Articles of Interest

Canada’s Retirement Crisis: A New Hope

As well documented, a growing number of Canadians are approaching retirement with an unsettling question: how will they afford it? The pillars of Canada’s retirement system: public pensions, private savings, and workplace retirement income arrangements, are cracking under demographic and economic pressures. Defined benefit (DB) pensions, once a cornerstone of middle-class security, have been steadily replaced by a patchwork of defined contribution (DC) plans, group RRSPs, and individual savings vehicles over may decades. These alternatives shift financial and longevity risks from institutions to individuals, most of whom are ill-equipped to bear them.

The result is predictable. A swelling cohort of Canadians faces retirement without a stable income. Many must navigate the vagaries of capital markets, retirement calculators, and shifting tax rules with limited financial literacy and minimal institutional support. The language of retirement planning, once built around income certainty, has been replaced by talk of account balances and risk tolerance. Workers are expected to become portfolio managers and actuaries. The odds are stacked against them. Investment fees remain high, advice inconsistent, and outcomes increasingly uncertain. In this context, retirement is less a dignified exit from working life than a precarious economic cliff.

The economic implications of this paradigm shift are far-reaching. Retirees with insufficient income may draw more heavily on public benefits, delay retirement, or reduce consumption. The effects ripple into productivity, public health, and intergenerational wealth transfers. Yet, policy responses have been piecemeal. Expansion of the CPP was completed recently but such additions are incremental and slow. Private-sector innovation, for its part, has mostly focused on product proliferation rather than systemic reform.

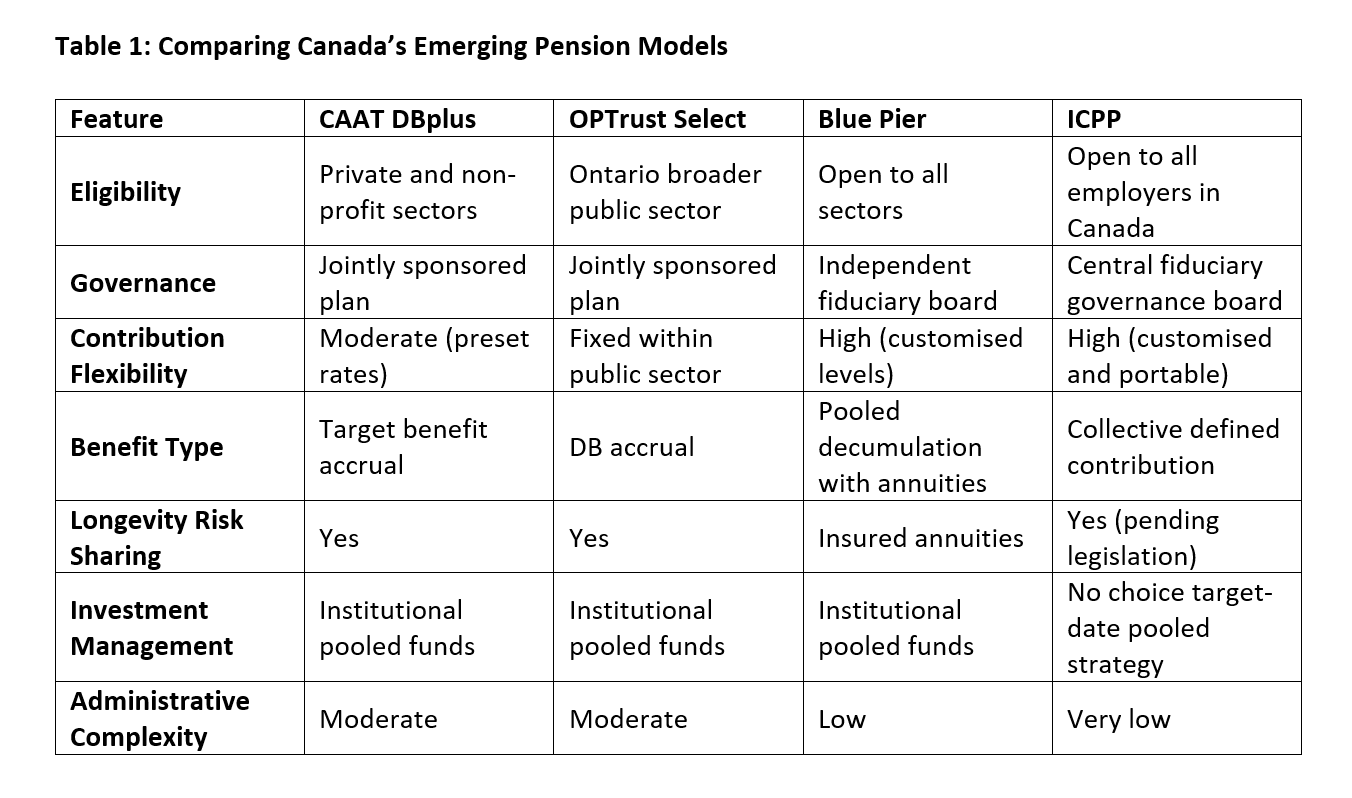

A handful of institutional actors are attempting to fill the vacuum. CAAT’s DBplus, OPTrust Select, and Blue Pier are among the few new platforms that seek to replicate some of the structural advantages of traditional pensions while adapting to a more fragmented labour market. Each pools assets, manages them professionally, and offers a degree of longevity risk sharing. In short, they bring structure back to a system that sorely needs it.

