Articles of Interest

Drawing Parallels

Key Points:

- Studying Korea can be used to assess the path forward for China.

- Understanding how a business serves all stakeholders helps to determine attractive financials vs. unsustainable earnings

- Society and institutions experience far bigger changes in the emerging markets than in the developed markets, creating both risks and opportunities.

Investing in the emerging markets typically requires covering a wide range of countries, and researching one region often helps inform your understanding of another. After visiting Korea for the first time in 2022, I couldn’t help but draw parallels with China. While the scale of their populations (52 million vs. 1.4 billion) and their economies (GDP of US$1.8 trillion vs. US$17.7 trillion) are fundamentally different, Korea’s development pathway has been, and continues to be, heavily studied by Chinese policymakers. As a result, researching Korea is deeply revealing, and through the exploration of three separate vignettes, I will share how this research can be used to assess the path forward for China.

Vignette #1: “Clear” Water

In downtown Seoul, an 11-kilometre-long stream called Cheonggyecheon runs through the city centre. This redeveloped stream has an eventful past, reflecting the country’s decades of rapid economic development. Since the 1960s, rapid industrialization transformed the stream into a badly polluted ditch, turning its name, which translates to “clear water stream,” into a paradoxical misnomer. Eventually, the stream was paved over. Years after that, an elevated highway was built. In 2003, Cheonggyecheon was part of a large and elaborate restoration project imposed by the municipal government. The intent was to better withstand floods and to improve the city’s irrigation infrastructure. Today, the restored stream is a picturesque and popular destination among tourists and locals alike.

To me, Cheonggyecheon is a symbol of urban progress and development that I doubt many (foreigners and Koreans alike) could have predicted 30 years ago. Since we often see things through our North American vantage point, we may forget how important resource management (in this case, water) is in parts of the world where resources are not as abundant.

In China, decades of rapid industrialization have resulted in significant environmental pollution as well. To combat this, since the mid-2010s, the country has taken significant steps to control pollution and protect the environment. The Yangtze Protection Act of 2020 is one of these efforts, a legislation to help improve water management for Asia’s longest river. Several good businesses have benefitted from these environmental protection policies, attracting interest from investors. Conversely, several industries/companies have suffered from rising compliance costs due to increasingly stringent environmental regulations or have had to shut down entirely. The environmental protection policy maturation process is a double-edged sword, and investors are looking to be on the right side of it.

As investors deepen their understanding of investing in China, the environment is among many areas of focus. In the context of resource scarcity in China, critical water infrastructure, energy infrastructure (i.e., wind/solar, hydrogen, and energy storage value chains), and agricultural infrastructure are going to be increasingly important. Investors continue to spend considerable efforts to broaden their understanding of these sectors, identifying admirable businesses along the way.

Furthermore, the quality of infrastructure in a particular region can help determine an investment’s sustainability and downside risks. These topics are especially important in the emerging markets, where institutions, societies, and businesses are often less engrained and still evolving, therefore requiring additional attention. Understanding how a business interacts with all stakeholders is paramount to delineating between attractive financials vs. unsustainable earnings that may be regulated away as society matures.

Vignette #2: The Involuted Rat Race

When assessing long-term business prospects in the emerging markets, environmental, social, and governance (ESG) risks and opportunities are critical considerations to the research process. At Burgundy, the ESG lessons we learned in Korea helped us avoid stepping on landmines in China.

