Articles of Interest

Investing in China today: Huge opportunities and Hidden risks

A generational shift: but not yet for all of us

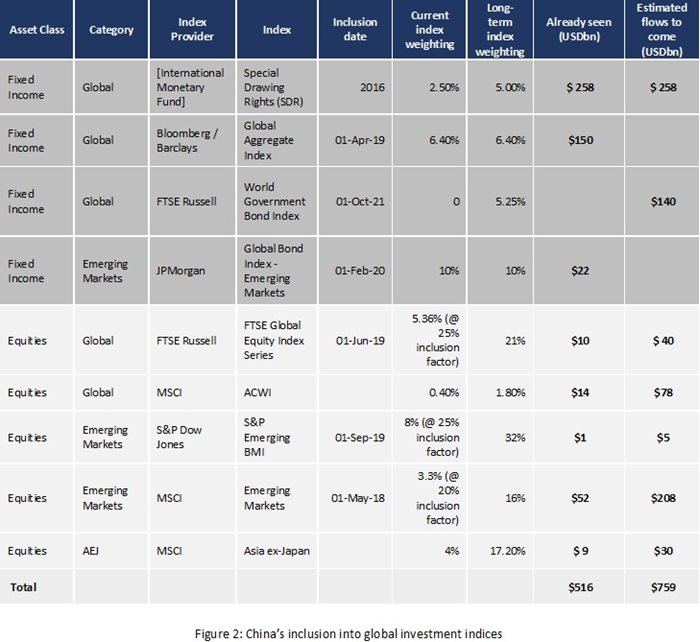

In March, JPMorgan confirmed that Chinese bonds would be included in their World Government Bond index. The decision triggers an expected flow of USD140 billion over the next three years, adding further momentum to a generational shift by global investors towards China assets that began in 2017.

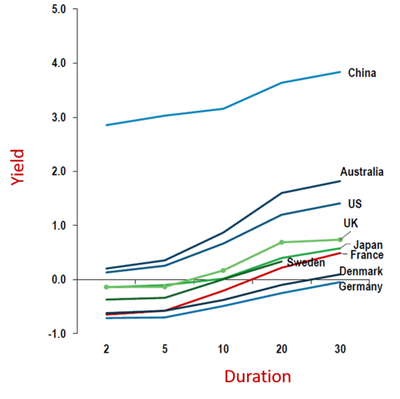

Today, China is more than an index inclusion journey and its appeal now extends far beyond passive investors. With a growing yield differential versus other ‘developed’ markets, 6% GDP growth and a 0.2 correlation to US/European debt, Chinese securities have become increasingly indispensable to global investors as they seek to drive new returns in today’s market conditions. As one pension manager recently said, “China is the only place on earth now where I can get 3% on a bond that’s not going to default”.

But despite this growing appeal, the vast majority of pension funds and public authorities continue to view China as a ‘tactical’ investment and are reluctant to give Chinese securities a role in their strategic asset allocations. Why is that? What is holding them back and what can we do to bring the significant investment opportunities that China presents into the investment mainstream?

What should exposures be today?

If the world’s leading index providers are to be listened to, the average global bond portfolio should today include a 3.25 – 6.4% allocation to Chinese (government) bonds. An Emerging Market bond portfolios should include a 10% allocation to CGBs; whilst its equities equivalent should be holding 3.3-5.36% of its value in A-shares (i.e. excluding Hong Kong-listed securities).

.jpg)

All indications are that many global pension managers have moved past these levels of allocation already. As some of the earliest foreign investors into China (using the previous QFII channel, launched in 2002), pension funds have built significant experience in managing Chinese investments – to the point where 62% of pension funds have begun to hold Chinese securities (based on our survey of over 250 investors in October 2020) with a further 24% expecting to launch investments shortly. Leveraging this experience, the average Pension fund’s China allocation is today double that of fund managers, with Asia-Pacific pension funds leading the pack (allocating 25% more to China than their North American counterparts and over 150% more than their European peers).

Clarity is the key starting point

That is not to say though that the average pension manager is without concerns when investing into Chinese securities. In our global survey of international investors in October 2020, “understanding the China regulatory landscape and market structure” was cited as the #1 challenge in investing in China (particularly by European investors) followed by ‘managing the operational and risk framework’ (a primary concern for North Americans) – hinting at a continuing feeling of complexity and confusion in the China markets.

Anecdotally this confusion centres on a continuing sense of bewilderment and catch-up. Foreign investors struggle to make sense of China’s complex web of access routes and rules – in the face of a steady stream of announcements and changes. “What are we missing and what is going to get us into trouble?”

This is impacting different investors in different ways.

Longer-term China investors, having invested heavily and early in understanding China, now have the direct presence in China and the connectivity to key decision makers that gives them the insight and clarity they need. In place of watertight regulation that enshrines the rights of beneficial owners, for example, these investors have come to accept regulators’ firm assurances that their interests will be preserved.

