Articles of Interest

Public sector pension plans and the indexation of pensions

Employees in the health or education sector, provincial and federal civil servants or even municipal employees, for example, mainly benefit from defined benefit plans (DB). These are generally good quality plans, guaranteeing a lifetime pension to retired people. In recent decades, this type of plan has seen a decline around the world, especially in the private sector. Multiple causes such as low reserves, regime improvements, improved life expectancy and lower yields are among the often cited explanations. In the public service, where they mainly still exist, certain parameters of these schemes have been reviewed in order to reduce their costs and ensure their sustainability. The indexing formula is one of the many parameters of a retirement plan that can be modified. This text will seek to present a general portrait of the situation of the indexation of pensions of the provincial public sector pension plans of Canada.

Indexation, or automatic adjustment, is closely linked to the purchasing power of retirees. It influences their ability to acquire the goods and services they need. A person's purchasing power decreases when their retirement pension increases less quickly than the cost of goods and services. In other words, a retiree receiving a fixed annuity will be able to buy half as many goods and services after a period of around thirty years if the inflation rate is 2%. In order to clearly understand the indexing formula of the different plans, it is useful to make comparisons between comparable institutions.

There are large differences between private sector plans and public sector plans in terms of pension indexation. A little more than half of active members of registered pension plans benefit from an automatic adjustment of their pension, a reality which improved significantly during the end of the 20th century but which has stagnated since the mid-2000s. Members of public sector registered pension plans are generally better protected against inflation than private sector members, as can be seen in the table below.

| Proportion of active members of defined benefits by sector and different pension adjustment methods, Canada, 2022 | |||

| Public sector | Private sector | Total | |

| No automatic adjustment | 28.8 | 87 | 44.8 |

| With automatic adjustment | 71.2 | 13 | 55.2 |

Source : Statistics Canada. (2023). Registered Pension Plans (RPPs), active members and market value of assets by method of automatic adjustment of pension for defined benefits pension plans Table 11-10-0121-01. Seen in : https://www150.statcan.gc.ca/t1/tbl1/fr/tv.action?pid=1110012101

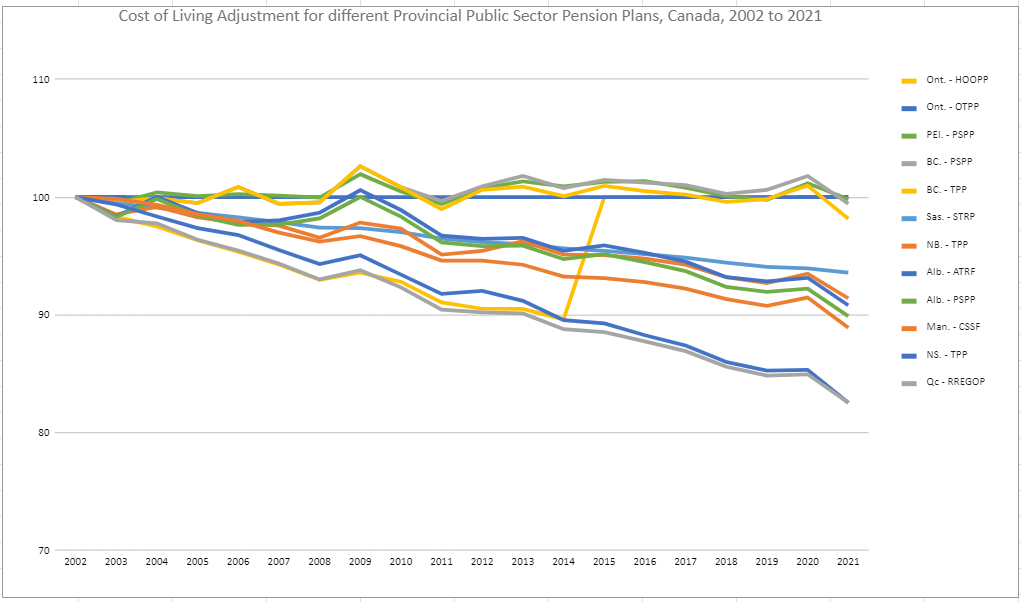

All Canadian provinces have public service workers who work in ministries or education and health sector. In many provinces, it is not uncommon to see two or three plans while in others there is only one, such as in Quebec where the same plan covers all these categories of workers. The following graph compares the evolution of the pension for a person who retired in 2002 according to the provincial public sector pension plan.

