Articles of Interest

A Data-Driven Case for ESG

Improved Market Metrics and a Lower Cost of Capital

Responsible investing (RI) offers an additional lens to execute security due diligence. The concept is not new, harkening back to the 1920s, but it has evolved over time, reflecting the evolution in investor concerns. In 2006 the UN Principles for Responsible Investing identified environmental, social and governance (ESG) as a core fiduciary risk management concept. 1

Traditionally, contingent liabilities were reported in the footnotes appended to financial reports. These potential perils, which could lead to capital impairment, are now reported in mandatory disclosures, ensuring universal owners can use consistent methods in executing their due diligence.

Pension plans are legal entities that must meet objective fiduciary standards to serve their beneficiaries interests. They can be buoyed by knowing there is a robust data-driven case to be made for casting a worthy comparative lens on companies to gauge the impacts business practices may have on long-term performance.

There is expanding data to show high ESG-rated companies display more compelling market metrics and can access capital for less than their lower-rated peers. Consideration of RI/sustainability/ESG data, alongside other relevant factors, may provide a very grounded argument to choose one company over another.

How do Evolving ESG Regulations in Canada Create Compliance Risks or Opportunities for Pension Plans?

The Canadian Sustainability Disclosure Standards (CSDS) recently released CSDS 1 and CSDS 2, which are the international sustainability standards adapted for the Canadian landscape. Currently, the standards are available for voluntary adoption with mandatory disclosure anticipated to occur in 2028. While there are many elements yet to be determined, the Office of the Superintendent of Financial Institutions (OSFI) has already begun phasing in CSDS into disclosure requirements for federally regulated financial institutions (FRFIs), while other elements are deferred to 2028, consistent with expectations for broad adoption across Canadian equities.

This slow adoption in Canada relative to global investors has led to a growing gap in the availability of decision-useful ESG information between Canadian and international companies. Bill C-59’s consumer protection “anti-greenwash” provisions have further complicated matters by indicating steep penalties for greenwashing – up to 3% or revenue is at risk, without providing sufficient clarity on what greenwashing is. As one executive put it on a recent engagement call, that has become “an inhibitor to transparency” despite the publication of further interpretive guidance.

The Reputational Risks of Ignoring ESG - Or the Potential Downsides of Greenwashing

Anti-ESG rhetoric and legal challenges to the south of the border have obviously had a significant impact on ESG. With the U.S. Securities and Exchange Commission’s mandatory disclosure considerations now shelved, Canadian securities regulators are assessing the implications for mandatory disclosure in Canada, with a particular focus on dual-listed entities. And while Europe has recently taken a “step back” with reduced expectations for human rights disclosure, it would be incorrect to conclude that ESG is now taking a back seat. In truth, the practice of ESG risk has been advancing steadily, following the “two steps forward, one step back” pattern known to change-makers. With each swing, ESG is progressively being distilled and refined through the process.

Similarly, the current political pendulum swing ignores the global trend of increasing relevance of a changing climate and economy. Take trade instruments, like carbon border adjustment mechanisms (CBAM), for example. Originally conceived by western nations when China’s coal-fired energy supply could be used to tax Chinese imports and promote cleaner domestic production, CBAM’s are being implemented in Europe in 2026.

And while it is highly unlikely the United States or Canada would adopt CBAM or additional carbon pricing instruments in the current political climate, a failure to consider the influence of carbon pricing on global trade is an increasing risk. While Canada has made limited progress on decarbonization, China has rapidly become the global leader in wind and solar energy generation. China’s solar installation of 277 GW of new solar capacity in 2024 exceeds the total combined solar installation of the United States, Canada, and Mexico combined. 2

While oil and gas expansion is being considered in both the United States and Canada, the long-term trend of the energy transition suggests that a failure to concurrently invest in longer-term decarbonization ambitions could find Canada unprepared and on the wrong side of a trade barrier.

Energy Return on Investment - EROI

There appears to be general acceptance that we are in an energy transition, still dependent on fossil/carbon fuels sources but quickly developing capacity in renewal energy infrastructure.

