Articles of Interest

Why Investors Should Care About Canada’s Green and Transition Taxonomy

Achieving net-zero by 2050 in Canada will require annual investments of $125 to $140 billion[1]. To help mobilize capital for such a major transition, the Sustainable Finance Action Council (SFAC) recently proposed a classification system to define what qualifies as “green” and “transition” projects. Once developed and the federal government gives these the go-ahead, investors and managers should get acquainted with the suggested language and consider the implications for the financial sector sooner versus later.

The recent Intergovernmental Panel on Climate Change (IPCC) report made abundantly clear the urgency of achieving net-zero by 2050 which will require a massive ramp-up in climate solutions and resiliency across all industries. For high-carbon emitting countries such as Canada, this is particularly important. A Taxonomy, the SFAC stressed[2], aims to provide certainty on which activities are aligned with the net zero transition which will help accelerate deployment of capital to help Canada meet its commitment to reduce greenhouse gas emissions by 40% by 2030 compared to 2005 levels.

The SFAC is an advisory group to the Ministers of Finance and Environment and Climate Change Canada that was launched in 2021[3]. It is supported by 25 of Canada’s largest financial institutions, as well as the Canadian Climate Institute, the Institute for Sustainable Finance, Queen’s University and the Transition Accelerator. One part of its mandate is to create a green and transition taxonomy to help define investment activities within Canada’s capital markets. A number of countries have already created these types of taxonomies, including the European Union, China, Brazil, South Korea, and many other countries have them under development. All these countries are using taxonomies to signal to their market participants which projects they hope to encourage to meet their net-zero goals, and to attract investment in their economies. Canada needs to do the same to stay competitive as the global economy transitions to net-zero.

Requirements

For pension plan sponsors and administrators, the definitions proposed by the SFAC are particularly important because they help determine whether their investments are aligned with the transition to net-zero. For issuers, the framework would ensure that climate-oriented investments are clearly categorized, helping mitigate greenwashing risk, while requiring them to provide transparent disclosure of net-zero plans and results.

To be taxonomy-eligible, a financial instrument would have to meet the following criteria[4]:

- General requirements: besides having net-zero targets, the issuing company must have a net-zero transition plan and report annually on progress.

- Specific requirements: the project financed by the financial instrument must be assessed against the framework’s criteria to determine whether it is a green or transition project.

- “Do no significant harm” requirement: the project must not undermine other environmental, social and governance objectives. An example provided by the SFAC is that of a wind farm located in a wetland.

Specific Examples

Activities that are ineligible under the taxonomy include those that are of high risk for carbon lock-in, and/or incompatible with 1.5-degree carbon emissions reduction pathway. This would include all new oil and gas with a long lifespan and no abatement.

To be eligible for green financial instruments (e.g., a green bond), a project should have low or zero scope 1 and 2 emissions, low or zero downstream scope 3 emissions, and aim to “produce goods or services that are expected to see significant demand growth in the global low-carbon transition.”[5] SFAC provides a few examples:

- green hydrogen production

- afforestation projects

- zero-emission vehicle manufacturing (with low-carbon supply chains)

- electricity transmission infrastructure.

To be eligible for transition finance instruments, a project must seek to decarbonize a sector that has historically generated high scope 1 and 2 emissions (e.g., iron and steel, chemicals, aluminum and cement production), or high downstream scope 3 emissions (e.g., oil and gas, internal combustion vehicles). These transition projects must have a short to medium lifespan to not lock in carbon emissions for the long term, and they should not make it harder or more expensive to transition to net-zero. There are certainly questions being raised on why transition investments are needed at all. Changing our energy systems to align with a 1.5-degree pathway will take time, especially for high emission industries like oil and gas which is Canada’s largest emitter at 27% of all of the country’s greenhouse gas emissions.[6] The development of the taxonomy will include setting boundaries for what a transition investment means and how existing oil and gas projects can demonstrate reductions in emissions aligned with the 2030 threshold and net-zero pathway. Having clarity on the classification of projects should provide the transparency to attract capital to support investment in both green and transition projects to advance a Canadian net-zero economy.

