Articles of Interest

Sustainable Investment: Despite Turbulences, Investors Are Staying the Course

The rise of anti-ESG sentiment in the United States is shifting the sustainability conversation in North America. This movement has politicized sustainable investing and introduced new headwinds for investors. Yet despite this, most investors in Canada and globally remain committed to long-term sustainability goals. These issues took centre stage at the Association of Canadian Pension Management (ACPM)’s 2025 National Conference in Halifax, where the plenary session “Navigating Sustainable Investing in an Ever-Changing World” brought together leading experts to examine how shifting political and regulatory landscapes are reshaping sustainable investing across North America.

Key Finding: Canadian Steadfastness Amidst Market Turbulence

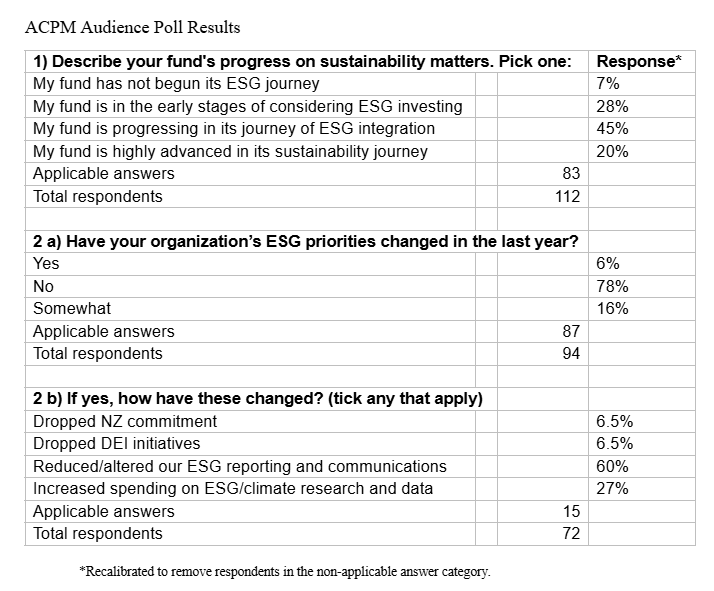

During the panel, over 100 asset owners, fund managers, and consultants were polled about their funds’ progress on environmental, social and governance (ESG) matters and how their priorities evolved over the year.

An overwhelming 93% of respondents indicated they remain on an ESG integration journey: 73% in early or progressing stages, and 20% highly advanced. Moreover, 78% said their ESG priorities had not changed since last year. For those respondents whose ESG priorities had changed, over half had reduced their ESG reporting.

How we talk about ESG is evolving in tone and language. Globally, investors are choosing terms such as “sustainable investing” rather than ESG. U.S. investors are de-emphasizing diversity, equity, and inclusion (DEI) initiatives to avoid political backlash.

However, these results suggest that, despite geopolitical and macroeconomic headwinds, Canadian investors are maintaining their commitment to their sustainable investment strategies. ESG integration appears to have matured to become a structural feature of investment management, corroborated by research demonstrating the financial outperformance of companies’ managing a broader set of risks and opportunities1.

Comparative Insights from Global Surveys

Recent surveys by Millani and BNP Paribas provide valuable perspective. Millani’s December 2024 interviews with 27 Canadian institutional investors2 found:

- 93% are maintaining their ESG strategies.

- 86% are pursuing direct, outcome-oriented engagement with companies.

BNP Paribas’s May 2025 global survey3 of 420 investors across 29 countries found:

- 87% state their sustainability goals remain unchanged.

- 84% expect the pace of ESG progress to continue or accelerate by 2030.

- 41% are adopting more cautious communication on ESG topics.

Over the next two years, investors plan to:

- Increase allocations to energy transition assets (49%)

- Use active ownership to advance internal ESG objectives (47%)

- Invest in low-carbon assets and divest carbon-intensive holdings (46%)

Together, these findings underscore that sustainable investment is evolving—not retreating. Investors are refining strategies, revisiting engagement strategies and improving measurement frameworks.

Canadian and U.S. Market Developments

Ongoing polarization of ESG matters continues to challenge the investment landscape. The U.S. federal government’s current stance towards sustainable finance is restrictive. Notably:

- Sixteen Republican states have laws restricting ESG investment, while Republican attorneys general in 11 states filed a lawsuit against asset managers alleging an ‘ESG conspiracy.’

- The U.S. Department of Labor is again reversing a rule allowing pensions to consider ESG in investment processes, while the U.S. SEC is dropping its proposed climate disclosure rule for issuers.

Exxon Mobil sued two of its shareholders in 2024 over a shareholder proposal requesting it accelerate its GHG reductions, marking the first time a U.S. firm sued its own shareholders. Although the proposal was withdrawn, the case is significant in attempting to silence shareholder voice, an ongoing concern in the U.S. legal landscape.

Yet California, the 5th largest economy in the world, leads on climate disclosure rules. SB 2534 mandates that firms operating in California with USD 1 bn+ in revenue annually disclose their emissions, and SB 2615 requires companies with USD 500 mn in annual revenues to report on climate-related financial risk biennially. These rules impact all companies doing business in California.

In addition, over 70 financial institutions—primarily U.S.-based but including six Canadian banks—have exited key global alliances committed to achieving net-zero greenhouse gas emissions by 2050.

