Articles of Interest

Are defined benefit type pension plan surpluses back?

The recent economic shift has been sudden and significant. With inflation increasing to near unprecedented levels, central banks increased interest rates to levels not seen for decades. Surprisingly perhaps, markets have experienced limited downturn and are even on the rise in 2023. This combination of events is, at least temporarily, resulting in many defined benefit (DB) type pension plans experiencing surpluses – something generally not seen since the late 1990’s.

Many of us have forgotten the “good old days’” when pension plan sponsors enjoyed seeing their actuaries as it typically meant good news! Plans were perceived to have gobs of money to spend, and in many cases were being forced by legislation to spend excess surplus. This resulted in plan sponsors increasing benefits to keep members happy and/or taking contribution holidays. After the financial crisis hit in 2008, most plans found themselves significantly underfunded and struggling to afford the benefits they had previously promised.

Several decades later, many plans have recovered and are finding themselves with surpluses again. This time around, plan sponsors are not keen to repeat the spending sprees of the past, and the collective vision is much more focused on the potential volatility of the future. So, what should plans be considering as they navigate this familiar yet new territory? Here are a few suggestions:

1. Dynamic Margins

Margins (also known as reserves or PfADs) act as a lever for plan sponsors to help manage sustainability and the likelihood of providing a particular benefit to members. Traditionally, actuaries included margins within their discount rates or even various actuarial assumptions. As actuarial standards have evolved towards a “best estimate” and “marked to market” approach, margins have eroded.

The challenge with traditional margins is that they are often “static”. To enhance the use of margins, plan sponsors should consider dynamic margins, which fluctuate with changing circumstances. These margins could be applied to both the going-concern balance sheet and current service cost. Fortunately, technology today enables us to peer into the future of possible outcomes in a much more sophisticated way. Stochastic modelling can provide trustees with the critical information they need to make more informed decisions about their margins – including whether they should change and by how much as economic conditions change over time.

2. Innovative Plan Design

With the introduction of target benefit plan legislation, the concept of using plan provisions as a lever to manage the sustainability of a DB-type pension plan was introduced. Since then, conditional benefits have been successfully implemented in various parts of the country. This has introduced an opportunity to provide a meaningful benefit in good times, while also allowing the plan to maintain core “guaranteed” benefits during down times. Although conditional benefits are commonly centered around post-retirement indexing provisions, pre-retirement conditional benefits can also act as a lever for plans. As plan sponsors consider options for surplus usage, introducing conditional benefits rather than improving guaranteed benefits should be contemplated.

3. Equity

Equity among members has increasingly been at the forefront of pension conversations. When DB-type plans were struggling, many plan sponsors asked members to pay more and receive less. The hope was that when surpluses improved, those benefits would be reinstated. This has not been the case, and likely never will be. As such, this strategy has resulted in significant inequities between generations of members that will likely never be corrected. When looking at improving benefits in the future, attention should be given to rebalancing benefits among all members (including active, retired, and deferred members) and looking at members most impacted.

In addition to financial equity, there is a growing desire to consider diversity, equity and inclusion factors when looking at plan design options. This may be another item for plan sponsors to consider when dealing with surpluses in the future.

A case study: Saskatchewan Teachers’ Retirement Plan

The Saskatchewan Teachers’ Retirement Plan (STRP) is a target benefit pension plan that was enacted in 1991 and covers teachers who were hired on or after 1980. Similar to most DB-like pension plans, the STRP experienced good financial times in the early years. Plan returns were better than expected and given that the plan was relatively new, there were few retirees receiving benefits which left the plan with positive cashflows in the early days.

Almost two decades later, on the heels of the 2008 financial crisis, the June 30, 2010, valuation revealed that the plan was likely to face some financial challenges. However, it wasn’t until the June 30, 2013, valuation that surpluses had turned to deficits, and difficult decisions were going to need to be made.

Two years following the 2013 valuation, with government funding fixed as per the provincial collective bargaining agreement, it was clear that there was only one solution - members were going to have to pay more and get less. The generous “guaranteed” benefits (final average earnings formula with a bridge benefit and guaranteed COLA) were reduced and replaced with a more affordable “core benefit” (career average earnings formula only), along with a promise to provide conditional enhancements to those core benefits when the funded status improved. The conditional enhancements would include offering not only a conditional COLA on post-retirement pensions, but also offering conditional “upgrades” to active members on their lower, career average pensions.

A funding and benefit policy was also created that clearly outlined the levers and margin levels to be used in the future. What became clearer as the funded status improved, was that there was not a common understanding of:

- When would the plan provide a conditional increase?

- Who would get the conditional increase?

- How much of an increase would they get?

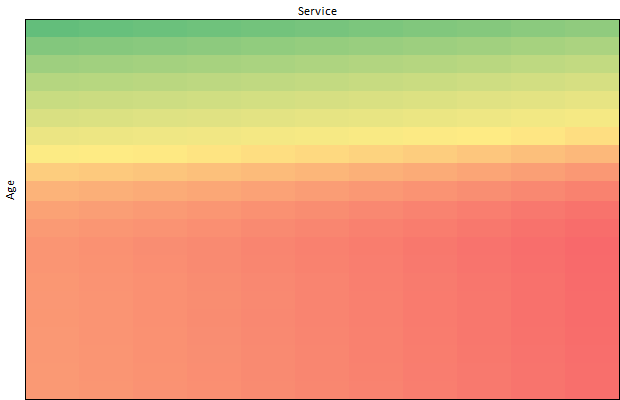

The Trustees agreed that the overall goal was to improve equity within the plan. Certain groups were hit harder than others during the plan changes. New members were asked to pay more and receive less, and it became clear that conditional increases could be provided strategically to lessen these inequities. Stochastic analysis provided a bird’s eye view into what possible future scenarios might look like and how decisions today might impact specific groups of members in the future. Equity heat maps allowed Trustees to understand how each member would be impacted. A final funding and benefit policy was developed, which now provides the Trustees with a road map for making critical future decisions – including answers to the questions above.

Over the past few years, the STRP has recovered financially and has been able to offer two years of conditional increases to the groups most negatively impacted by the plan changes. At the time of writing this article, the valuation also includes a fully-funded reserve for conditional increases every year into the future.

Equity heat maps plotting all members (before and after implementation of policy)

A collective opportunity

Retirement income adequacy is a growing concern for many Canadians. DB-type pension programs contribute to Canada’s social fabric by offering important financial security to participating members and their families. The strategies we have discussed in this article, and the Saskatchewan Teachers’ Retirement Plan case study represent a collective opportunity to ensure these programs remain sustainable for generations to come.

Simon Deschênes, Principal and Actuary at Eckler

Simon Deschênes is a Winnipeg-based Principal and actuary at Eckler. Simon has been assisting organizations on pension matters for over twenty years. Prior to joining Eckler, Simon spent over a decade at a global HR consulting firm in Montréal and Toronto before moving to Manitoba.

Troy Milnthorp, Senior Managing Director of Corporate Fund Services at the Saskatchewan Teachers' Federation