The Ontario Public Service Pension Plan was excluded from the analysis due to lack of information as well as the Public Service Pension Plan of Newfoundland and Labrador, the New Brunswick Public Service Pension Plan and the Public Service Pension Plan from Nova Scotia. Author's calculations. To simplify the calculations, the evolution in pensions was compared to the Canadian CPI between January and December, and not in comparison to the index or to the period favored by the plans for their pension adjustment calculations. This is why data points for plans indexed to 100% of the CPI do not necessarily equal the CPI from January to December. These data do not take into account the coordination of annuities with public plans.

This comparison is instructive. RREGOP and the Nova Scotia Teachers' Pension Plan offer the least generous inflation protection of all other provincial public service pension plans studied for retirement taken in 2002 after 35 years of service, with the exception of the Saskatchewan Public Employee Pension Plan which has been a defined contribution plan since 1977. The Nova Scotia Teachers' Pension Plan shows a reduction in purchasing power similar to RREGOP, approximately 17.5%. On average, for the twelve provincial public service pension plans studied where data is available between 2002 and 2021, the loss average purchasing power was approximately 7%. Public sector pension plans are therefore generally effective in limiting the loss of purchasing power of pensioners. The indexation method is an important dimension of retirement plans. However, it is not the only one; it would be misleading to judge the general quality of these plans based solely on this parameter.

The study of the indexation of provincial public service pension plans can also inform us about other parameters used. For example, some plans use a formula for calculating pre-established indexation based on years worked, such as the public sector workers’ pension plans of Alberta or the one of Quebec. Others, such as the public sector pension plans of Nova Scotia or Prince Edward Island, adjust the pension each year based on the financial health of the plan. For the latter cases, the modifications apply to all retirees according to the financial situation of the plan, regardless of when they completed their service.

Public sector pension plans in the United States have also undergone changes. Since pensions cannot be reduced due to the legislation in place, public sector employers have instead turned to the pension indexation method in order to reduce their financial implication. On average, the pension adjustment of public sector plans in the United States fell from a little more than 2% per year in the mid-2000s to around 1% towards the end of the 2010s, a reduction by 50%. Since inflation also decreased during this period, the net effect is an improvement in the adjustment of the pension in relation to inflation.

Indexation plays an important role in the design of a pension plan. In the case of provincial public sector pension plans, protection against inflation is generally good. For workers in the public service and the education and health networks, their plan generally protects them well against rising inflation. In all cases, the issue of indexing retirement pensions must be better explained and presented to the general public, elected officials, work groups, as well as retired people.

1 Fitzpatrick, M. D. et Goda, G. S. (2023). The prevalence and nature of COLAs in public sector retirement plans. Journal of Pension Economics and Finance (2023), 1–13. doi:10.1017/S147474722300001X

About l’Observatoire de la retraite

L’Observatoire de la retraite is an initiative of the Institut de recherche en économie contemporaine (IRÉC), which is aimed at organizations and people who want to better understand and act on the institution of retirement in Quebec. L’Observatoire brings together partners from different backgrounds who are keen to place debates on retirement in a broad perspective, that of social and economic policies.

Topics of research

Axis 1: The role and responsibilities of stakeholders

Axis 2: Improving pension plans and financial security in retirement

Axis 3: Conditionality of benefits

Axis 4: The socio-economic issues of retirement

Riel Michaud-Beaudry, Policy analyst, Observatoire de la retraite

Riel Michaud-Beaudry is a research professional at l'Observatoire de la retraite, a project of l'Institut de recherche en économie contemporaine. He completed a bachelor's degree in sociology and a master's degree in public affairs at Laval University. In addition to having published works on retirement in Quebec and Canada, he has conducted research in the fields of urban development, economics, social norms and public policies regarding electoral participation.