Developments in Canada

Canada’s ESG regulatory landscape is progressing, though not without its challenges. Momentum has slowed, with several proposed regulations and the proposed sustainable finance taxonomy paused.

In early 2023, the Office of the Superintendent of Financial Institutions introduced the leading Guideline B-15 Climate Risk Management6, requiring federally regulated financial institutions to integrate climate risks into their governance, risk and business strategies. In late 2024, the Canadian Association of Pension Supervisory Authorities rolled out Guideline No. 10 for Risk Management for Plan Administrators7, mandating administrators incorporate ESG considerations into risk management by January 1, 2026. Yet:

- The Canadian Securities Administrators (CSA) paused approval of a new mandatory climate-related disclosure rule (National Instrument 51-1078) for issuers in April 2025, to support Canadian issuers adapting to ‘recent developments’ in the U.S.

- The federal government’s Bill C-599, aimed at curbing corporate greenwashing, had an unintended, chilling effect on corporate disclosures-called greenhushing10. Major oilsands producers halted sustainability disclosures, and several financial institutions—including RBC and CPPIB—scaled back or withdrew climate pledges, citing legal uncertainty.

The effects of these regulatory misalignments is to reduce investor access to relevant and comparable sustainability disclosure, altering the attractiveness of investing in the Canadian market. At the time of writing, however, there are hopes that Prime Minister Carney’s soon to be announced climate competitiveness strategy will address some of the gaps. These developments could have implications for pension funds, who may find themselves at a crossroads in their ESG risk and stewardship strategies amidst shifting political and regulatory pressures.

Implications: Recalibrating and Reassessing Risk

In Canada, sustainable investing has become embedded within risk and core investment functions of most institutional investors. This is not surprising: climate change represents a systemic, accelerating risk. Canada is warming at twice the global rate and insured losses from climate-related events reached a record CAD 9 bn in 2024.

Accordingly, investors are aligning portfolios to manage emerging risks and seize sustainability-linked opportunities. To continue advancing their ESG journey, investors can:

- Governance: Revisit ESG related policies, protocols, philosophy, and board education.

- Strategy: Evaluate how ESG risk/opportunity features in investment strategy.

- Risk: Include ESG in enterprise risk management protocols and use climate scenario analysis.

- Implementation: Integrate ESG analytics across investment processes, asset classes, and monitor external managers on their ESG performance.

- Stewardship: Prioritize engagement on material ESG topics.

- Advocacy: Engage with regulators/policymakers to promote system wide approaches, such as methane reduction regulations and disclosure rules.

Leadership Across Canadian Pension Funds

Canadian pension funds continue to demonstrate leadership in sustainable investing. Institutions such as CDPQ, IMCO, UPP, and OTPP integrate climate considerations directly into investment analysis and decision-making. While all major “Maple” funds practice ESG integration, not all have formal net-zero targets—highlighting varying approaches but shared recognition of sustainability as a value driver.

Conclusion: Recalibration, Not Retreat

Canadian investors remain aligned with their global counterparts in their steady commitment to sustainability. Despite shifting political rhetoric and regulatory uncertainty, most view ESG integration as essential to long-term investment performance and risk management, based on evidence that it protects, and creates value.

Sustainable investment is no longer niche or a moral pursuit—it is a pragmatic response to systemic risks and an essential component of fiduciary duty. By continuing to integrate sustainability into core investment processes, investors are building portfolios that are resilient and aligned with the broader transition to a low-carbon economy.

The message for pension plans is clear: this is a time for recalibration, not retreat. Sustainable investing remains a cornerstone of prudent, forward-looking investment management—and a pathway to securing financial and societal well-being for future generations.

2 https://www.millani.ca/pre-page

3 https://securities.cib.bnpparibas/bnp-paribas-esg-survey-2025-press-release/

4 https://legiscan.com/CA/text/SB253/id/2844397

5 https://legiscan.com/CA/text/SB261/id/2670346

6 https://www.osfi-bsif.gc.ca/en/guidance/guidance-library/climate-risk-management

7 https://www.capsa-acor.org/Documents/View/2101

9 https://www.canada.ca/en/department-finance/corporate/transparency/2024/part-2.html

10 Greenhusing is the deliberate act of withholding information and decreasing transparency to avoid scrutiny

Alison Schneider, Principal, Encompass ESG Corporation

.jpg)

Alison Schneider, sustainable finance consultant, is the Canadian representative for Ceres Investor Network, and Senior Fellow with GRESB BV. Alison led the sustainable investing function at Alberta Investment Management Corporation for over a decade. Alison is a co-founder of GRESB Infrastructure, and Climate Engagement Canada, and served on the GRESB Foundation Board, and multiple national and global committees addressing sustainability governance and standards. Alison is a recipient of the Canadian Clean50 Award, and University of Alberta Alumni Award. She instructs a climate-risk micro-certificate through the Canada Climate Law Initiative, and sustainable finance for the University of Alberta’s MBA program.

Rosalie Vendette, Director, Quinn+Partners

Rosalie Vendette leads Quinn+Partners’ Asset Owner Practice. A responsible investment expert, she has more than two decades of experience advising asset owners and managers to drive sustainable, transformational change. This includes Canada’s Maple 8 pension funds, global banks and insurers on pathways to integrate environmental, social and governance factors (ESG) in governance, risk management and value creation. Rosalie is certified in climate governance by the Canada Climate Law Institute and teaches sustainable finance to HEC-McGill Executive MBA students.