of Canada (BoC) is employing to counteract it, is a profound shift for pension plan sponsors and members who had adapted to what became known as a low-for-long interest rate environment.

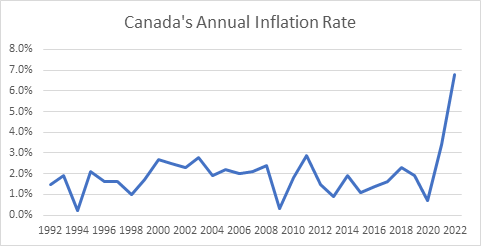

The sharp rise in the cost of living in Canada marks a dramatic shift after an extended period of low annual rates of inflation dating back to the early 1990s. The BoC enjoyed a near-30-year streak of maintaining an annual inflation rate within or below its 1% to 3% target range. (Historically high interest rates – with overnight rates topping 20% in 1981 – were implemented to fight inflation in the 1970s and 1980s.) We cannot rule out a return to low interest rates as economic growth slows.

Source: Statistics Canada

Twelve months after the BoC’s first of a historic 8 rate hikes in a 12-month period, the lagging impacts of inflation are beginning to materialize in the economy, posing new challenges as well as opportunities for workplace savings plan members and sponsors alike. Depending on the type of pension plan an employer offers, plan sponsors may need to find new ways to combat inflation within their plans that eschew the historical inflation playbook. Retirees and those nearing retirement without income payments linked to inflation or cost of living increases, may need to spend more money to maintain their standard of living, leading to lower income and financial insecurity in retirement.

Cooling the impacts of inflation in pension plans

Rising inflation and interest rates have had a largely positive effect on funding ratios of Defined Benefit (DB) plans and their sponsors. Those who have promised to pay retiree benefits indexed to inflation are feeling the pinch, but to a degree that’s offset by rising interest rates. And while higher interest rates tend to hurt equity valuations, the actual interaction can be quite complex. So even as raw material costs rise, many public companies come out ahead and see their share price climb as a result.

Capital Accumulation Plan (CAP) sponsors are less impacted of course, but they do face workforce management challenges brought about by the higher cost of living and elevated borrowing costs facing their members. (We are referring to CAP as an umbrella term, which includes defined contribution pension plans, group RRSPs, etc.)

The combination of high inflation and high interest rates pose a different set of challenges for CAP sponsors. Now is a good time to conduct a review of the investment options available to CAP members. Recordkeepers can provide data on member contribution rates, filtered by age and income level. Many sponsors that haven’t made real assets available to members via target date funds (TDFs) might do so now.

TDFs provide a diversified investment approach that balances risk and return over time and are designed to manage inflation risk for plan members depending on how close they are to retirement. By allocating assets across different asset classes, including equities, bonds, and real assets, TDFs can help to protect against inflation while still delivering strong returns.

Engage with your members

Communication matters at a time like this, especially for those close to retirement. CAP members continue to underutilize retirement planning and other tools designed to help. This period has also amplified the industry focus of making professional financial advice available to members. Effective decumulation strategies are made far more complicated by environments like this.

Key messages to communicate to plan members right now include reminders about:

- workplace plans focus on the long-term and are designed to help weather near-term volatility,

- the power of compound interest,

- the advantages of dollar cost averaging

- the low cost of CAPs relative to the retail market and

- the tax advantages of saving within a registered plan.

Retirees and those close to retirement are more vulnerable

All but a relatively few pension plan members – those who enjoy the inflation-linked DB pensions – are vulnerable. Those without are seeing the real value of their retiree benefit fall. CAP members are experiencing a similar challenge with their retirement savings, and those still in the accumulation phase find it more difficult to save for their financial future.

Members are vulnerable in the asset accumulation phase because of the choices they have with regard to contributions, withdrawals and investment selection. But given that central banks are seeing some success in their efforts to combat inflation, we should not overreact to what may well be a short-term challenge.

Based on a sample of our Group Retirement Services client data, members don’t appear to be overreacting. Analysis of our data* showed member contribution rates remained largely consistent with historic rates, and interfund transfers remain steady.1 We saw a decline in the latter in 2022, relative to the year before – both in dollar terms and the number of transfers. The nature of those transfers is also telling. We saw more member transactions designed to increase risk (e.g., buy more equities) in 2022 than the opposite (e.g., sell equities in favour of more conservative assets).