The Energy Return on Investment (EROI) concept is an important gauge to demonstrate our progress away from fossil/carbon dependence. The economic friction, not just the environmental toll, of fossil/carbon fuel sources is a very good measure that demonstrates the benefits the economy may realize as the transition continues. This realization is the foundation for the concept of having stranded assets, those which will eventually diminish in importance as the transition realizes its objective.

The two charts below demonstrate the diametrically different business models supporting fossil/carbon fuel sources on one hand and renewable sources on the other.

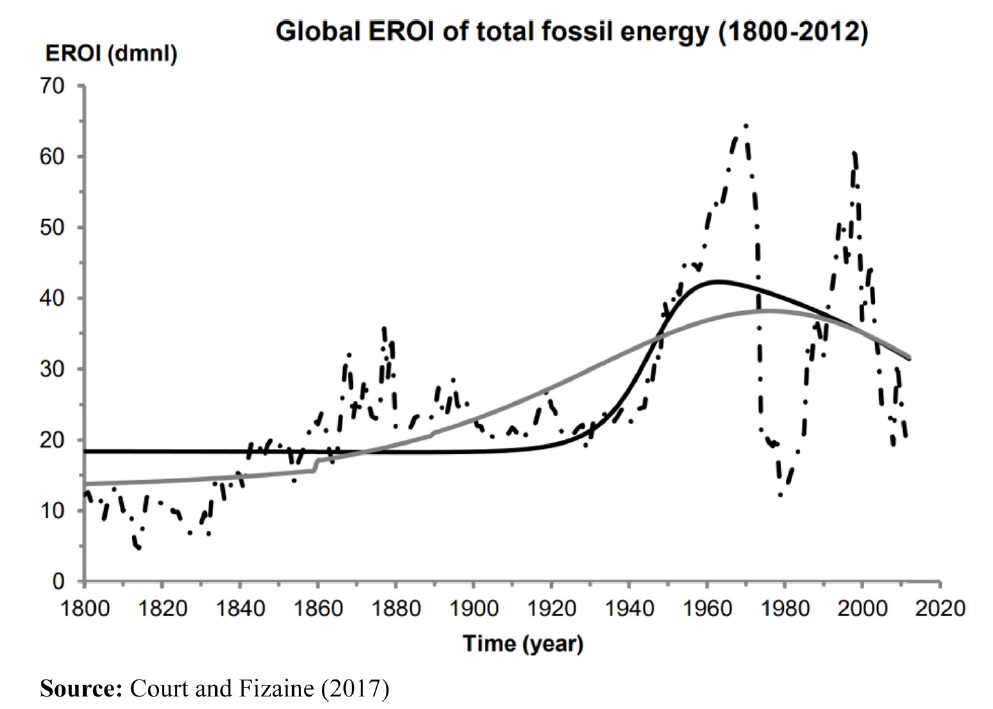

In the transition from coal to oil, the world realized considerable economies of scale from the 1930s onwards, peaking at some point in the 1960s. By that time, however, we had depleted the ‘easy’ fuel sources and have since moved on to more difficult to access reserves like tar sands, offshore exploration and shale.

Source: Dr. Nafeez Ahmed, Planetary Phase Shift & the Coming Age of Superabundance, Unitas Global Advisory, March 2025

