Articles of Interest

Financial Literacy - Your Best Bet Against Debt

Starting from birth, a person’s existence on the planet is going to cost money. Sometimes the money is available but, when it’s not, it can be obtained by creating personal debt. Throughout one’s lifetime, debt will almost never completely disappear and it can take many forms:

- Having to borrow because you’re spending more than you actually have

- Purchasing a residence (mortgage) or renting a residence (rent payments)

- Making a purchase that has ongoing expenses such as a vehicle

- Taking out a loan or cash advance

Debt and expenses paid from your money supply reduce the amount of money you have for other current and future activities and pursuits. If you do not have the money to pay for current expenses and incurring debt is your only option, then a financial advisor or institution has to be involved. (You could borrow money from a relative or a friend, but a delay in repayment could lead to financial and peronal consequences that may be irreconcilable and could result in regrettable legal action.)

How Debt Affects Your Retirement

The chart above shows increasing debt levels for the average Canadian consumer quarter-over-quarter and year-over-year. Since the listed items are all debt items, there will be less money for other expenses that can lead to a trade-off between paying off debt and saving for retirement.

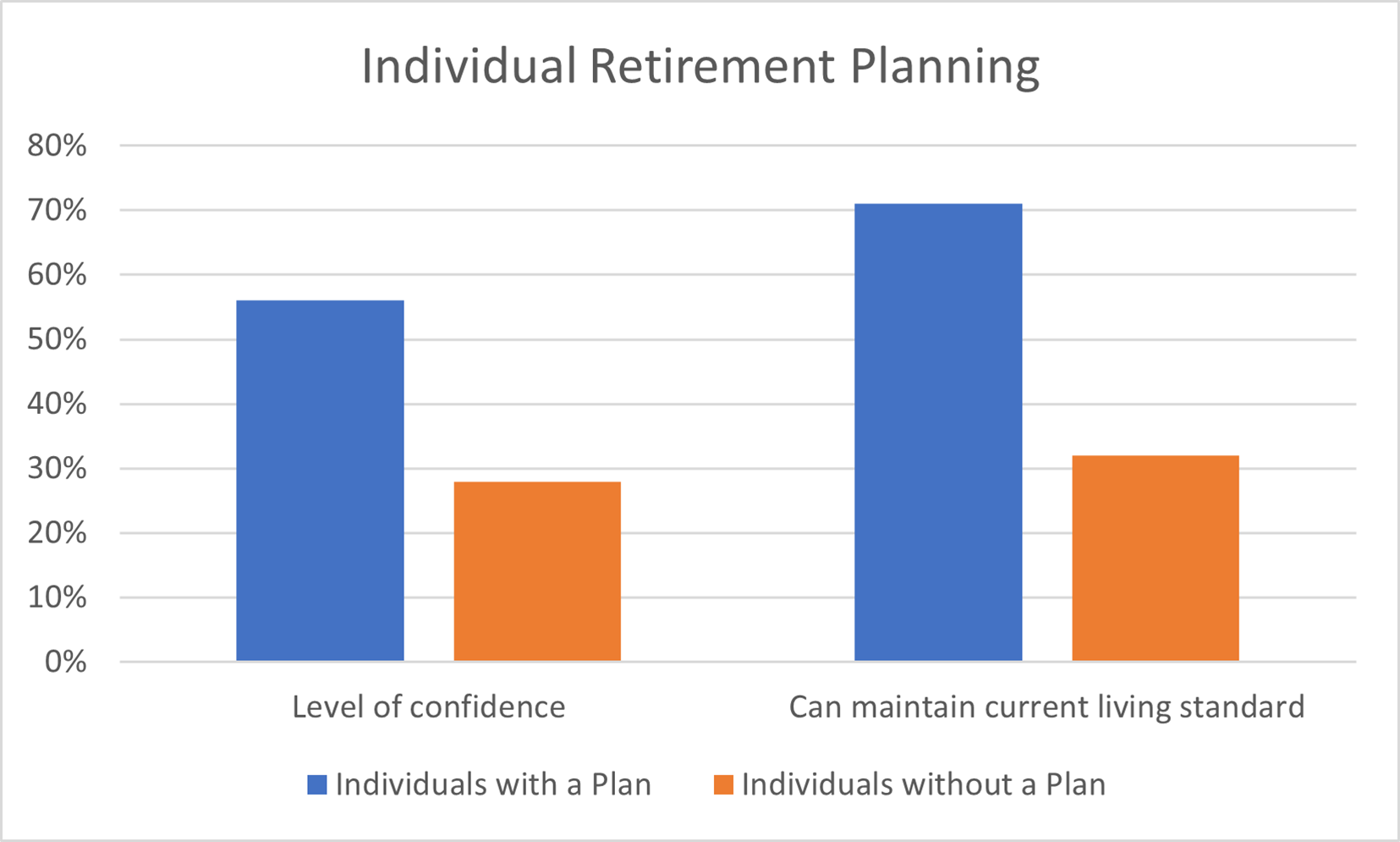

In 2019, the Financial Consumer Agency of Canada published “Key Findings from the 2019 Canadian Financial Capability Survey”. With respect to retirement planning, the survey illustrated that a financial plan was essential for an improved retirement outlook.

Regardless of one’s current status, a financial plan is an effective way to start saving toward future goals. And financial literacy is a key component in the development of a financial plan.

The Association of Canadian Pension Management (ACPM) conducted a survey in 2019 that surfaced some key points from the majority of respondents:

- They agreed that the general public was not sufficiently financially literate.

- Financial literacy is essential for everyone, especially younger individuals who are trying to make and save money.

- They believe that financial literacy is a basic life skill that is essential at nearly every stage of life.

Survey responses also suggested that improving financial literacy is likely best achieved through the combined efforts of educational institutions, financial institutions and work environments. This combined approach can be most effective when someone takes individual responsibility to improve their own financial capabilities.