Yet none has proven a silver bullet. OPTrust Select is confined to Ontario’s broader public sector and relies on joint governance models that limit adoption by many employers. DBplus requires conservative funding margins that reduce member retirement income able to be supported by plan assets. Blue Pier aims for greater administrative simplicity and broader access but lacks the scale to deliver cost effective retirement solutions. These designs are commendable but have yet to achieve their goal of providing a retirement income solution suitable for all Canadians. What Canada needs is something more radical in its simplicity: a retirement platform built for the many, not the few.

What’s missing from Canada’s retirement infrastructure is a scalable general solution. The core features of such a platform must include:

- Cost-effective accumulation: The ability to save for retirement through pooled investment vehicles that offer institutional-grade returns at lower fees.

- Structured decumulation: A built-in system to convert savings into retirement income with predictability and protection.

- Longevity risk pooling: Use of variable payment life annuities or VPLAs, a framework that allows the risk of outliving savings to be shared across participants, improving efficiency.

- Ease of adoption: Employers should be able to join with minimal friction, and employees should find the plan intuitive and automatic.

These are not trivial goals. They require thoughtful plan design, strong governance, and a willingness to move beyond the traditional divide between DB and DC models and adopt the best of both models.

One such model is the Ideal Canadian Pension Plan (ICPP), a new kind of collective defined contribution (CDC) plan designed for all small and medium-sized employers across the country (i.e. less than 500 employees). Unlike traditional multi-employer arrangements, the ICPP is sector-agnostic, open to all employers, and deliberately engineered to be plug-and-play. Its promise lies in its ability to deliver institutional-grade outcomes, including pooled assets, lifetime income, and low fees, without the bureaucratic sprawl that usually accompanies such ambition.

Specifically, the ICPP’s structure combines the cost-efficiency and scale of institutional investing with the flexibility of DC contributions and, once permitted, the risk-sharing benefits of longevity pooled decumulation. In general, the ICPP works by:

- Asset pooling: All contributions are pooled, managed collectively, and invested using a target date methodology aligning portfolio risk with member age, driving down fees and gives members access to professional asset management typically reserved for large pension funds.

- Collective decumulation: Upon retirement, members draw income from the pooled fund. Once permitted by legislation, the Member has the option to pool longevity risk among other participants, so individuals aren’t forced to be overly conservative or over-save to protect against running out of money.

- Centralized administration: The ICPP handles compliance, reporting, and governance. Employers don’t need to manage the plan internally, removing a significant barrier to entry. Employer simply manager their payroll and provide information to the administrators.

- Cooperative governance: The plan is overseen by a professional management board, with fiduciary duties to plan members. This governance model ensures decisions are made in the long-term interest of participants.

By design, this model echoes the disruptive nature and simplicity of index-based exchange-traded funds. Much like how ETFs democratised investing by lowering costs and improving transparency, the ICPP seeks to democratise access to reliable retirement income. For employers, it offers a way to attract and retain talent without the burden of managing a pension plan. For workers, it offers a credible path to lifelong income that has become increasingly rare.

Employers, especially smaller ones, gain a tool that levels the playing field in the war for talent. Importantly, the ICPP is not proprietary. Its structure of open eligibility, fiduciary governance, collective investment, and pooled income is replicable. Others can, and should, develop similar platforms. Indeed, a competitive market of CDC plans could foster innovation, improve outcomes, and encourage best practices. Retirement security, like health care or education, is a public good in all but name. It should not be left entirely to individual improvisation.

Canada’s retirement challenge is not unique, but it is urgent. A rapidly ageing population, rising life expectancy, and stagnant real wage growth combine to make the current system untenable for millions. More tax shelters and robo-advisors will not solve the problem. Systems will. The ICPP is not the only answer, but it is a credible one. It combines the elegance of good design with the humility of practical execution. It does not try to be everything to everyone. Instead, it aims to be exactly what most Canadian workers and employers need: a dependable, low-friction mechanism for converting wages into income-for-life.

That is a vision worth pursuing. And better, ideal solutions are here.

Andrew Gillies, FCIA, FSA, Principal, Robertson, Eadie & Associates

Andrew has more than 20 years of experience in all aspects of pension consulting, including the design, implementation and administration of defined benefit and defined contribution plans. He is a Fellow of both the Society of Actuaries and the Canadian Institute of Actuaries. He has been a frequent speaker to employee groups, company management, boards of trustees and union groups on pension plan design, valuation results, the importance of pensions and the promulgation of pooled retirement solutions for Canadians.

Andrew has dedicated his professional volunteer career toward the education of new actuaries and the public on the actuarial profession. As an engaged member of the actuarial profession, Andrew currently sits on the Committee on Insight Statements for the Canadian Institute of Actuaries where in his role, he assists the publication of documents providing actuarial insight on current topics of discussion within society. Formerly, Andrew volunteered on the Education and Examination Committee of the Society of Actuaries, serving as General Officer, where he was responsible for the fellowship exam syllabus, including review and creation of content for all fellowship candidates of the Society of Actuaries completing the fellowship Retirement & Benefits track.