Articles of Interest

Exploring Private Assets: What Canadian Pension Plans Need to Know

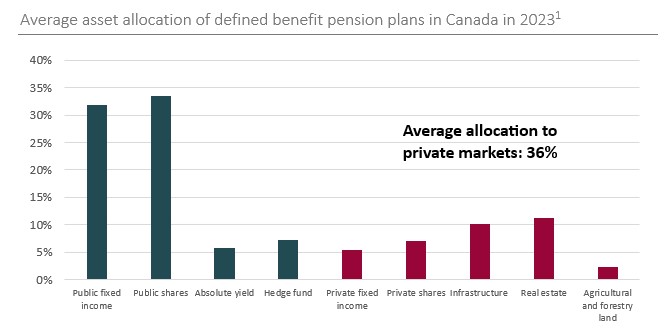

Except for large institutional investors, access to private assets (private equity, private debt, real estate, infrastructure, and others) for pension funds in Canada is relatively new for most, dating back only a few years. However, this novelty has not prevented the community from investing with conviction to capitalize on some of the most attractive aspects of this field.

In fact, particularly during periods of market volatility, private assets can provide a certain foundation to a fund’s portfolio, offsetting sharp declines in the stock and bond markets, as was the case in 2022. The role of private assets is, however, debated by some. Among the main arguments against them is the presence of volatility concealed behind more opaque and, above all, less frequent valuations of portfolio investments. While this aspect is certainly worth noting when an institutional investor is considering this type of asset, there are several other factors that work in their favour. For several years, the reality has been that the available investable universe is much larger (9.5 x)2 for private markets than for public ones. Private market investors also tend to be more patient, less short-term oriented, and don’t usually penalize companies based on a single disappointing quarter or year, as is the case with the public markets. All this makes the arguments against private assets a little easier to digest.

Once the relevance of this niche has been established, investors need to work out how to access it. This is far more complex than for public markets, and the level of resources (dedicated staff) for each plan has a major impact on the type of exposure considered. The good news is that the options are multiplying, and with the right support, most plans can choose investment options that are relevant to their specific situation.

Choosing Between Open-End and Closed-End Funds

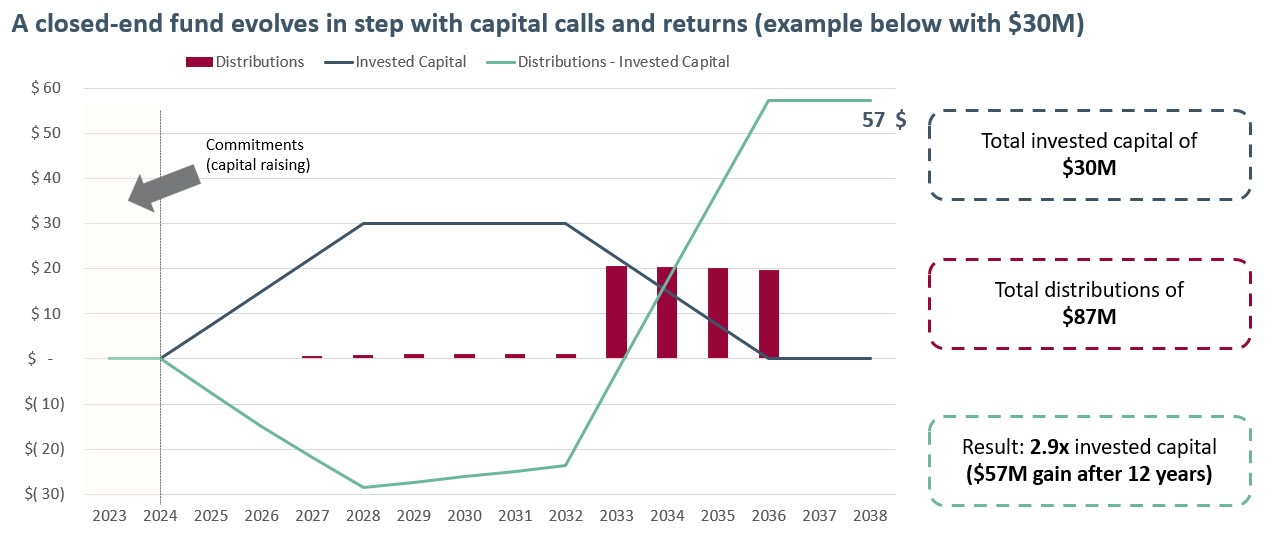

The most common structure for private assets is undoubtedly the closed-end fund, whereby a manager raises capital, invests it gradually, and redistributes the gains to investors over a pre-defined period.

