Articles of Interest

Solutions for Plans under 1 billion AUM: optimizing investment outcomes and ESG exposures

Investment management is a very difficult practice, trying to manage assets with limited flows to meet future liabilities. It is equal measure imperfect science and abstract art. The destination has many routes but finding the cleanest path can be difficult.

Size or scale is often discussed in pension management. The larger the asset base, the greater the economies of scale and, importantly, the deeper the expertise in plan design and asset mix. Larger plans have more resources, specialized portfolios managers with access to direct investments and deeper capacities to model risks and returns.

Canada’s largest pension plans are global leaders, often lauded in the press for their innovative approaches. Many have international offices, managing direct investments to meet their plan needs.

It is natural to examine what leading plans do, to determine if similar strategies can be replicated for small or medium sized plans. What may be aspirational, however, may also be impractical. In an effort to achieve the same diversification, smaller plans face significant obstacles which compromise the potential outcomes.

Constraints are particularly acute for plans with less than $1bln. One remedy, a departure from the norm, would be to consider Exchange Traded Funds (ETFs). ETFs provide transparent low cost exposure with robust data sets to model risks and returns, expanding a small pension plan’s access to strategies otherwise reserved for larger plans.

The Pensions and Investment Association of Canada (PIAC), publishes an Asset Mix Report which reflects its membership’s allocation across three main asset classes – Equities, Fixed Income & Alternatives (https://piacweb.org/site/publications/asset-mix-report). Covering over 130 members and $2.45T, the approximate asset mix is:

- 40% Equity, of which the largest component is Global Equity;

- 39% Fixed Income, of which the largest component is Long-term bonds;

- 21% Alternatives, of which Real Estate is the largest component.

The aforementioned figures are averages; larger plans have allocated significantly more assets to Alternative exposures.

If we assume that larger plans have achieved greater diversification because they have more rigorous asset-liability modeling capabilities, leading them to branch out into more asset classes to diversify their return streams, this implies their returns should be enhanced, over time.

From a Fiduciary perspective, it is important for small plans to consider all options to enhance their asset management to achieve investment objectives.

Exchange Traded Funds provide low cost diversification, robust data sets to model risk, scale and access to areas of the market which may otherwise be difficult to integrate into portfolio construction.

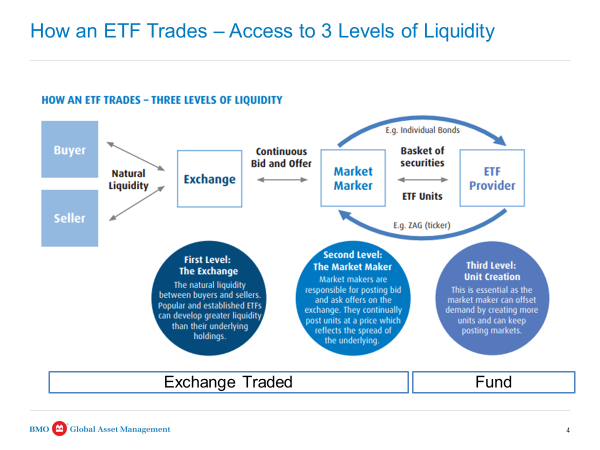

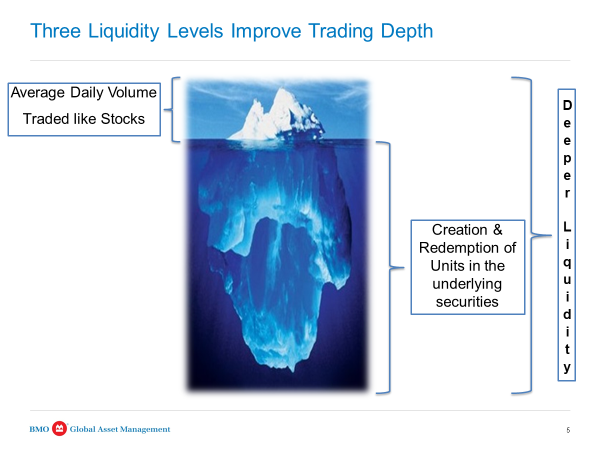

ETFs are very interesting market access tools. Unlike Pooled funds or Separately Managed Accounts (SMA), ETFs have three layers of liquidity:

The ETF ecosystem, comprised of ETF issuers, Market Makers and the Exchanges, ensures effective execution at each level:

- Natural liquidity between seller & buyer across the exchanges;

- Market maker inventory to absorb excess buy or sell orders placed in the market;

- Creation & redemption liquidity is identical to any pool or SMA managing the same assets.

Trades executed on the exchange or through market maker inventory are additive to the creation/redemption liquidity in the underlying market. Depending on size, trades may be executed using the first two liquidity levels, without buying or selling underlying assets.

This makes the ETF a highly effective asset management tool, not immune to market strains, but certainly less susceptible to periodic trading stresses. Assets can be traded between market participants without necessarily having to buy or sell the underlying securities.