The greater concern is for those nearing or entering the phase where they’ll begin drawing retirement income from their savings. CAP members in their 50s and 60s need to think about diversification in less traditional ways because of the impact higher interest rates will have on the bond market. They’ll have to remain invested in return-seeking assets, including real assets, a little longer to earn additional returns.

Those entering retirement will find that payout annuities offer greater value and longevity protection as part of a decumulation strategy. The rise in rates means these products can pay out more in retirement income. The protection annuities indexed for inflation can provide against price increases come at the cost of a lower initial payout amount, but we can expect them to take on greater relevance if we remain in a prolonged period of elevated levels of inflation.

Mostly though, inflation is tough on retirees living with a fixed income. Those carrying debt are also hamstrung by higher borrowing costs. So, those with assets in both a DB plan and CAP may find that they are well-served by an untraditional approach to the order in which they draw down money.

“Traditionally, members with both income from a DB plan and assets in a CAP would consider postponing drawing income from their DB plan (if they can) at least until their pension is fully unreduced. Sequence of returns risk can be managed by ensuring plan members have a flexible and diversified financial plan that helps them understand how to draw income from all their sources of retirement income while managing their cash flow needs.” 2

A lot to think about

We can take some comfort from the drop in the annual rate of inflation since it hit a peak of 8.1% in June 2022. The actions taken by central banks here and abroad seem to be working.

We continue to see messaging from both the Canadian and U.S. central banks that they’re going to remain vigilant. Paul Volcker’s success in combatting inflation as chairman of the U.S. Federal Reserve System between 1979 and 1987 is seen as a masterclass on the subject. Because of this legacy, while the BoC held rates for a second time in early April 2023, it reaffirmed a commitment to staying the course and doing what’s necessary to have inflation reach its 1% to 3% target.

While the BoC is striving to hit 1% to 3% inflation target, market participants should remember there is no guarantee that the BoC’s target inflation rate will remain in that range forever. Using policy rates to control inflation is a blunt tool, with the potential to cause a recession as collateral damage. As a result, there exists a delicate balance between achieving the inflation target and causing longer-term economic damage. The recent banking industry turmoil in the U.S. is evidence of this. “While U.S. bank runs may have limited direct impact on Canadian economy, the U.S. Federal Reserve’s interest rate decision could dictate the tone for Canada.”3

To the extent the policy rate remains between 1% and 3% – and investors believe the central bank is in control – long-term implied inflation and the cost of inflation protection remains closer to 2%. However, even a 1% upward shift in the target rate would have a major impact on DB plan sponsors with indexed benefits. A plan with a 20-year duration, for example, could see costs jump by about 20%.

This scenario doesn’t seem to be on the horizon just yet, but it is one that plan sponsors and their consultants should be thinking about when considering the risks faced by pension plans.

Eric Monteiro, Senior Vice-President, Group Retirement Services, Sun Life

Eric leads Canada’s largest provider of workplace and savings and retirement platforms, covering 1.3 million Canadians and over $125B in assets. Eric’s team is responsible for developing and delivering a wide range of products and services to meet the unique needs of Sun Life’s plan sponsors and plan members.

Since joining Sun Life in 2016, Eric has held several roles including Senior Vice-President, Chief Client Experience Officer. In that role, he oversaw the creation and delivery of great Client experiences across all channels and businesses in Canada, as well as the rollover and in-plan wealth and insurance businesses. Before joining the Client Experience Office he was Chief Analytics and Engineering Officer for the retail business.

Prior to joining Sun Life, Eric was Chief Strategy and Analytics Officer at Aimia Inc., and a former partner at McKinsey & Company.

Eric sits on the Board of Directors for The Princess Margaret Cancer Foundation, one of the world’s leading cancer research and care organizations.

Born and raised in Brazil, Eric has a Robotics Engineering degree from The University of Sao Paulo, an MBA with high-distinction from the Ross School of Business at the University of Michigan, and a ICD.D designation for Corporate Directors.