Why do you need financial literacy skills?

Very simply, poor financial literacy skills can adversely impact long-term planning, especially in respect to retirement wealth accumulation. It influences the ability to make good day-to-day financial decisions, navigate dynamically changing economic conditions and opens susceptibility to financial fraud. Without the skills to make informed decisions, some people will not save enough for retirement, their standard of living may decrease and they may consistently pay too much on fees for financial products.

For younger people, a lack of financial education may lead to them not saving enough early on. Many of them will have no significant retirement savings and will consider retirement to be so distant that it can be dealt with at a future time – they assume that things will turn out for the better. Unfortunately, it is exactly this attitude that forces people to “catch up” on their savings as they get older and, unless they make major adjustments, their ideal retirement scenario is at risk.

There are five stages when financial literacy would benefit Canadians:

- Pre-career: Learn the basics of finance BEFORE you enter the workplace.

- Early career: Employer-sponsored programs can help you to understand and manage debt and improve your financial wellness.

- Mid-career: Budgeting is increasingly important as this is the stage when employees have the greatest amount of expense in relation to their income.

- Late career: Time to prepare a detailed retirement plan. Asretirement gets closer, individuals should research various financial retirement income vehicles and the benefits of different income sources.

- Retirement: In retirement, budgeting is still important, but other factors become as important such as longevity risk, fraud risk, health demands, secure housing and estate planning.

Planning and saving for your retirement are the most important things you can do to ensure an adequate and secure retirement. There are many situations that can cause stress during one’s lifetime and retirement should not be one of them. Everyone can achieve their retirement dream if they take the time to learn their options and opportunities and how best to use them.

Where to Start

The first thing that you can do is to become familiar with income, debt, investing and employer workplace savings programs. Knowing and understanding your retirement options is one of the single most beneficial activities that can pay off in the long run. To start, ACPM offers a free, online Retirement Savings Course that can put you on the path to greater control of your finances and improve your opportunity for a secure retirement.

ACPM (Association of Canadian Pension Management)