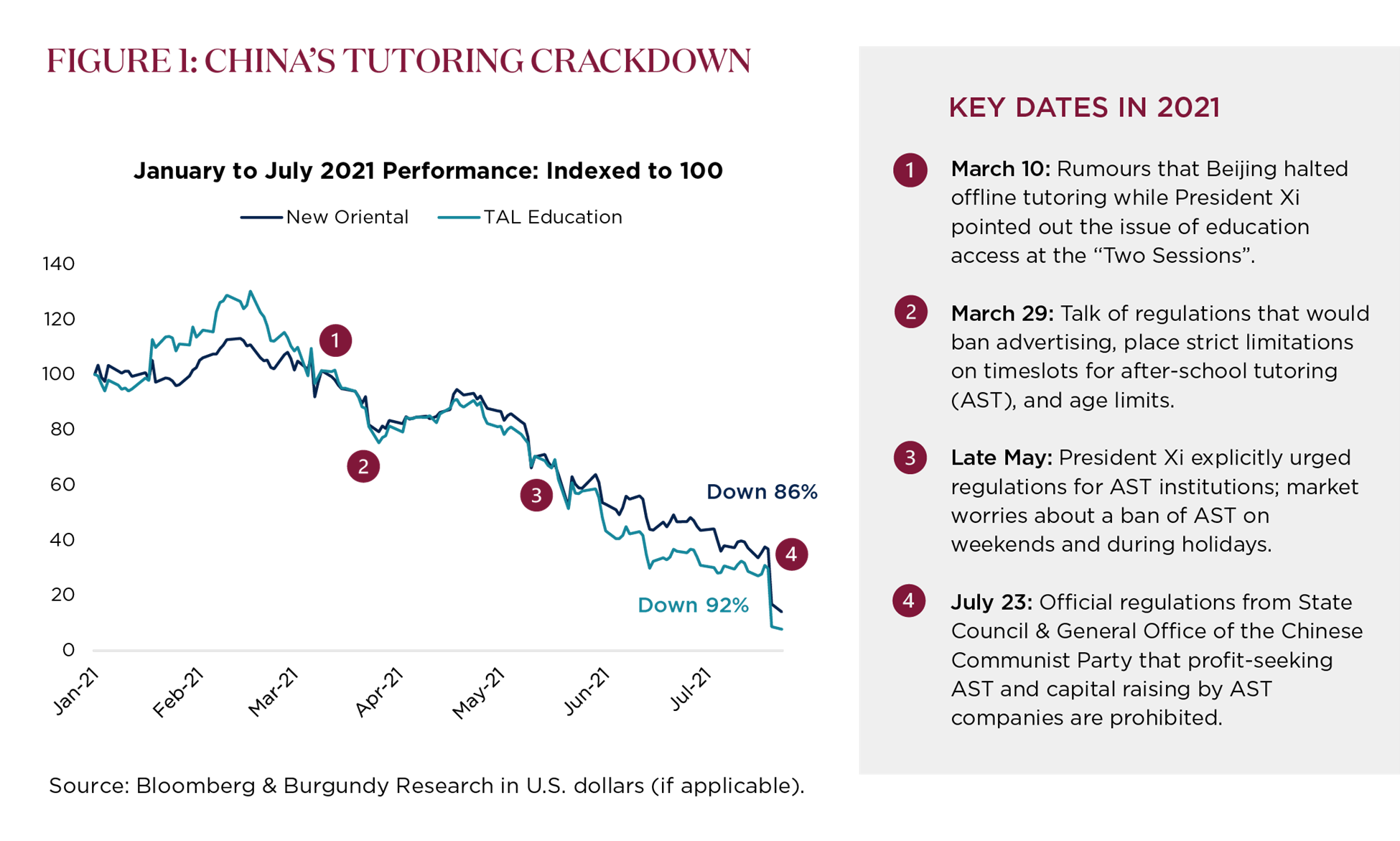

Like many cultures, Korean culture values education. The competitive dynamics of the CSAT (Korea’s standardized testing for university entrance) are intensive and parallel the Gaokao, China’s university entrance exam. Due to rising incomes and the desire for better education, parents in China had begun to invest significant amounts of their hard-earned dollars to after-school tutoring, much like Korean parents did. In some Chinese consumer panels, after-school tutoring represented up to 20% of a family’s disposable income. This resulted in significant growth in the after-school tutoring industry and produced attractive-looking financial statements. Yet, after years of growth and profitability, the Chinese government pivoted quickly, and the industry turned into a non-profit in short order with stocks imploding thereafter.