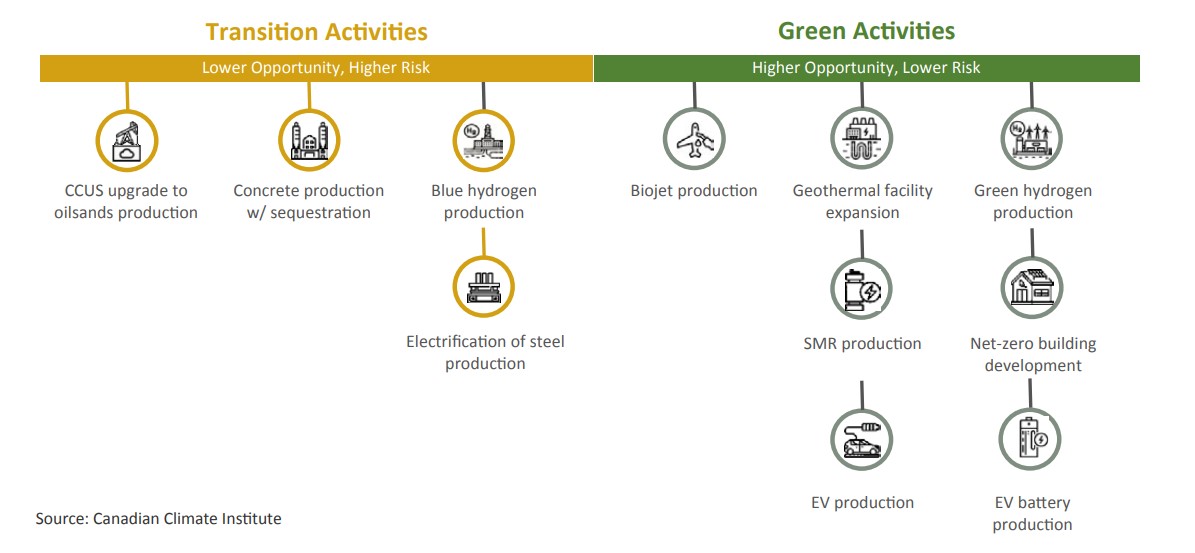

Hypothetical Green and Transition Projects[7]

The SFAC’s proposed framework is expected to evolve over time. Phase 1 will involve releasing an abbreviated version of the taxonomy by mid-2023, while setting the table for long-term implementation that will include governance, financing, and strategic planning. Phase 2 of the initiative will address full implementation, including a more detailed taxonomy, by 2025. As part of the governance proposed by SFAC, there are a number of tiers with the key recommendation being the independent “custodian” organization that will be responsible for developing the technical criteria for the taxonomy and accessing scientist and other experts to ensure its credibility and feasibility.

The custodian organization would provide their taxonomy analysis and recommendations to a leadership Council which SFAC proposes be led jointly by the federal government and the financial sector with “strong provincial and Indigenous participation.” The framework’s suggested governance has raised concerns among some groups who wonder about the role played by financial institutions, with a suggestion that additional independent experts should be on this leadership Council. Regardless of the criticisms of the initial proposal, it is clear that transparency and independence of the process will be critical for the taxonomy’s credibility and acceptance in the marketplace. It is also important to get started on investing at scale in the climate transition and not let the perfect be the enemy of the good. Having a scientifically based green and transition taxonomy which can evolve and be improved along the way, can provide the impetus for investment in Canada’s net-zero transition.

[3] https://www.canada.ca/en/department-finance/programs/financial-sector-policy/sustainable-finance/sustainable-finance-action-council.html

[4] See diagram on p. 4 https://www.canada.ca/en/department-finance/programs/financial-sector-policy/sustainable-finance/sustainable-finance-action-council/taxonomy-roadmap-report.html

[5] Definitions for scopes 1, 2, and 3 emissions found on p. 58 of the SFAC Taxonomy Report—link above.

Andrea Moffat, Senior Director, Sustainable Investing, Addenda Capital

Andrea Moffat leads Addenda’s stewardship efforts. Stewardship includes active engagement with companies and issuers on Environmental, Social and Governance (ESG) matters to enhance the long-term value of investments for clients. This also includes actively promoting sustainable financial markets by collaborating with experts and engaging with standard-setters and policymakers to create a more sustainable and net-zero aligned economy and market.

Career:

- Addenda Capital: Senior Director, Sustainable Investing (since 2023)

- Ivey Foundation: Vice-President (2015-2023)

- Ceres: Vice-President, Corporate Programs (2005-2015)

- Environment Canada: Senior Advisor (1999-2005)

- University of Toronto: Research Assistant, Environmental Risk Assessment and Financial Products (1996-1998)

- The Municipality of Metropolitan Toronto: Associate, Office of the Chairman (1996)

- African Medical and Research Foundation: Community Development Research Analyst (1995-1996)

- Burns Fry Ltd.: Associate to Quantitative Financial Analyst (1993-1994)

Education:

- Master of Environmental Studies from the Dalhousie University

- Honours Bachelor of Business Administration from Queen’s University

- High Potential Leaders Program from the Harvard Business School

- Boardroom Financial Essentials course from the Institute of Corporate Directors

- Sustainable Investing Program from the Smith School of Business