Articles of Interest

The US Stock Market And The Case For The “Boring Middle”

In recent years, investors in the US have faced a particularly challenging dilemma as they navigate a stock market of two extremes. Sitting at one end are the recent winners, the biggest of which have been disruptive technology companies (think Software-as-a-Service) that offer a unique combination of rapid growth, high profitability and near-immunity to the economic cycle. While these characteristics are certainly appealing, many of these Growth stocks now trade at historically high valuations that seem likely to lead to disappointment. On the other extreme, one can find plenty of cheap-looking Value stocks, but many of these are secularly challenged businesses on the wrong side of changes in technology and consumer behaviour. While investors may be able to find a few great bargains here, many of these depressed stocks may prove to be cheap for good reason.

The environment seems to have only hardened the beliefs of dogmatic investors who sit on either side of the Value and Growth divide. Neither style looks especially compelling to us at the moment, but we believe there is a way out of this dilemma.

Rather than blindly following either the Value or Growth approach, we have always sought to be more opportunistic in our search for shares trading at a significant discount to intrinsic value. By keeping an open mind, you can maintain as wide an investment universe as possible, which is especially important as the opportunity set around you changes. There are times when it makes sense to lean heavily into Value stocks and there are times when Growth stocks are more attractive. But there are also times when a more nuanced approach is required—and we believe that is currently the case in the US.

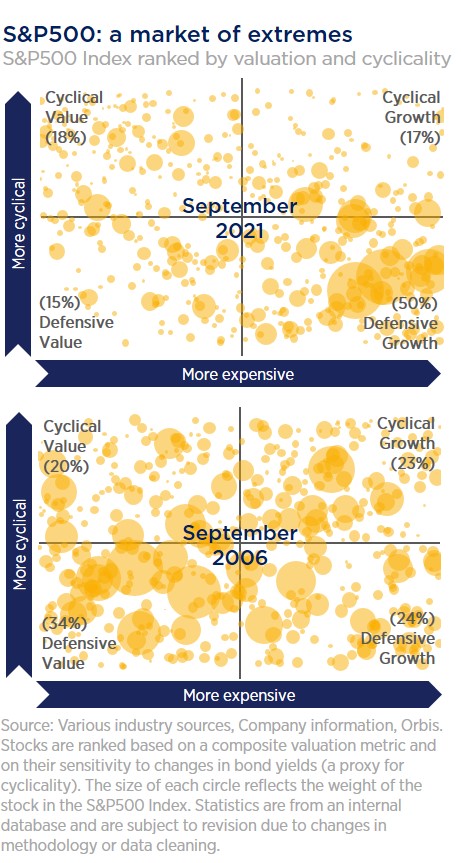

S&P 500: a market of extremes

To help illustrate the current market dynamic, we have plotted each security within the S&P 500 Index (sized based on index weighting) along two axes. The vertical axis ranks each stock based on cyclicality and the horizontal axis ranks each stock based on valuation. As shown in the first chart, the US market is heavily skewed in favour of Growth companies with relatively defensive characteristics, which accounted for 50% of the index at the end of September. Many of these companies trade at incredibly rich multiples. For example, in September, there were 73 companies in the S&P 500 trading at more than 10 times revenues—and many can be found in that bottom-right quadrant. This number has nearly tripled from the start of 2018 and now dwarfs the previous record of 39 set during the dot-com bubble.

It is worth noting that it doesn’t always look this way, as shown in the second chart from 2006—a time when the US opportunity set was much more evenly distributed.

The boring middle

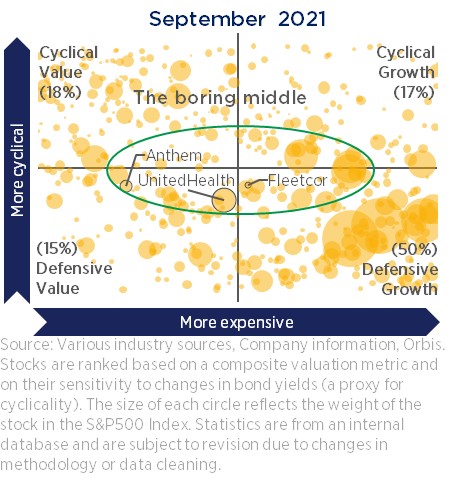

The advantage of being a bottom-up stockpicker with an opportunistic approach is that one can find attractive investments in all four quadrants. But in our view, the most intriguing area today is what we call the “boring middle”. Focusing here means avoiding the hot software company trading at 30 times revenues, while also steering clear of the disrupted retailer trading for less than the book value of its assets. In the middle, we can find a number of high-quality businesses with strong, but perhaps not stellar, growth prospects. They come with at least some element of cyclicality, but are available at reasonable valuations.

