Articles of Interest

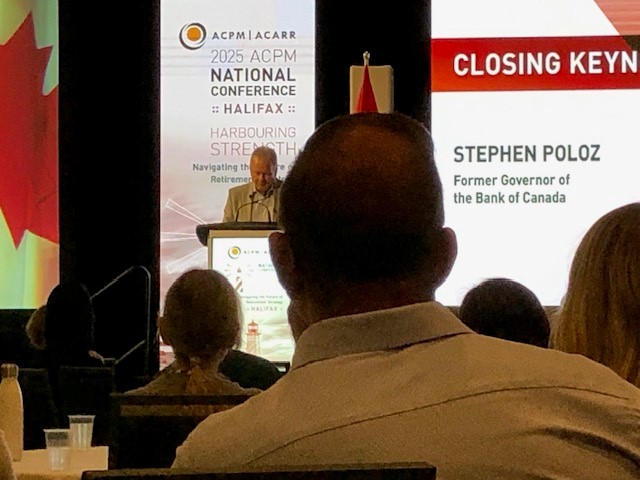

‘The greatest intentional destruction of income ever': Poloz

This article originally appeared on Benefits and Pensions Monitor. Read the story here.

Former BoC governor Stephen Poloz highlights where he sees US trade policy going and why plan sponsors will need to adapt to current risk management strategies

Former governor for the Bank of Canada Stephen Poloz views today’s economic landscape as “a seismic global realignment.”

“Obviously, the topic of the day is that the world has changed. It’s changed in the last six months, and of course, it’s changed not for the better. I don’t actually think it’s possible to be confident about the future right now. We shouldn’t pretend otherwise,” he said, adding that “this will be the greatest intentional destruction of income ever,” estimating losses of more than $40 trillion over the next decade if current US trade policies persist.

“Business used to be about economics, but I think today it’s more a mixture of economics and geopolitics,” said Poloz, citing Financial Times writer Gillian Tett’s phrase, geo-economics.

To Poloz, the upheaval is not about one politician or one policy, but rather “truly economic,” pointing out that history shows repeating cycles of polarization, protectionism, and financial crises.

While speaking at the annual ACPM conference last week in Halifax, Poloz emphasized that each of the past three industrial revolutions - the steam engine, electricity, and the internet - produced not only productivity gains but also bubbles, crashes, and widening inequality.

He believes the fourth industrial revolution, led by digitalization and artificial intelligence, will follow the same pattern.

And while previous eras eventually saw corrective policies like income taxes or stronger labour unions, no such adjustment has yet come in the wake of the third revolution. Still, Poloz cautioned that while his explanation of current events isn’t the only one, it’s a scenario that deserves serious attention.

“It’s pointless to continue debating trade policy with the US administration, trying to convince the Trump team that they are on a trajectory of self harm,” emphasized Poloz, emphasizing that Canada and other countries need to accept the reality of the new environment and adapt.

Consequently, plan sponsors will need to adapt in how they approach risk management as they need to be able to pivot quickly when conditions change and turn uncertainty into an advantage, said Poloz.

For him, the firms that will succeed are those that don’t shy away from risk but actively manage it and even convert it into shareholder returns. That ability, he suggested, becomes a competitive edge. Poloz added that investors should look for evidence of this kind of resilience.

“Risk is going to be higher for the foreseeable future. We have to be ready to manage it and actually thrive on it,” he said. “It just means that risk management is no longer something you do once a quarter, it should be an everyday thing now.”

For Canada and the bigger pension plans, this shift could present an opportunity only if the country strengthens its investment climate and reduces allocations to the US.

“The biggest thing that can happen here is if the new government is able to restore a sense of confidence in our investment environment… I think there's money that's poised to come to Canada, but they're looking for assurances that the ground isn't going to be shifted on,” said Poloz.

While he acknowledged the future is uncertain, he sees reasons for optimism.

“At least I’m encouraged by what I’m hearing and I think for today, we have a better chance of attracting that than we’ve had for some time,” he added, noting that Canada has a list of potential projects ready to move forward and another group still under discussion.

Even if only part of those ideas advance, the momentum could be significant. Still, he cautioned that success depends on how opportunities are framed for plan sponsors.

“We're going to go for a good ride. There will be lots of opportunity, but they individually need to be structured in a way which is attractive. It’s not like going around and taking each pension plan, and getting them to arm wrestle to put money in. It’s got to be structured in a way that’s attractive to their mandate,” said Poloz.

Poloz argued that Canada’s pension system doesn’t need to be torn down, but it will need to evolve as demographic pressures reshape the labour market as he noted it’s the first time in 50 years “that we’ll actually be living through a shortage of labour,” he said, pointing to the retirement wave of baby boomers and limited population growth.

And with market power shifting from employers back to employees, Poloz suggested that broader access to dependable pension models, whether through expanding the CPP or encouraging private plans, could provide the security future generations will need in an era of greater uncertainty.

“How we’ve managed it has been superb,” he said, but added that widening coverage will be essential.

Rather than waiting for policies to change in Washington, plan sponsors and investors will need to gear up to prepare for a harsher reality, underscored Poloz.

“We need to adapt to this new unfortunate reality and position ourselves to defend against the downside risks,” he said.

Josh Welsh, Journalist, Benefits and Pensions Monitor

Josh Welsh is a journalist in the Wealth vertical for Key Media. He's the lead reporter for BPM and has written for BPM's sister US publication InvestmentNews. Josh is a Humber College alumnus, with a bachelor’s in journalism and a diploma in screen acting.

When he’s not writing or interviewing, he’s likely spending time at the historic Arts and Letters Club of Toronto, watching the newest movie on the biggest screen possible or pursuing his dream of being an actor. For story suggestions or to get in touch, he can be reached at [email protected].