We chose to sidestep the Chinese after-school tutoring companies entirely, believing the cost burden on parents and the psychological pressures on children were unsustainably benefitting investors. In 2021, there was a tutoring crackdown (Highlighted in Figure 1), and two of the most prominent after-school tutoring companies in China were affected by this regulatory impact. The situation in China resembles a similar episode in Korea, where, a decade prior, the Korean government intervened in after-school tutoring.

Vignette #3: Big vs. Little Giants

The greater Seoul metropolitan area’s vibrant business scene is palpable, and so is Korea’s economic dynamism. Along with the household-name Chaebols (which are large conglomerates like Samsung Group), we also met with several smaller enterprises during our most recent visit to Korea. We noticed that these smaller enterprises operate in niche markets in which they have dominant market positions and competitive advantages. These management teams are keenly aware of how hard they must work to retain that edge by innovating and staying ahead of the competition. During multiple conversations, I sensed the national pride coming from the management teams as they shared how their company’s products were poised for dominance across the world. While household names like Samsung, LG, and SK Group control a significant portion of Korea’s gross domestic product, there are also many smaller, lesser-known enterprises. A smaller company with a dominant market positioning in its niche market could be a better investment than a larger company in a less favourable competitive landscape.

So, how does this relate back to China? Not surprisingly, Chinese policymakers have studied the development history of Korea and devised similar plans. The nomenclature of “specialized, refined, peculiar, and innovative little giants” first appeared in official policy documents in 2011 and was brought to the forefront of policy priority because of the need for industrial upgrade, the economic policy priority of moving away from low value-added manufacturing (apparel, toys, etc.) and into higher value-added manufacturing (motors, precision machinery, industrial robots, etc.). Over time, as businesses become more research-and-development intensive and learn to build more sophisticated capabilities, the best managed and well-positioned companies will create profitable solutions for customers, dominate their chosen niches (and/or successfully grow into new attractive markets), and expand their competitive advantages. As of September 2022, the Ministry of Industry and Information in China has identified some 9,000 of these “little giants.” While not all will be successful (and certainly not all will qualify for investment), investors will continue to sift through these innovative businesses, assessing for quality and looking for strong management teams to capitalize on the next phase of China’s economic development. Like many investors, at Burgundy, we are excited about the prospects of this upgrading spanning various sectors and industries. Applying one’s observations in Korea can help identify investments in similarly small but dominant businesses in China.

Final Thoughts

Research trips help investors deepen their understanding of businesses, customers, and societies – beyond what they read and see in the news.

These three vignettes help shed light on some of the areas investors need to remain alert. These are just a few examples of how studying Korea can be used to analogize the path forward for China. Research in Korea offers a lens to evaluate the investment implications of rapid industrialization, ESG risks and opportunities, as well as the impact of innovative enterprises (big or small) on economic development. The lessons to be learned from Korea also apply to a more nuanced understanding of China. Still, it’s important to also acknowledge the risks and opportunities that come with investing in a developing country where society and institutions experience much larger changes.

By working the process, investors can sidestep landmines and make good investment decisions to generate strong long-term investment results.

David Hao, CFA, Investment Analyst, Emerging Markets Equities, Burgundy Asset Management

David Hao, CFA, INVESTMENT ANALYST

AREA OF FOCUS - Emerging Markets equities

David made his first “investment” in Grade 6 of elementary school when he bought a Scyther Pokemon card for $0.25, which he promptly sold for $0.50 the following day. Since the beginning of his career, he’s been trying (unsuccessfully) to replicate that rate of return.

David was born in China and educated in North America. This rich background leads him to be motivated every day to delve into the dynamic economies of Emerging Asia. He looks forward to researching and analyzing prospective investments that are in line with Burgundy’s quality-value investment philosophy.

BURGUNDY EXPERIENCE

- Joined Burgundy in 2020

RELEVANT EXPERIENCE

- 10+ years of combined professional experience

- Experience includes positions at: Causeway Capital Management, StackLine Partners, TD Asset Management

EDUCATION

- CFA Charterholder

- MBA (Value Investing Program), Columbia Business School

- Bachelor of Commerce, University of Toronto

MEMBERSHIPS & COMMUNITY

- Mentor, Portfolio Management Group, University of Toronto

- Member, CFA Institute