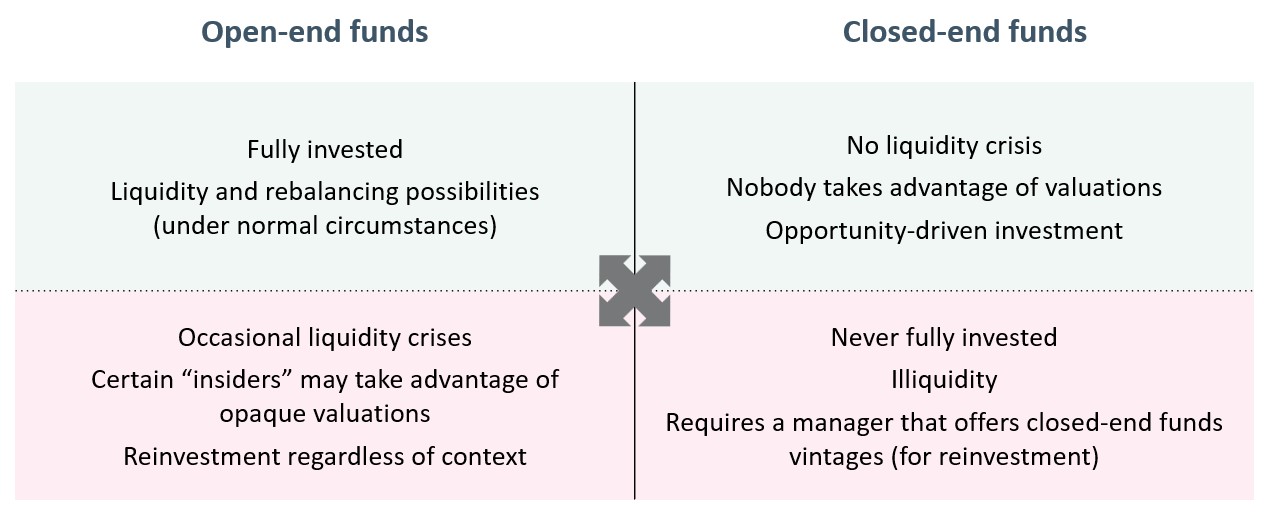

This approach enables a manager to raise one fund after another (different vintages), and to be constantly on the lookout for the best opportunities, ultimately monetizing them and then moving on to the next fund. However, this type of investment involves juggling multiple cash flows and does not allow for easy, efficient management of a plan’s exposure to an asset class. That’s why many of the more sophisticated funds have established programs with multiple closed-end funds to counter this challenge. Other funds with more limited resources will opt for the open-end (evergreen) approach. This type of fund enables capital to be rapidly and fully deployed indefinitely, thus limiting the need to constantly feed a complex program of closed-end funds for a given asset class. The key, however, is to find a manager with extensive capabilities and in-depth expertise in all types of funds and assets. It is also important not to view this type of fund as entirely liquid, despite the attractive operational features put forward by the manager. In times when private market conditions are more difficult and less liquid, it’s not uncommon for these funds to limit their investors’ outflows. An open-end fund should be treated as a way of facilitating deployment into an asset class, not as an opportunity to access an illiquidity premium while also being able to cash out as one pleases.

Primary, Secondary, and Co-Investments: What’s the difference?