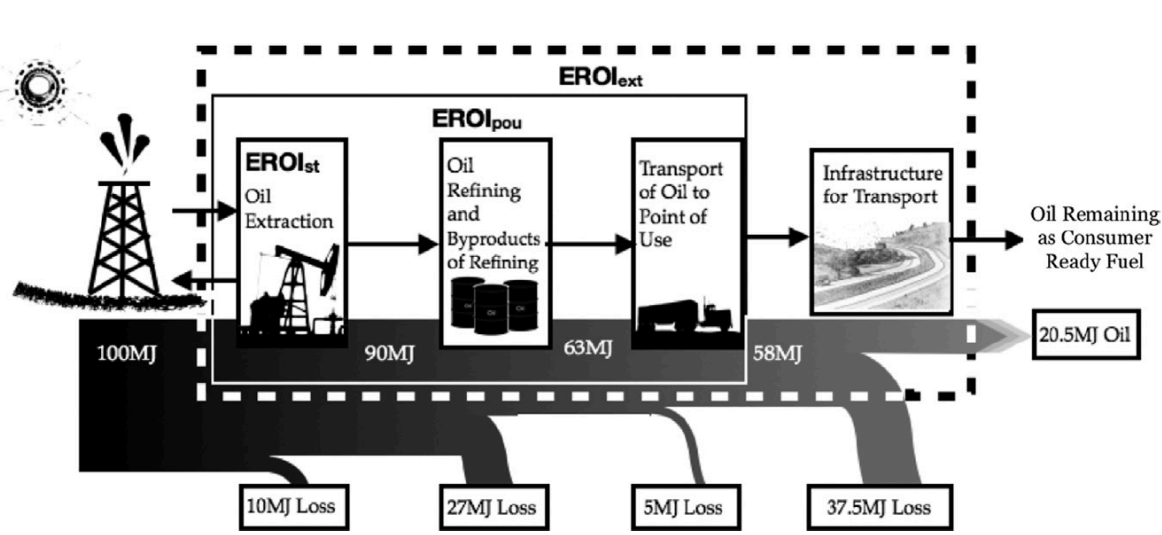

Because present reserves pose significant extraction challenges, and in some cases require more expensive refinement, cumulative energy losses at each stage in energy production result in declining benefit from each energy unit sourced.

Source: Energy Return on Investment: A Unifying Principle for Socio-Ecological Sustainability, R.E.M Melgar & C.A.S. Hall

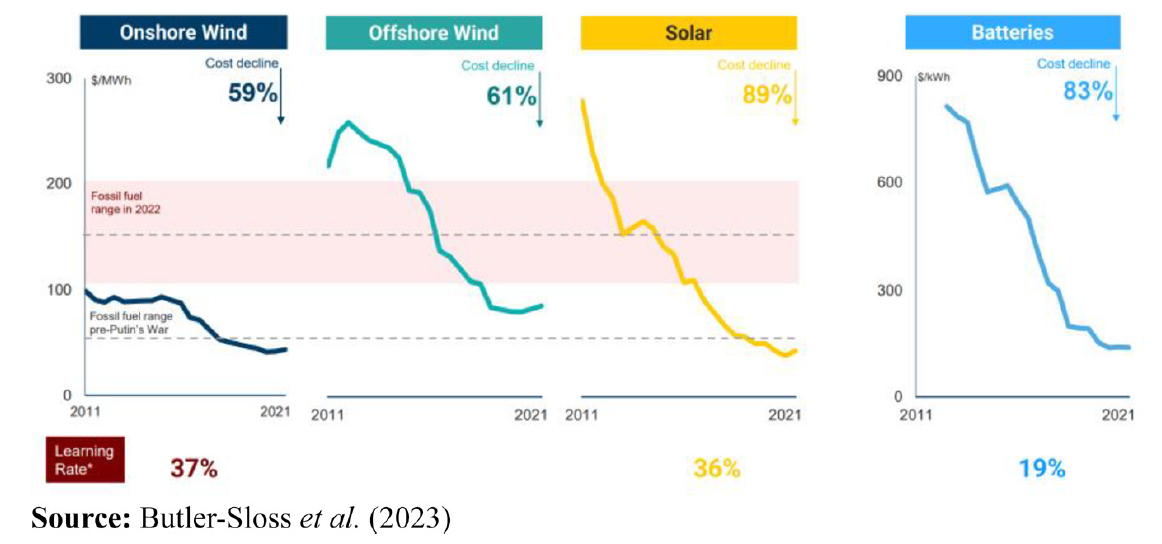

In contrast, as renewable energy sources start to reach scale, their cost declines.