Some might refer to these stocks as “GARP” or growth at a reasonable price.

GARP stocks currently appear broadly attractive in the US. According to our analysis, the expected relative return of the cheapest one third of stocks in the S&P 500—identified using the price/earnings-to-growth or “PEG” ratio (a fundamental formula for identifying GARP stocks)—is near a 20-year high.

The story is even more compelling when you look at the picture from the bottom up—as we do. In the following section, we discuss just three of the many stocks we have found in the boring middle.

Stocks in the boring middle

Anthem and UnitedHealth Group, both leading managed care organizations (MCOs), are good examples of the value we are finding in the boring middle. Despite attractive fundamentals, the stocks have rarely traded at demanding valuations due to long-held fears that the MCOs will one day be put out of business by a nationalized healthcare model. Since 2001, Anthem has on average traded at a 22% discount to the S&P 500 and UnitedHealth has traded at a 6% discount—all while growing earnings at a solid 15% and 18% per year, respectively.

The stocks will likely remain volatile as much of the same rhetoric that accompanied “Obamacare” and “Medicare for All” continues under President Biden. That said, history has shown that changes to the US healthcare system tend to be gradual rather than revolutionary, and that leading MCOs can adapt and remain an important part of the system. Furthermore, major changes in government tend to happen in the first year of a new president’s term and the current administration appears focused on other priorities.

As such, we believe the drivers that propelled their earnings growth in the past will continue to serve as powerful tailwinds in the future. More specifically, Anthem and UnitedHealth benefit from significant scale advantages at a state (e.g. operating hospitals and local health networks) and national (e.g. procuring drugs) level, which makes it difficult for smaller players to compete effectively. The industry as a whole has also been buoyed by secular growth trends that are likely to continue as the US grapples with the challenges of providing better healthcare to an ageing and growing population at a manageable cost. Trading at just 14 and 19 times next year’s consensus earnings—compared to 20 times for the S&P 500—we believe Anthem and UnitedHealth are available at attractive prices given the quality of the businesses and long-term growth runway ahead.

Another example is Fleetcor, a US-based global business payments company. It operates four major lines of business: fuel cards, corporate payments, tolls and lodging, and faces a number of headwinds that we believe to be transitory. These headwinds include Covid-related cyclicality across many parts of the business that have been slow to reverse and a company-specific decision to tighten credit extension, which hurt its sales pipeline.

While not the most exciting business, it has grown earnings per share at 20% per year over the last decade and operates in niche, fragmented and growing markets, which have high barriers to entry. It is also led by a talented owner-CEO, who has a strong track record of astute capital allocation in his 20-plus years at the helm and is well aligned with shareholders. At just 18 times next year’s consensus earnings, we believe the market fails to appreciate the opportunity on offer with Fleetcor for long-term investors able to look through the short-term headwinds.

Keeping an open mind

As Warren Buffett put it in his 1992 Berkshire Hathaway Chairman’s Letter, Value and Growth investing “…are joined at the hip: Growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive.” We share Buffett’s view and have always sought to keep a close eye on both valuation and growth, especially as the opportunities on offer change.

In the current environment, many investors in the US appear either stuck paying an excessive price for exciting, but unproven, Growth opportunities, or lost searching through the rubble of disrupted Value stocks. We believe this has created an unusually attractive opportunity in the boring middle. Companies like the MCOs and Fleetcor have been left behind by investors who, like the market itself, sit at extremes in their own investment styles. Whether you call these opportunities “GARP” or the “boring middle”, they are neither depressed enough for deep Value investors nor exciting enough for Growth investors.

What matters most is the ability of the underlying businesses to stay boring—in a good way—and to quietly compound value over the long term. For opportunistic investors able to keep an open mind, the boring middle today could actually turn out to be quite exciting.

Chris Horwood, MBA, CFA, Head of Institutional Business, Orbis Investments

Chris Horwood joined Orbis Investments in 2013 and is responsible for the firm’s institutional client business in Canada. He previously worked as a trader at Orbis and, before joining Orbis, as a strategy and operations consultant at Deloitte. Chris holds a Bachelor of Arts in Economics and Political Science from McGill University and a Master of Business Administration from UCLA Anderson School of Management. He is a CFA® charterholder.