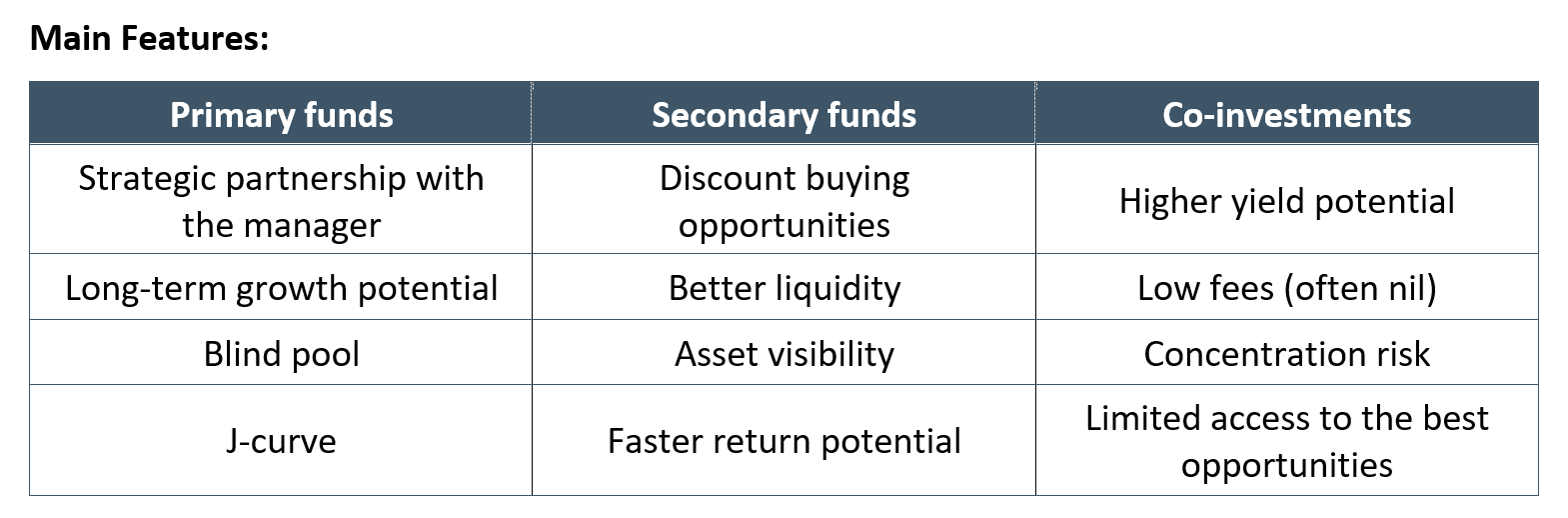

Regardless of whether the investor chooses a closed- or open-end fund, exposure to primary fund, secondary fund, and co-investment assets is a key factor in the investment strategy. Access to primary funds enables us to adopt top-quality manager strategies from the get-go and to benefit from their expertise and capabilities from the beginning to the end of the fund’s term. Secondary funds, on the other hand, enable you to take advantage of opportunities on the primary market and obtain significant discounts to market value, while avoiding the well-known primary fund “blind pool”. Finally, co-investments provide direct exposure to companies and projects while limiting management fees. This type of asset is often the result of strategic partnerships with primary funds, helping to enhance the return profile of a broader private market strategy.

In short, a balanced use of these three types of assets allows you to benefit from a healthy approach, giving you access to the benefits and mitigating the disadvantages inherent in each of the three categories.

Selecting the Right Approach to Private Asset Investing

For most investors, greater accessibility to capital deployment in private markets is good news. However, a closed-end fund approach can be time-consuming and tedious to manage, requiring considerable resources and expertise to set up a program and maintain it in line with the portfolio strategy over time. That is why the use of an open-end fund (fund of funds), covering all the asset types previously mentioned (primary, secondary, co-investments), can be an excellent way of gaining exposure to the different asset classes in private markets. It’s just a matter of finding a manager with the calibre to access the best projects from around the world, and to offer a concise, clear, and diversified multi-axis structure within its investment solution.

Depending on the size of a plan’s assets, it may be wise to consider the addition of certain closed-end funds to bring more specific market segments to the investment strategy. A closed-end fund would then complement and even enhance an open-end fund already in the portfolio, without significantly adding to the monitoring burden.

All in all, the development of a closed-end fund program is appealing at first glance and holds out the promise of attractive results. However, the reality is that operational constraints are significant and the team needed to deploy this type of program must be built accordingly. This strategy is best suited to large pension funds holding a few billion in assets, rather than smaller plans juggling much more modest assets.

In green: benefits / In pink: drawbacks

[1] https://piacweb.org/site/publications/asset-mix-report

[2] https://russellinvestments.com/ca/fr/blog/why-private-markets

Olivier Houde, Consultant, PBI Actuarial Consultants Ltd.

Olivier Houde has been with PBI's Asset Management department for nearly seven years. Since his early days, he has been involved in many types of asset management projects: performance analysis, investment policy development, manager selection/research, investment training for various pension committees and foundations, as well as asset allocation strategy. He has also been involved in various special mandates concerning ESG factors and alternative investments (private debt, real estate and infrastructure equity). His supervised master's project was carried out in partnership with PBI and focused on responsible investment (Responsible investment and its impact on the risk and return of North American equities). Since the start of his career, he has been called upon on several occasions to share his varied expertise as a speaker (IGOPP, ARASQ) and trainer (ARASQ).

Mr. Houde joined PBI Actuarial Consultants Ltd. in May 2018, the same year he obtained his Bachelor of Business Administration (B.B.A.) from HEC Montréal, followed by his Master of Management Science in Finance from HEC Montréal in 2020. He also obtained his CFA designation in 2021.