Source: Dr. Nafeez Ahmed, Planetary Phase Shift & the Coming Age of Superabundance, Unitas Global Advisory, March 2025

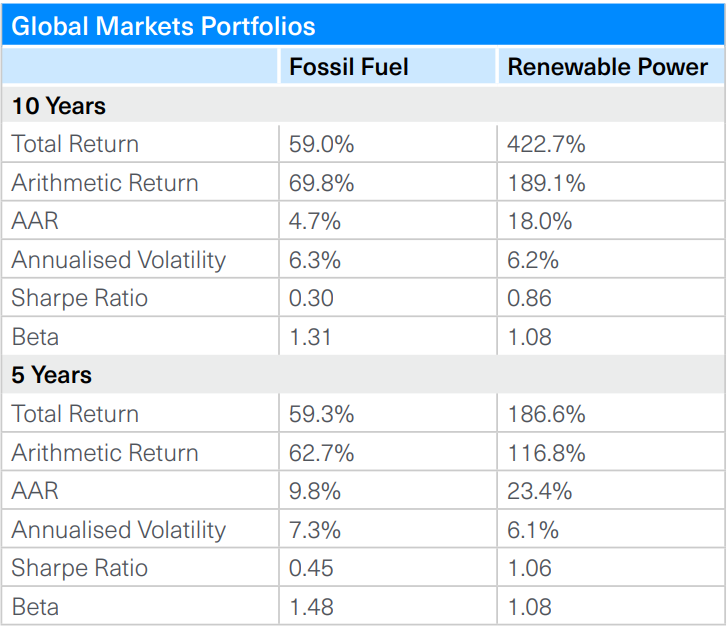

The International Energy Agency and Imperial College published a report on clean energy investing which contrasted the returns on renewable energy compared to fossil fuels and found that, even in our nascent stage in the transition, the returns reflect the capital implications for each source.

Source: Clean Energy Investing: Global Comparison of Returns, Imperial College and International Energy Agency, March 2021

Global policy can influence the pace and nature of the energy transition, and the economics are a large impetus driving the shift towards renewables. After all, as one adage puts it, “the stone age didn’t end because we ran out of stones”. Asset owners must similarly consider their asset valuations and retirement obligations, and whether the assumptions for such obligations align with anticipated future expectations on operations.

In a wider perspective, assessing more than energy transition and climate, there are some very strong arguments that make a strong case for evaluating ESG scores in security selection.

McKinsey identified five distinct areas where ESG commitment enhances value creation3:

- Top line growth: higher ESG scores expand opportunities in more markets because regulators are less concerned that business practices might result in costly interventions:

- Cost reductions: more effective resources use can reduce variability in operating margins by 60%.

- Regulatory & legal interventions: according to McKinsey research, almost 1/3 of corporate profits can be at risk due to regulatory intervention.

- Improved productivity: engaged employees who have a strong social commitment have been shown to be more productive. Companies with poor governance, for instance, have higher incidences of strikes or worker disruptions.

- Investment & asset optimization: avoiding stranded assets may align capital with longer-term benefits.