By contrast, new entrants to China’s market worry about China’s market framework and unpredictability as a key obstacle to their investing there (“Too much is grey”). With limited direct experience of investing in China, few sources of direct communication with key policy makers and only their market and legal documentation to go on, they worry that there is too much scope for ambiguity in the regulatory and market structure.

In a world of careful risk management, China continues to challenge global investors by its need for nuance and experience, in place of regulatory clarity and rules.

Hidden Risks: The Operating Model

If clarity around rules and market practices has subsided as a concern for Tier 1 investors over the last few years, the question of operational risk (and hence fungibility across access channels) has grown in importance.

Although, today, most investors can invest in most cash-asset classes in China – they need to do so via one of the most complicated ranges of access channels of any global market. An equities fund may use the Hong Kong – China Stock Connect to access secondary market trading for large-cap stocks (for example) but they will have to use the Qualified Foreign Investor (QFI) channel to short those same stocks or to access smaller fintech stocks. Equally a fixed income manager may choose to access the China Interbank Bond Market using the Bond Connect – but they will then have to use QFI to access Exchange-traded bonds.

The multitude of nuances in each channel creates substantial operational challenges. First, all holdings have to be kept separate and accounted for separately on the basis of which fund holds it, which channel and which currency (CNY/CNH) was used to buy it. Second, the time-criticality of China’s T+0 settlement cycle (for A-shares) means that global investors must either pre-fund trades or adopt bespoke settlement models in order to avoid significant trade failures on a regular basis. And in a no-fails market, there is little perceived tolerance for error.

As more assets have flowed into China, through more investment products, this cost and risk of this complexity has grown. What was a niche concern when everyone was using one channel is now a bigger problem when everyone is using multiple channels to fulfil their overall investment needs.

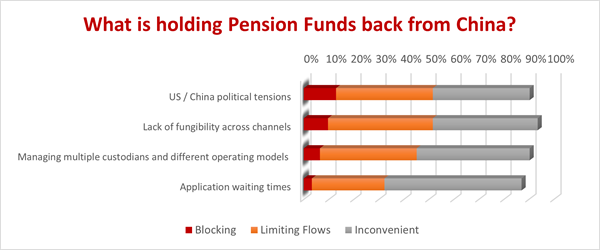

Today this issue is the single largest obstacle to new flows from China investors: creating an artificial cap on volumes for 39% of investors and actually blocking 6% of investors from investing in China. Fortunately change is happening – as the consolidation of RQFII and QFII channels demonstrated in October 2020 – and we can look forward to more simplification of the China access channels ahead. Importantly, this issue is most strongly felt by today’s most experienced China investors (residing in APAC) and so it serves as a warning of how this issue could escalate in the near future if not addressed.

Enter the custodian

Imagine that all of the above complexity around channels was then multiplied by the number of custodians you have servicing your China investments. Sitting in the middle of global investors and local banks, Global Custodians have acquired a huge degree of influence in dictating how investors make their China investments – but they have also added significantly to the market’s complexity. Whilst Global custodians would normally only choose a sub-custodian in any traditional market, the Global Custodian’s chosen bank in China dictates the channel (i.e. Bond Connect vs CIBM Direct); the operating rules (e.g. Omnibus or segregated accounts in the case of the Stock Connect); the investment currency (CNY or CNH in the case of the Bond Connect); and the FX and hedging rules the investor has to abide by.

In practice this means that a single pension fund can face a situation where (through their choice of different Global custodians) two investment vehicles may have different rules around pre-funding, hedging, repatriation and CNY access. One fund may be able to buy in CNY but only hedge up to 110% of their positions, whilst the other fund may not even be able to access CNY or hedge at all.

In practice, this complexity means that every portfolio manager needs to maintain and follow one of more than 10 different operating models for each fund that they manage – each of which drives many fundamental elements of their investment strategy. 3 products can mean 3 operating models and 3 sets of investment rules for China.

The operational and risk challenges with this complexity are obvious. Importantly, this also creates a major concentration risk in Tier 1 fund houses (who manage large fund ranges for multiple investors across multiple domiciles and custodians and who are therefore obliged to support every conceivable operating model); and turns major index rebalancing weekends into a critical pressure point.

What is the right China path?

Much has been written about the most visible risks of investing in China (e.g. quality of corporate disclosures, unhedged currency risks, etc.) but it is increasingly important that we recognize the impact of hidden risks in limiting global investors’ ability to make the most of the China opportunity.

Investing in China is not without its complexities, but the USD15-25 billion of monthly global inflows into Chinese securities today is evidence that these risks can be managed. Nearly 20 years of foreign investments into China have proven that success relies on close connectivity with informed advisors – and new investors to China need to be part of that same dialogue if they are to succeed. At the same time, they must keep simplicity at the centre of their China operating model if their investments are to scale in keeping with the opportunities that China offers.

.jpg)