EQUITY

The first ETF trade, for TIPS in the 1990s, was a very large Institutional order. Attracted by the ability to do a portfolio trade in real time at a known price, TIPS inspired State Street to list SPY. The industry has matured immensely, offering core exposures as well as more specialized solutions.In equities, ETFs provide diversification and, more importantly, a strong and consistent data set to model risks and returns. It is important to reflect on why indexing is a compelling investment thesis.Measuring managers to the recently published S&P 500 index in the late 1950s[RLJ1] , people were surprised to note how few managers could beat the benchmark. Managers who outperformed did so fleetingly, eventually reverting to the mean as their style fell out of favour. The index, however, was a grand arbiter, tracking capital as it moved through the market, from one sector to another over the economic cycle.Investment management has become highly analytical, using reams of data to model possible outcomes. Asset allocation remains the most important determinant of whether plan objectives can be met. It makes sense to use the most robust data set to model appropriate portfolios weights, using index-based ETFs to minimize execution costs and asset management fees.ETFs can be used for index exposure, providing the potential to earn securities lending premium by lending through a custodian, thereby creating additional cash flow.For plans interested in generating alpha, Factor ETFs refine the exposure by isolating desirable Factors which have demonstrated, over time, an ability to reduce risk and to outperform market capitalization indices. Some of the more popular Factors – Low Volatility, Quality, Dividend/Yield, Value and Size – can achieve the same risk adjusted returns pension plans seek in Active mandates but using a transparent and consistent methodology which provides better data for asset allocation modeling.

FIXED INCOME

Several studies have measured the active return that managers can achieve through security selection in fixed income funds. Depending on the study, it ranges from 10-30% of total return. This means that 70-90% of total return is due to macro risk, where the bonds lie on the yield curve, not which bonds were bought on that point.

From this perspective, low cost, highly tradable fixed income ETFs can provide distinct advantages to active fixed income pools. Because the ETF has 3 liquidity levels and provides transparent pricing on the exchange, plan sponsors can achieve much better execution. Although pools trade at NAV, that NAV is a manufactured value which comprises the spread of the underlying securities and the trading activity of all the pool’s unit holders.

Fixed income ETF units may be created or redeemed at NAV, but a cost adjustment factor is applied to ensure the trading party assumes the spread costs associated with their trading activity. This ensures trading costs are attributed according to activity. In a pool, larger plan activity cascades to all the other unit holders, distorting the NAV which is equitably applied across the Pool.

ALTERNATIVES

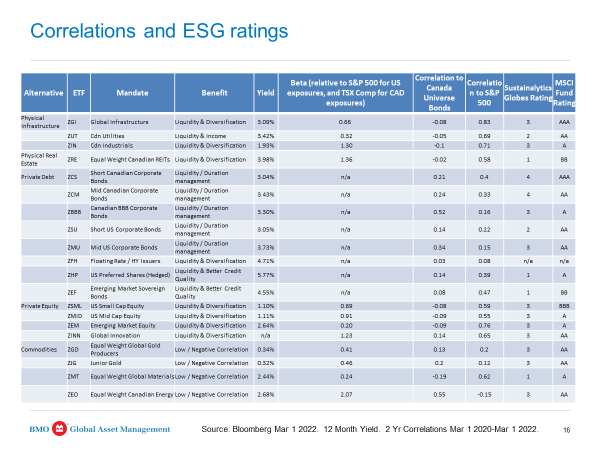

As noted earlier, Alternatives have become an important element in portfolio construction. They diversify away from traditional asset classes, smoothing returns by accessing risk premia in Infrastructure, Real Estate, Private Debt and Private Equity. Many of the large and mega plans are direct investors in the asset classes, performing their own due diligence and modeling the risks to their own portfolio needs.

Smaller plans use pools, but the pool experience introduces several constraints which may change the nature of the Alternative risk profiles plans hope to achieve:

- No universal benchmarks to measure manager performance;

- Manager risk – highly idiosyncratic data sets;

- Capacity limitations;

- Placement delays;

- Limited liquidity to manage flows or to rebalance.

Several pension plans have used ETFs, either as liquidity sleeves, holding accounts for eventual pool placement or simply because they can be very good proxies for illiquid Alternative assets.

The table below outlines some of the ETFs which may provide the risk premia sought in Alternatives, but in lower cost, highly liquid exposures with consistent and long data sets:

RI / ESG

An important consideration for smaller plans is how to integrate responsible investing or ESG into their investment portfolios. Relying on pooled fund managers to demonstrate RI/ESG credibility may be a simple method, but the results are not very pretty.

Plans who hire different managers would have inconsistent RI/ESG methodologies, exposures and stewardship across mandates and asset classes.

Using an Index-based ESG ETF provides a transparent, consistent, rules-based methodology which is uniform across geographies and asset classes. Perhaps more important, an index ESG approach establishes a platform to engage stakeholders.

Integrating RI/ESG into the investment process may be the most contentious, time-consuming exercise for all pension sponsors, regardless of size. Every plan must take difficult decisions but using an index ESG ETF provides clarity to measure impact and progress towards cleansing capital. These are the cornerstones of building consensus.

Smaller plans aspiring to recreate the scope of their larger counterparts should consider using Exchange Traded Funds to enhance their portfolio construction. They are low cost, transparent and liquid tools which can be used by investors large or small to broaden exposure and to diversify into different asset classes.

Suggested reading: https://www.bankofcanada.ca/2020/07/staff-analytical-note-2020-16/

Mark Webster, Director BMO Exchange Traded Funds, BMO Global Asset Management

Mark is responsible for BMO ETF initiatives in Western Canada, working with asset owners, asset managers and investment counsellors. With over 30 years of experience in the financial services industry, Mark has covered many diverse forms of financial risk. He began his career as a professional indemnity broker, becoming a vice president, conducting risk analysis for the Big 8 global accounting firms, as well as some of the top U.S. law firms. In addition to having worked with two asset management firms, Mark has worked in the pension industry with Standard Life and with Canada Trust, covering both Eastern & Western Canada. Mark holds a Master’s degree in Russian History from McGill University and several industry accreditations.