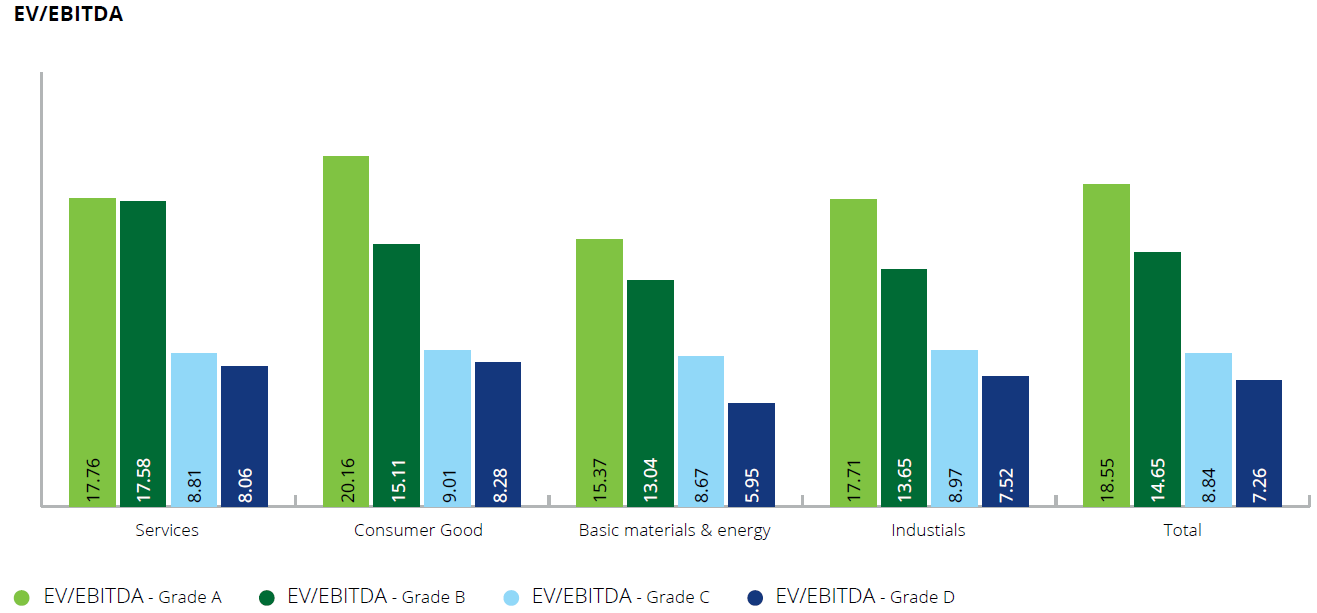

In another study4, Deloitte found evidence that there is an ESG value premium. Companies with higher ESG scores displayed 1.2 times higher EV/EBITDA scores than companies with lower score. More significantly, companies with rising ESG scores showed 1.8 times higher EV/EBITDA. The authors concluded that superior ESG metrics were rewarded with additional value over and above net financial gains.

Source: Deloitte, Does a company’s ESG score have a measurable impact on its market value?, Igor Heinzer & Andrea Mezzanzanica, 2022

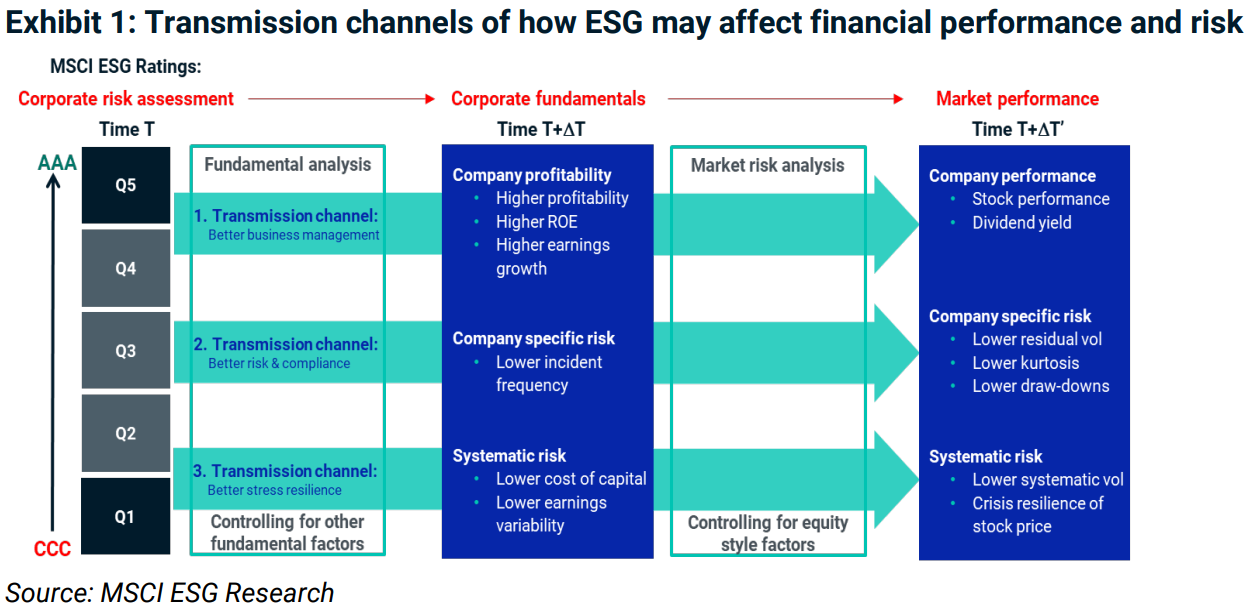

MSCI5 has more data to demonstrate a positive correlation between high ESG score and company performance. Examining ESG score, measuring its business practices, and its relation to company financial ratios, they see a distinct positive impact on valuation and performance:

MSCI ESG Ratings in Global Equity Markets: A Long-term Performance Review, Guido Geise & Drashti Shah, March 2024

Interestingly, the positive impact was far more noticeable and more enduring at the cumulative ESG score level than it was for any of the individual components, E, S or G. This might be a testament to the more comprehensive nature of ESG in assessing overall business practice risks.

Financial ratio fundamentals were examined closely to address the critique that performance might be bolstered due to ESG crowding, that investment management firms might flock to higher rated companies to improve their own ESG metrics.

Using the formula below, MSCI dissected equity returns to parse the P/E crowding effect from total returns:

Total equity return = Earnings Growth + P/E Growth + Dividend Yield

Their study revealed that between May 2013 and November 2020 that company outperformance was attributable to stronger earnings growth and marginally higher dividend growth.

The data was more pronounced in developed markets than in emerging markets, due to earlier regulatory impetus and radically different energy infrastructure (several emerging economies remain heavily dependent on coal to expand industrial production, for example).

Interestingly, the study also found that companies with superior ESG scores displayed lower idiosyncratic risk, which makes sense, but also lower systemic risk.

The underlying fundamentals to explain such why highly rated ESG companies display lower risks are found in a more recent MSCI report entitled MSCI ESG Ratings and Cost of Capital6, published in July 2024.

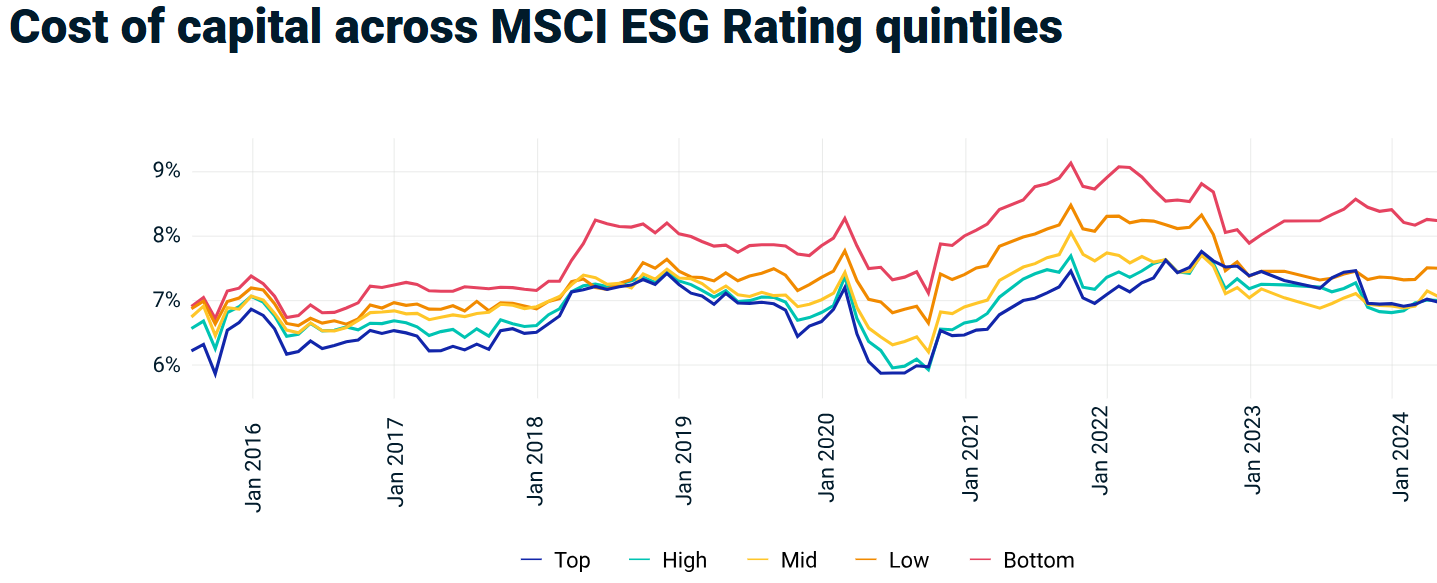

Examining the cost of capital and associated risk metrics, Beta for equities and credit spread for fixed income, the study demonstrated markedly different profiles for companies with differing ESG rankings:

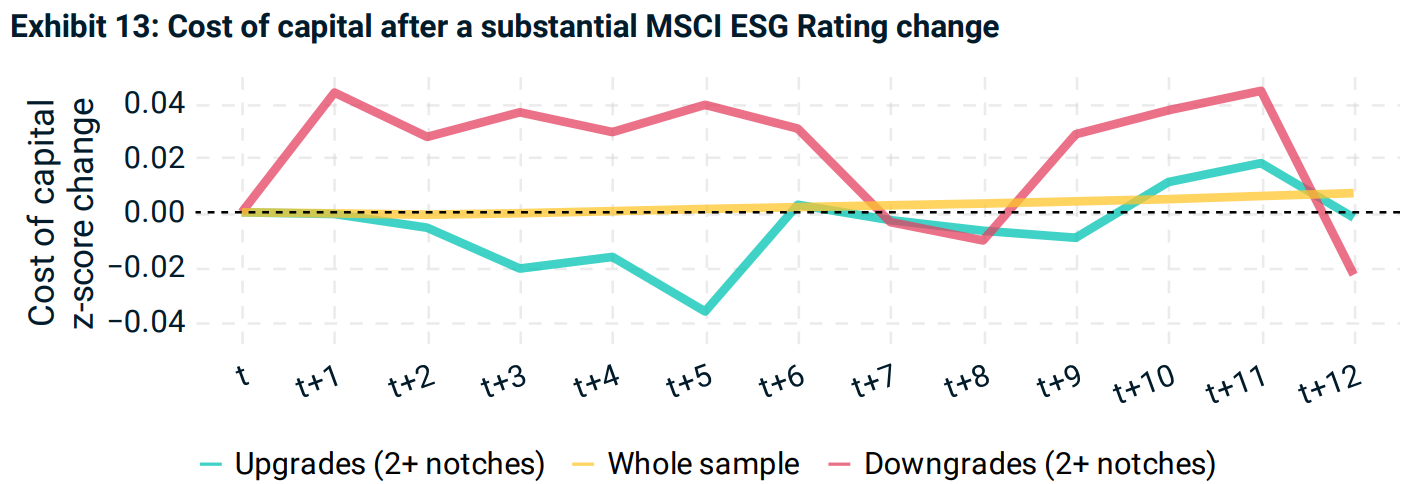

Data period from August 2015 through May 2024. We show the differences in the z-scores for the cost of capital (to neutralize the overall changes in the sample’s cost of capital) during the 12 months after a substantial change in the MSCI ESG Rating (+/- two or more notches) during our study period (106 monthly observations). We did not observe a strong pattern for small rating changes (+/- one notch). Source: MSCI ESG Research

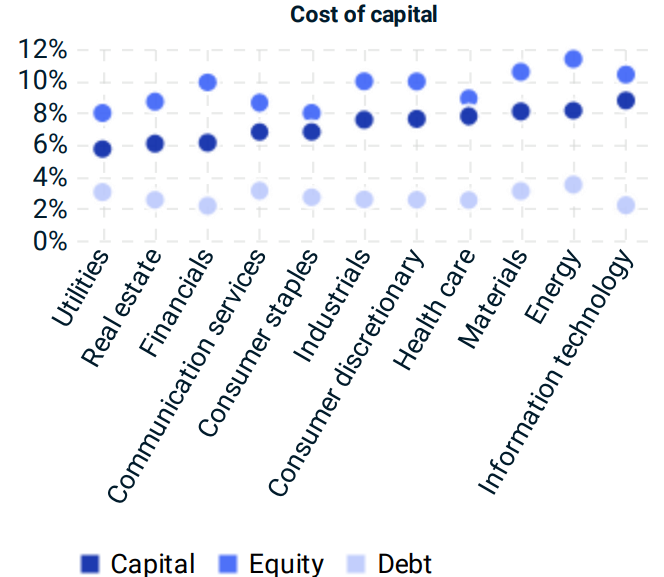

Unsurprisingly, there were noticeable differences across sectors, due partially to traditional capital structures in different industries but likely also attributable to the cyclicality which is a particular risk for both energy and materials:

Data period from August 2015 through May 2024. WE show the average values over the study period. Source: MSCI ESG Research

Always cognisant that data tends to be historical, MSCI explored whether ratings changes had any impact on future capital costs. Unsurprisingly, rising ESG scores lowered the cost to access capital:

Data period from August 2015 through May 2024. We show the differences in the z-scores for the cost of capital (to neutralize the overall changes in the sample’s cost of capital) during the 12 months after a substantial change in the MSCI ESG Rating (+/- two or more notches) during our study period (106 monthly observations). We did not observe a strong pattern for small rating changes (+/- one notch). Source: MSCI ESG Research

Perhaps understood, given the trend I the data, companies with declining ESG scores faced higher capital costs than their highly ranked or appreciating peers in the same sector.

Conclusion

RI/ESG data can be tabled for objective consideration and discussion, leading to better decisions and better policy.

Thorough data is available to demonstrate there is a sound thesis to support ESG’s integration into the investment decision-making process alongside the consideration of other relevant factors. Not only is consideration of ESG risks and opportunities a core fiduciary concept and obligation, it may demonstrate a positive impact on a company’s metrics and long-term performance.

1 Integrate the Principles for Responsible Investment | UN Global Compact

2 Infographic: China's solar capacity growth sets new record in 2024 | S&P Global

3 Five Ways that ESG Creates Value, Witold Henisz, Tim Koller, and Robin Nuttall, November 2019

4 Deloitte, Does a company’s ESG score have a measurable impact on its market value?, Igor Heinzer & Andrea Mezzanzanica, 2022

5 MSCI ESG Ratings in Global Equity Markets: A Long-term Performance Review, Guido Geise & Drashti Shah, March 2024

6 MSCI ESG Ratings and Cost of Capital, Jakub Malich & Anett Husi, July 2024

Mark Webster, Director, Institutional Sales & Service, Western Canada, BMO Global Asset Management

Mark is the BMO ETF team's representative for Western Canada. With over 30 years of experience in the financial services industry, Mark has covered many diverse forms of financial risk. He began his career as a professional indemnity broker, becoming a vice president at Minet International Professional Indemnity Ltd. (now part of AON), conducting risk analysis for the Big 8 global accounting firms, as well as some of the top U.S. law firms. He is responsible for overseeing the proliferation of ETFs throughout Canada’s vast western region and providing support to portfolio managers from the Pacific (Duncan B.C.), to the Lakehead (Thunder Bay, Ontario). He has worked as a retail investment advisor with RBC DS; in the mutual fund industry with First Trust Portfolios; and has held several other positions in the pension industry. He brings with him a Master's degree in Russian History from McGill University and several CSI accreditations

Graham Takata, Director of Climate Change, Responsible Investment, BMO Global Asset Management

Graham leads BMO GAM’s Climate Action and Net Zero strategy through which BMO GAM has committed to achieve net zero emissions across all assets under management by 2050 or sooner. Prior to BMO, Graham worked in both technical and climate advisory roles, leading some of Canada’s first carbon-financed projects, North American green building strategies, and ESG benchmarking for institutional investors and asset managers. He led Ontario’s commercial cap and trade investments under the Green Ontario Fund and has supported multiple sectors to integrate climate change risks and opportunities into their business strategy. Graham is a member of the Responsible Investment Association and the Association of Energy Engineers and holds a Bachelor of Environmental Science from the University of Guelph and a Masters in Applied Science from Ryerson University.